Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

Another day of mixed inflation data led Treasury yields to rise but munis mostly stayed put after underperforming a UST rally earlier in the week. The market is also focused on the $9 billion of redemption flows coming on Tuesday.

By Lynne FunkAugust 11 -

Refinitiv Lipper reported $278.559 million of inflows into municipal bond mutual funds for the week ending Wednesday, led by exchange-traded funds.

By Lynne FunkAugust 10 -

After July's hike, analysts are mixed on whether the Federal Open Market Committee is done raising rates.

By Gary SiegelAugust 1 -

Analysts look at whether the FOMC will bring the last rate hike in the cycle, whether recession is coming, and whether the Fed is making a policy mistake.

By Gary SiegelJuly 24 -

Much uncertainty remains as the second half of the year begins, with Federal Reserve rates, recession and inflation all still to be decided.

By Gary SiegelJuly 5 -

Analysts agree with the market that the Federal Open Market Committee will hold rates in a range of 5% to 5.25%, but guidance will suggest a future hike.

By Gary SiegelJune 13 -

The CPI numbers coming in pretty much as expected "was a relief" to the markets, with the bond market rallying after the release, said Luke Bartholomew, senior economist at abrdn.

May 10 -

Still no clarity as the banking crisis adds to the difficulty of predicting an economy still feeling COVID impacts and uncertainty about the prospects for a recession.

By Gary SiegelApril 24 -

The reverberations from the Silicon Valley Bank and Signature Bank failures make the outcome of this week's Federal Open Market Committee meeting unpredictable.

By Gary SiegelMarch 20 -

The collapse of Silicon Valley Bank and Signature Bank clouds the economic landscape and complicates monetary policy decisions but it's a long way off from the troubles banks and broker-dealers faced in the 2008 financial crisis.

March 17 -

The recent bank failures have changed market thinking about the Federal Reserve's next move.

By Gary SiegelMarch 14 -

Analysts opine on the Federal Open Market Committee meeting, how high interest rates will go and when the first cut may happen.

By Gary SiegelJanuary 30 -

"I think the bond market is right, a recession is coming," said Liz Young, head of investment strategy at SoFi, "and the economic indicators reinforce that message."

By Gary SiegelJanuary 3 -

Some analysts see the Federal Reserve cutting rates in late 2023, but others expect no rate cuts before 2024.

By Gary SiegelDecember 28 -

The Fed chairman said he believes the Fed is getting close to a sufficiently restrictive level, but they're not quite there. While two good inflation reports are good, "there's still a long way to go to price stability."

December 14 -

Markets took the news that it will soon be appropriate to increase the Fed funds target rate at a slower pace as good news.

By Lynne FunkNovember 23 -

It appears to have been a good time to request bonds as most of the largest issues were approved.

By Gary SiegelNovember 9 -

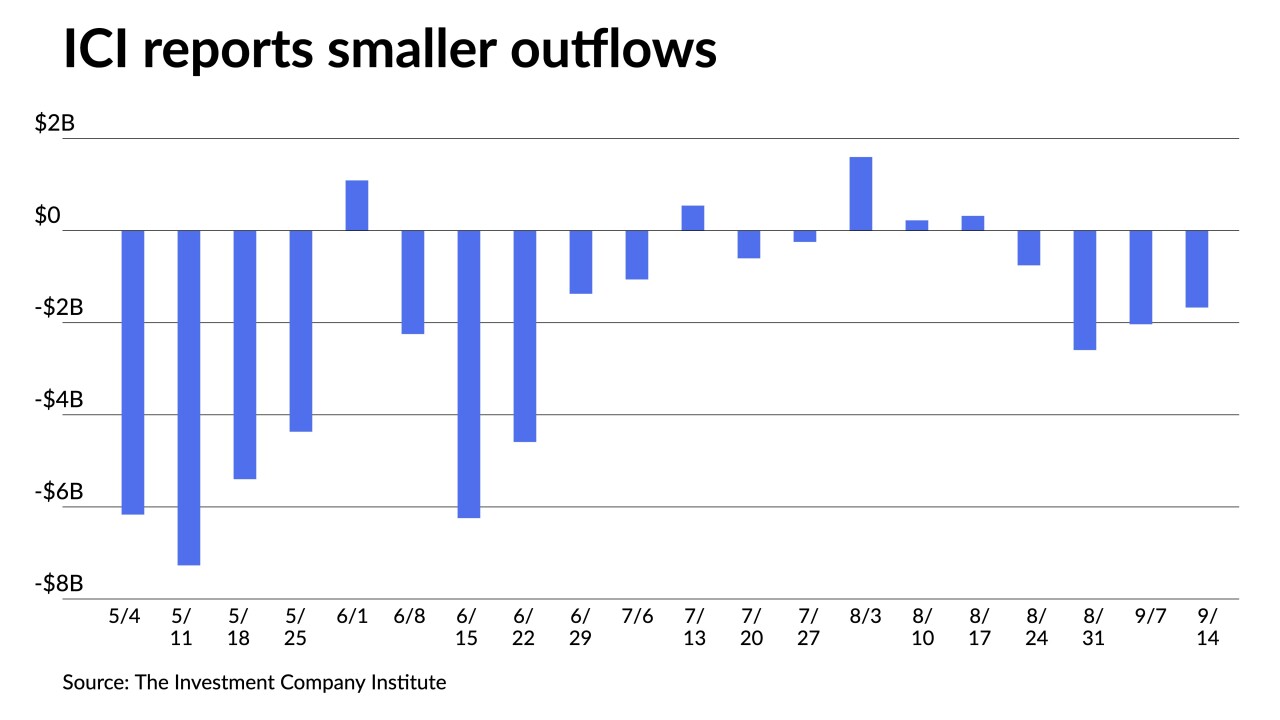

Investors pulled $3.843 billion from mutual funds in the week ending Oct. 26 after $3.876 billion of outflows the previous week, according to ICI.

November 2 -

With the Federal Reserve's hike pretty much expected, analysts will search for clues about future moves.

By Gary SiegelOctober 31 -

Munis were little changed while long UST improved and equities ended in the red after the FOMC raised the fed funds rate target 75bps to a range of 3% to 3.25% and members are leaning toward a rate of 4.4% by yearend.

September 21