Christine Albano is a reporter in the Investor’s & Investing beat, which she has covered for the past two decades. She has a wide range of buy side sources in the municipal market and has covered trends affecting retail investors, institutions, municipal mutual funds, tax-exempt money market funds, and the high-yield beat. She has also written about some of the industry’s biggest issues, such as historic defaults in Orange County, Calif., Puerto Rico, and Jefferson County, Ala., as well as the collapse of the variable-rate demand market. In addition, she reported on the subsequent 2008 financial crisis, and the death of municipal bond pioneer Jim Lebenthal. She provided next day coverage of the impact on the municipal bond market of the Sept. 11 terrorist attacks on the World Trade Center, and recently interviewed The Vanguard Group Inc. founder, former chief executive officer, and investment guru John C. Bogle about the best investing advice for the municipal market.

-

Taxable munis have posted the highest returns among all fixed-income indexes this year, BofA said.

By Chip BarnettDecember 22 -

Paltry supply will force the secondary to handle the rest of 2020; New York City taxable general obligation bonds trade up by nearly 20 basis points on intermediate bonds.

By Lynne FunkDecember 18 -

The entire municipal exempt yield curve is seeing consolidation with a 125 basis point spread between one and 30 years, and sub-1% yields are holding firm inside of 15 years.

By Lynne FunkDecember 17 -

Muni benchmarks were steady while new deals re-priced to lower yields in a tale of two markets. ICI reported more inflows.

December 9 -

Strong technicals, low supply, yield-seekers keep munis outperforming.

By Lynne FunkDecember 8 -

A heavier calendar still will not fulfill the $20 billion-plus of December redemptions. Muni/UST 10-year ratios fell to 74% as the UST 10-year came closer to 1.00%.

By Lynne FunkDecember 4 -

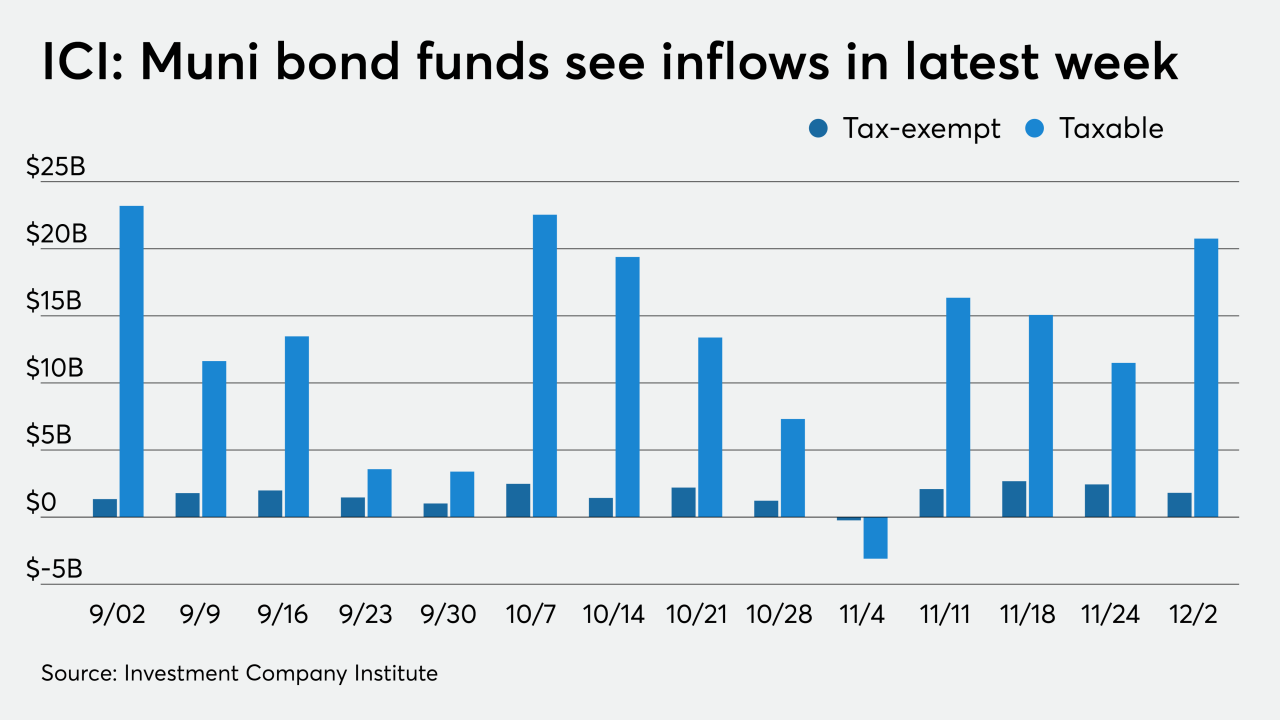

Until supply increases, year-end demand has munis outperforming. ICI reports another multi-billion week of inflows.

By Lynne FunkDecember 2 -

Munis are likely to lag Treasuries in some fashion once year-end empathy settles in mid-month and ratios become a factor.

By Lynne FunkDecember 1 -

After volume in November came in around $19 billion, the lowest since 1999, investors look to December.

By Lynne FunkNovember 30 -

The Investment Company Institute reported municipal bond funds saw $2.675 billion of inflows in the latest reporting week.

By Chip BarnettNovember 25 -

Joseph P. Rogers, Jr. “Buck", 84, a U.S. Navy veteran, retired bond lawyer at Hawkins, Delafield & Wood LLP, and innovator in the public finance industry, died on Oct. 23 of a recurrence of Lymphoma.

November 23 -

Municipals continue to rally as market participants get ready to head into a quiet holiday week.

By Chip BarnettNovember 20 -

A supply/demand imbalance allowed New Jersey and Massachusetts to reprice to lower yields while the beleaguered New York MTA will head back to the Fed for liquidity.

By Chip BarnettNovember 18 -

Municipals firmed Friday, with yields falling by as much as two basis points, as coronavirus threats grow and a flight-to-safety resumes.

By Chip BarnettNovember 13 -

Municipal bonds strengthened Thursday as yields fell by as much as four basis points on AAA curves but coronavirus vaccine rally in stocks slowed and UST, munis regained ground.

By Chip BarnettNovember 12 -

Light primary easily absorbed while secondary trading showed a steadier market as it closes for Veterans Day. Massachusetts announces $1.4 billion of GOs for next week.

By Chip BarnettNovember 10 -

Municipal yields rose as much as five basis points on the long end, but the losses were not as pronounced as UST. Light dealer inventories and scarce secondary trading let munis outperform Treasuries.

By Chip BarnettNovember 9 -

As the week drew to a close, municipal bond market participants looked ahead to a smaller-than-usual supply slate dominated by revenue bond deals.

By Chip BarnettNovember 6 -

Top-rated muni yields fell by as much as 10 basis points on the AAA curves on Wednesday the largest move better for the market since late April, early May. ICI reported $1.2B of muni bond fund inflows.

By Chip BarnettNovember 4 -

The only major deal slated on the calendar, the Maine Turnpike Authority, came to market on Tuesday.

By Chip BarnettNovember 3