Municipals held steady to a basis point weaker in spots Wednesday as New Jersey Transportation bonds priced 15 to 20 basis points lower than premarketing levels as demand heavily outweighed supply.

Treasury losses were more muted but municipals did not follow for a second day with primary deals getting bumped in repricing.

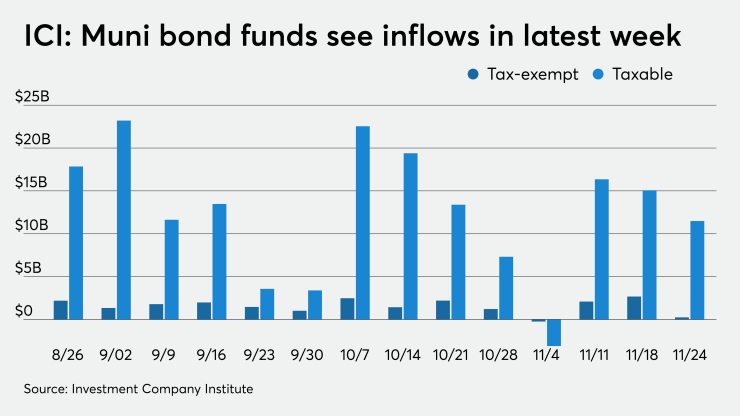

Meanwhile, ICI reported another $2.5 billion of inflows after a nearly $3 billion week prior.

The primary isn’t providing enough for investors and unless a major economic or health-related event occurs — with the COVID-19 factor mostly priced in — most participants expect munis to hum along to end the year.

The repricing of New Jersey’s Transportation Trust Fund deal was not surprising to the buy-side community in the current muni market climate.

In fact, the bonds are expected to trade to lower yields — just like the state COVID-19 emergency general obligation bonds did after a recent deal, according to John Mousseau, chief executive officer of Cumberland Advisors. The Jersey GOs traded up by as much as 50 basis points after breaking free.

“The muni market is now treating COVID as a ‘known’ rather than an ‘unknown,’ ” he said Wednesday.

“Whereas this may mean a rise over time in overall yields as Treasury yields move up with an expectation of greater economic activity, yields on more pandemically affected bonds and issuers should improve relative to the market and that is the case here,” Mousseau said of the New Jersey transportation deal.

The market demand for yield paper is “pretty insatiable right now.” as evidenced by the recent spread tightening in various mid-grade and high-yield credits and the heavy oversubscriptions on recent new issues, such as last week’s JFK International Airport deal, according to Justin Horowitz, vice president and municipal trader at AllianceBernstein.

Initial price talk from earlier in the week was 5% coupons at plus 170, roughly 90 basis points wider than where the GO deal has traded up to, Horowitz said.

“The 90 basis point spread pickup was quite attractive for the one notch lower rating and being an appropriation of the state,” he added.

“As a result, it was no surprise the deal saw extremely strong demand even at revised levels when it was released with a $20 billion order book and greater than 100 investors participating and was re-priced much tighter to plus-145” basis points above the generic, triple-A scale, Horowitz said.

November’s New Jersey COVID-19 emergency GOs (A3/BBB+/A-/A) traded up significantly in the secondary after it broke free to trade. The closest comparable to today’s deal is the 4s of 2032, which were priced at 2.25%, and traded Tuesday at 1.81%-1.75%.

Overall, buy side participants said the deal will set a precedent for the future for lower-rated credits.

“The market is looking down the corridor and around the corner at a world post vaccine,” Mousseau said. “And these types of deals — lower-rated, but not junk — should continue to get good reception.”

“The strong demand for both yield paper, and this deal in particular, would lead us to assume the deal will perform very well on the break and most likely trade tighter,” according to Horowitz.

MSRB data show less than 20% of volume traded has been in AAA-rated names in the last 30 days, while 25% of volume has come in the nonrated, BBB and A-rated categories.

“Until a broader range of credits comes to market, secondary flows will favor sellers and holders of high-grade credits,” said Kim Olsan, senior vice president at FHN Financial.

Indeed, secondary trading of large blocks of Virginia, Massachusetts, Maryland, Utah, and Montgomery County, Maryland, paper exchanged hands at tight spreads.

Even lower-rated names showed tighter trades as investors reach for yield. New York City TFA 5s of 2036 traded at 1.49% versus its original 1.92% and TFAs if 2037 at 1.53%. On November 13 they traded at 1.71%-1.70% after originally pricing at 1.98%.

Primary market

Goldman, Sachs & Co. priced $1.5 billion of transportation program bonds for the New Jersey Transportation Trust Fund Authority (Baa1/BBB/BBB+/A-) and repriced to lower yields by 15 to 20 basis points. The 5s of 2035 yielded 2.29% (-15 in repricing) 4s of 2035 at 2.44% (-20), 5s of 2040 at 2.62% (-12), 4s of 2040 at 2.79% (-15), and the long bond 5s of 2050 at 2.94% (-17), 4s at 3.06% (-15) and 3s at 3.22% (-15). Spreads against AAA benchmarks showed the 5s of 2035 +135, 5s 2040 at +143 and the long bond 3s of 2050 at +181.

Siebert Williams Shank also priced for institutions the New York City Municipal Water Finance Authority’s (Aa1/AA+/AA+/NR) $533 million of tax-exempt fixed-rate bonds, an increase in amount from Tuesday’s retail pricing. The first part, $305 million of water and sewer system second general resolution revenue bonds Subseries BB-1, 5s of 2050 were priced to yield 1.74%, 3s of 2050 to yield 2.17% (two basis points lower in repricing). The second, $229 million of water and sewer system second general resolution revenue bonds Subseries BB-2, priced two basis points lower to yield 0.21% with 4% coupon in 2023, 0.25% with a 4% in 2024, 1.73% with a 4% coupon in 2042.

Morgan Stanley priced $305 million of aviation revenue refunding bonds, non-AMT, for Miami-Dade County Florida (/A-/A/A+), had 5s of 2023 yield 0.49%, 5s of 2030 at 1.38% and 4s of 2041 at 2.20%.

ICI: Muni bond funds see $2.5B inflow

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $2.463 billion in the week ended Nov. 25, the Investment Company Institute reported Wednesday. In the week ended Nov. 18, muni funds saw an inflow of $2.675 billion, ICI said.

Secondary market

High-grade municipals were little changed to a basis point weaker out long, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were flat at 0.14% in 2021 and 0.15% in 2022. The yield on the 10-year was unchanged at 0.72% while the yield on the 30-year was one basis point higher at 1.42%.

The 10-year muni-to-Treasury ratio was calculated at 77% while the 30-year muni-to-Treasury ratio stood at 84%, according to MMD.

The ICE AAA municipal yield curve showed short maturities unchanged at 0.15% in 2021 and 0.16% in 2022. The 10-year maturity rose one basis point to 0.72% while the 30-year yield was unchanged 1.43%.

The 10-year muni-to-Treasury ratio was calculated at 77% while the 30-year muni-to-Treasury ratio stood at 84%, according to ICE. The five-year ratio was at 50%.

The IHS Markit municipal analytics AAA curve showed short yields at 0.15% and 0.16% in 2021 and 2022, respectively, and the 10-year steady at 0.70% as the 30-year yield rose three basis points to 1.42%.

Treasuries rose a few basis points as equities were up again. The 10-year Treasury was yielding 0.94% and the 30-year Treasury was yielding 1.70%. The Dow rose 59 points, the S&P 500 rose 0.18% and the Nasdaq lost 0.05%.