Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Total volume in the first half of the year was at $209.718 billion in 5,153 deals, down 11.2% from the $235.836 billion in 6,793 over the same period in 2021, according to Refinitiv data.

August 15 -

The two main insurers, Assured Guaranty Municipal Corp. and Build America Mutual, accounted for $17.132 billion of deals in the first two quarters compared to $18.794 billion a year earlier.

August 15 -

Investors will be greeted Monday with an increase in supply with the new-issue calendar estimated at $5.941 billion, up from total sales of $1.700 billion.

August 5 -

Investors poured $1.094 billion into municipal bond mutual funds in the latest week, versus the $236.491 million of inflows the week prior. It marks only the second time this year inflows eclipsed $1 billion.

August 4 -

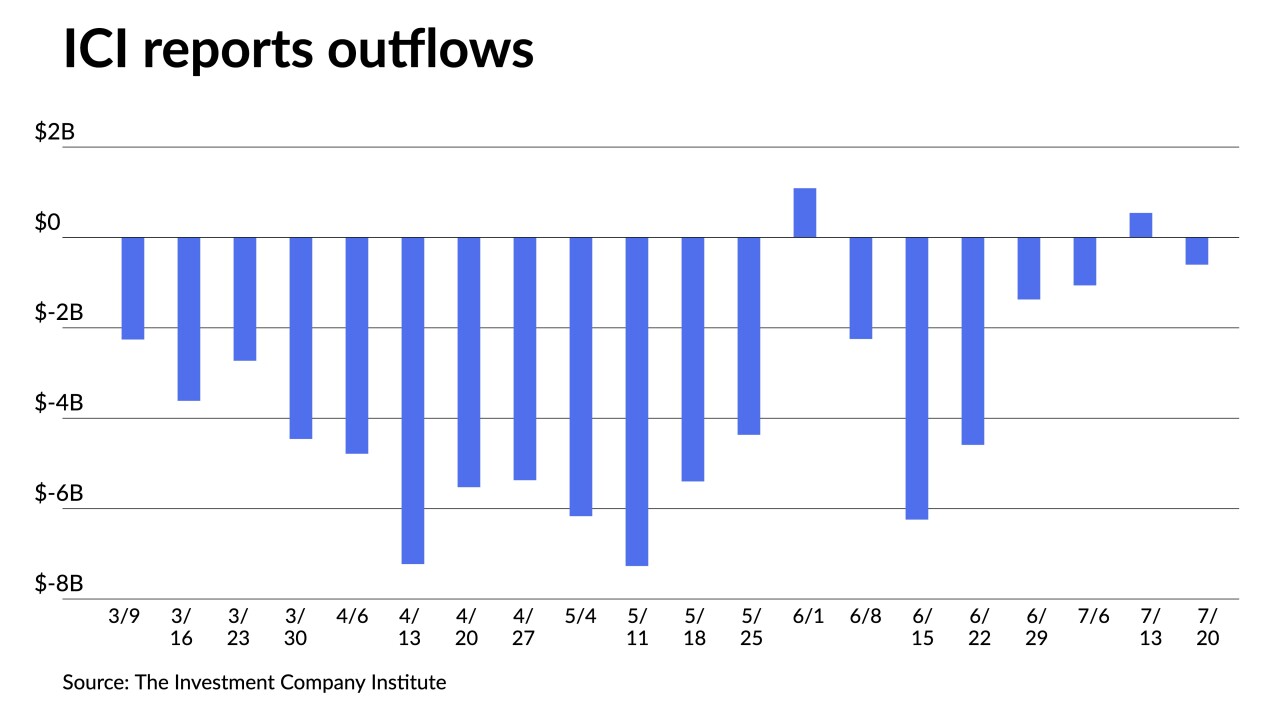

The Investment Company Institute reported investors pulled $246 million out of muni bond mutual funds in the week ending July 27 compared to the $602 million of outflows in the previous week.

August 3 -

The large primary was led by two $700-plus million of revenue bonds from the Port of Seattle and the Georgia Ports Authority.

August 2 -

Summer redemption season starts winding down; Net negative supply stands at $18.777 while 30-day visible is at $12-plus billion.

August 1 -

Municipals will end July with positive returns across all sectors. The Bloomberg Municipal Index shows a 2.49% return in July, moving year-to-date losses lower to 6.71%.

July 29 -

Total July volume was $25.598 billion in 520 deals versus $37.573 billion in 1,013 issues a year earlier, according to Refinitiv data.

July 29 -

Investors added $236.491 million to municipal bond mutual funds, per Refinitiv Lipper data, versus the $698.782 million of outflows the week prior. High-yield saw inflows hit nearly $550 million.

July 28 -

Municipals are poised to end July in the black. Demand for muni product has been strong this summer, with analysts expecting supportive market technicals through August with a likely continuation of positive performance.

July 27 -

With the Fed committed to fighting inflation with aggressive rate hikes, fewer issuers want to take the risk with taxable advance refundings.

By Lynne FunkJuly 27 -

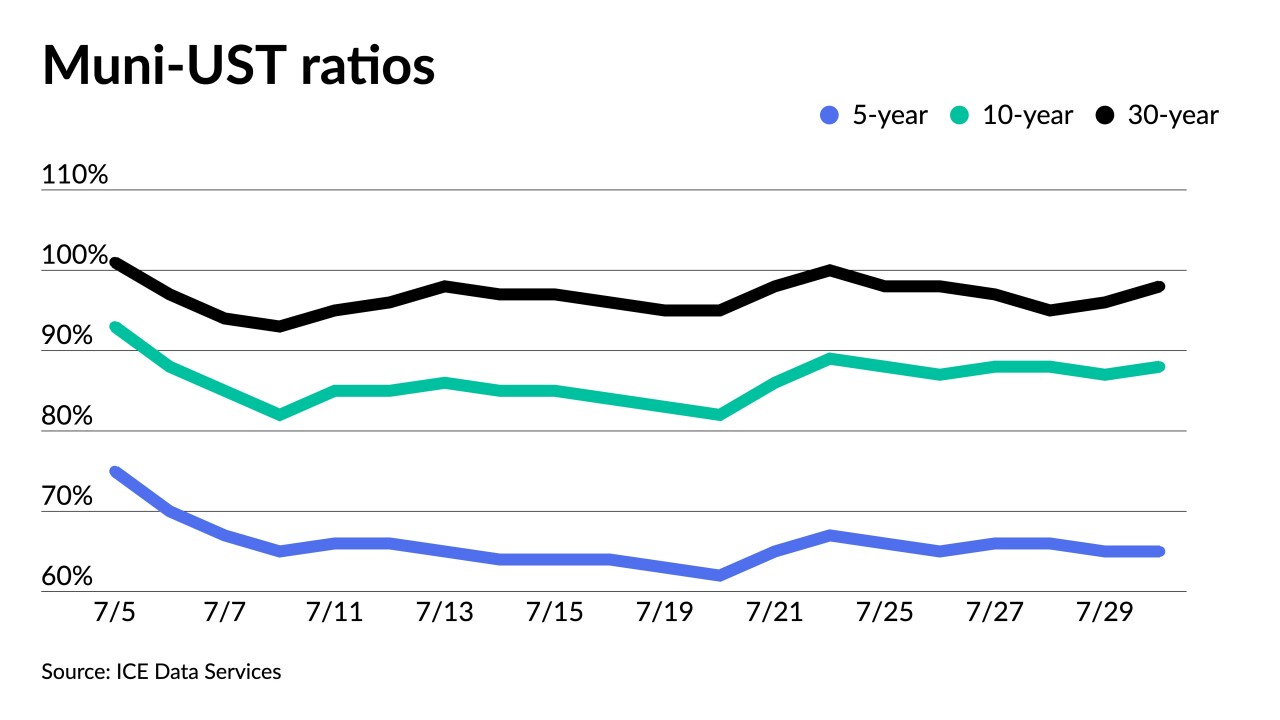

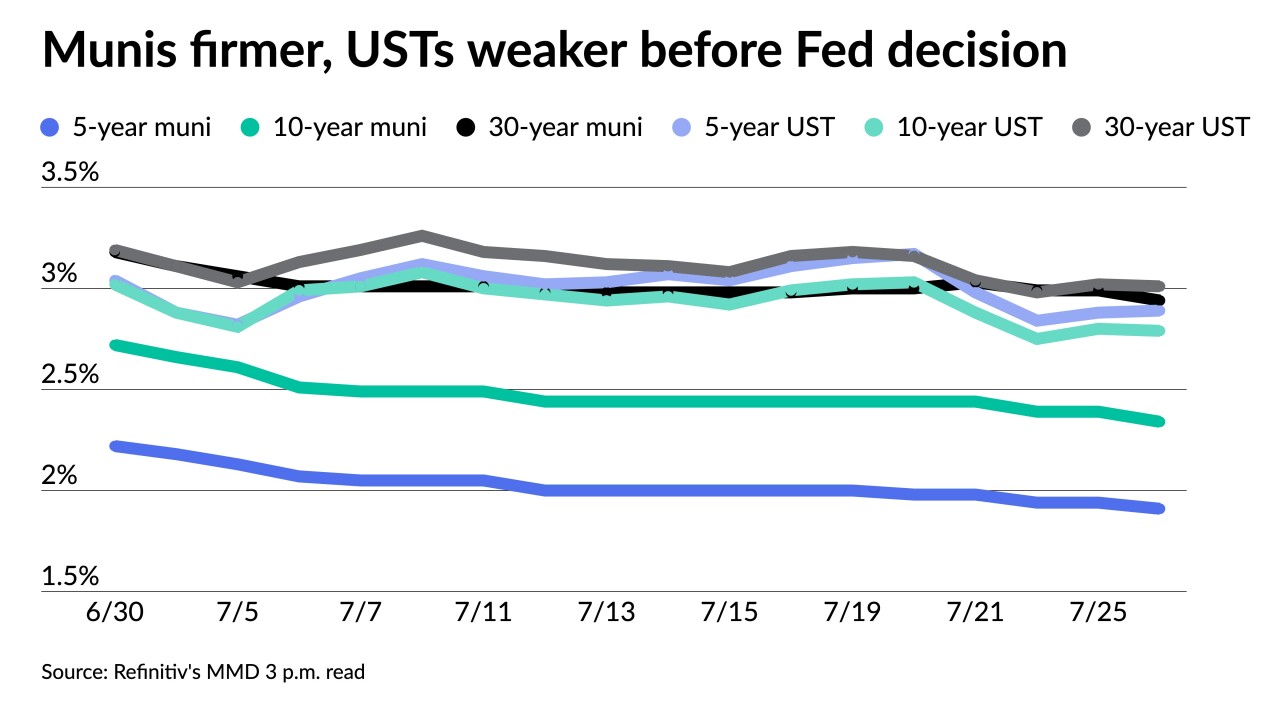

Investors sit on the sidelines, waiting to see how much the Fed will hike rates. The consensus appears to be another 75 basis point rate hike, though a full point hike could be on the table.

July 26 -

Only two firms remained in the same spot at this point last year: Orrick Herrington & Sutcliffe and Norton Rose Fulbright.

July 26 -

With the Fed rate decision coming this week, issuers are sitting on the sidelines in both primary and secondary Monday with little changed yield curves.

July 25 -

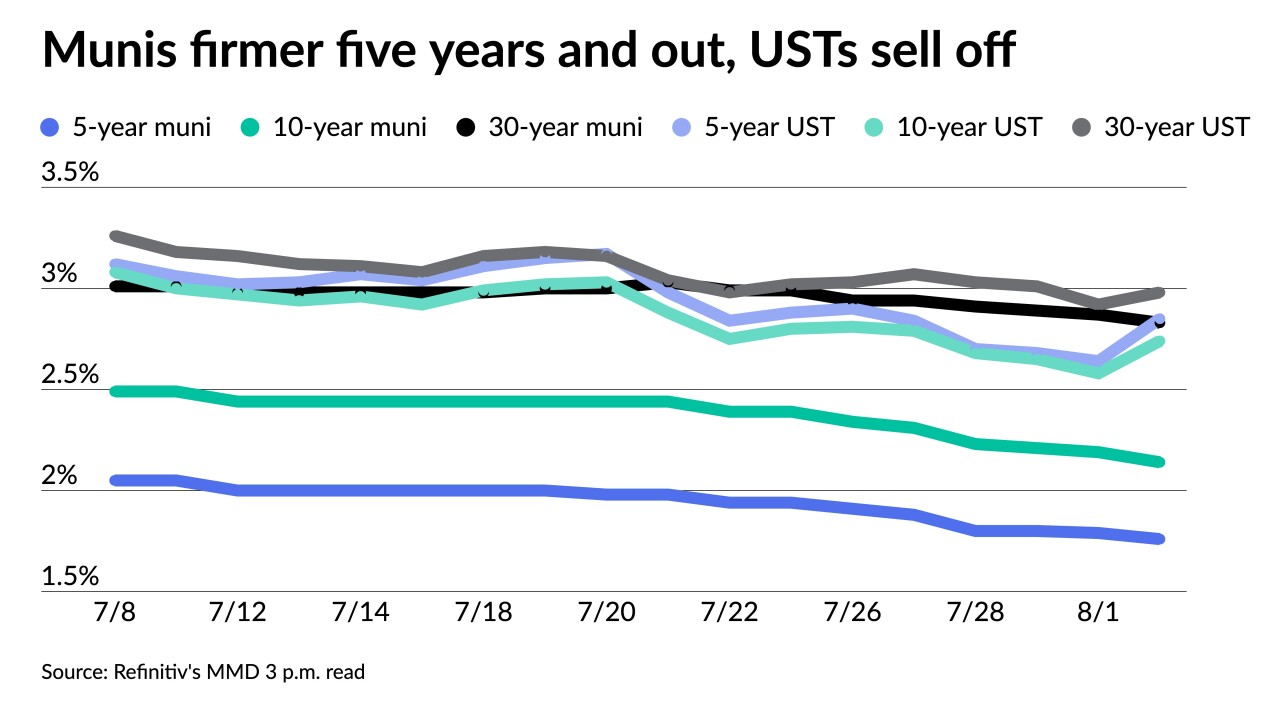

Munis were firmer to end the week but underperformed U.S. Treasuries.

July 22 -

Investors pulled $698.782 million out of municipal bond mutual funds, per Refinitiv Lipper data, versus the $206.127 million of inflows the week prior. High-yield saw small inflows.

July 21 -

The top two bond insurers — Assured Guaranty and Build America Mutual — accounted for $17.132 billion of deals in the first two quarters.

July 21 -

The Investment Company Institute reported investors added $543 million to muni bond mutual funds in the week ending July 13 compared to the $1.061 billion of outflows in the previous week.

July 20 -

Looking forward, a myriad of factors, including spiking fuel prices, fallout from the Russian invasion of Ukraine and the heat wave, “will facilitate recessionary(ish) economic outcomes by year end," noted an MMA report.

July 19