Municipal bonds strengthened on the long end Friday as the new-issue calendar bulked up to over $11 billion. Crosscurrents of the coronavirus spread, state and local government shutdowns, and post-election stress pushed investors into safe-haven assets.

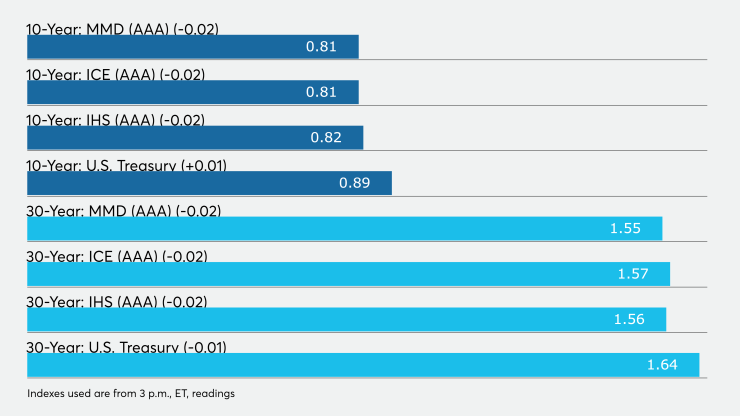

Yields on top-rated bonds fell by as much as two basis points on the AAA scale. On the week, muni yields were little changed after rising early in the week and then falling back to recent levels.

IHS Ipreo estimates volume for the week of Nov. 16 will be $11.4 billion, up from just under the $2 billion seen in the previous week. The calendar is composed of $9.6 billion of negotiated deals and $1.8 billion of competitive sales.

Refinitiv MMD estimates the supply total consists of $8.7 billion of tax-exempts and $2.7 billion of taxables. The year-to-date weekly average volume has been $6.1 billion.

On Friday, New York City Mayor Bill de Blasio warned city schools may end in-person classes as soon as Monday. Out West, California, Oregon and Washington asked people arriving there to self-quarantine because hospitals were nearing capacity. In the Midwest, Illinois reported a record number of hospitalizations after Chicago Mayor Lori Lightfoot issued a 30-day stay-at-home advisory. On Monday, Puerto Rico will activate National Guard units to enforce virus prevention orders.

"What seems apparent as the pandemic runs its course is the market will be particularly news-dependent and a broad range trade is most likely through the end of the year," said Kim Olsan, senior vice president at FHN Financial. Olsan noted, since the beginning of October, the 10-year AAA spot has traded between 0.80% and 0.94% and at the long end the AAA range has been 1.58% to 1.74%. Current levels of 0.83% and 1.60%, respectively, are "indicative of a market running mostly on inventories and sell situations."

That changes when supply ticks up next week

"Bidding will have to decipher how deep demand really is and work into yields that take into account a growing list of competing factors — pressured city and state budgets, lower relative value ratios, decent reinvestment flows and reasonably competitive taxable equivalent yields," Olsan said.

Demand for paper remained heavy on Friday as the supply/demand imbalance factored into market sentiment in the backdrop of both an upcoming large calendar and limited supply through year end, municipal buyside sources said.

“While there is definitely uncertainty in the markets, the recent performance of municipal bonds versus Treasuries, in the face of large issuance, demonstrates that there is strong demand” for tax-exempts, said Robert Roffo, managing director at R&C Investment Advisors LLC.

“Muni ratios have been driven to rich levels and today's positive price movement will certainly add to the richness,” he explained. Still, Roffo said investors can “breathe a sigh of relief” as municipals have not experienced the same rise in rates as Treasuries.

While the calendar is larger than average, he noted, much of the volume is due to New Jersey’s COVID-19 emergency general obligation bond issue. The deal “should see wider than normal spreads and good demand based on those spreads.”

Muni issuance should be light for the remainder of the year, according to James Noble, portfolio manager of Principal Global Investors’ Municipal Fixed Income Strategy.

Muni issuance is typically heavy post-election, according to Noble, but this year is different for the tax-exempt market, as he expects coupon and principal repayments to exceed supply through year end. “This will provide a positive technical to the muni market as investors need to put cash to work,” he said.

The elections impacted supply before and after America went to the polls, Noble said.

“The fear of a blue wave leading to higher rates caused municipalities to front load supply for the three months ahead of the election, pushing muni yields higher,” he said, as a result, supply — and some market volatility — will both decrease going forward.

“With a divided government, the market tail risk for munis is going down because it will be harder for the federal government to implement big, sweeping policy changes — and markets like that,” Noble explained.

In other expectations, he said, federal taxes are not likely to go up in the near-term, but that state taxes will have to rise to cover budget shortfalls.

“If you are waiting for a signal, we believe the likely downgrade of Illinois to junk could be an entry point to add muni exposure,” Noble said. Along with the election results, rating agencies were waiting for the state’s vote on the progressive tax before taking any rating action on Illinois, he pointed out.

Primary market

States feature prominently on the upcoming calendar, with the Garden, Bay and Aloha states all set to offer large bond issues.

BofA Securities is expected to price the

“New Jersey’s mega-GO sale probably becomes something like Illinois’ $1 billion-plus GO sale in 2013 or the $3.5 billion Puerto Rico GO sale from 2014 — both of which were benchmark wider and/or high-yield credits that served as proxies for their sectors,” Olsan said. “Given the shorter structure of the New Jersey issue with a maximum 2032 maturity, its applicability will be greater for short- and intermediate-duration focus.”

Morgan Stanley is expected to price Massachusetts’ (Aa1/AA/AA+/) $1.362 million of GOs on Wednesday. The deal consists of $500 million of consolidated loan of 2020 Series E GOs, $417.655 million of Series 2020D GO refunding bonds and $444.09 million of Series 2020E taxable GO refunding bonds.

Hawaii is coming to market with $242 million of harbor system revenue bonds. BofA is set to price the deal on Thursday. The issue is composed of Series 2020A bonds subject to the alternative minimum tax, Series 2020B taxables and Series 2020C non-AMT bonds.

Also on the calendar, UBS financial Services is expected to price Baltimore, Md.’s (Aa2/AA-/NR/NR) $670.33 million of revenue bonds on Wednesday. The deal consists of Series 2020A water project revenue bonds, Series 2020B taxable water project refunding revenue bonds and Series 2020A taxable wastewater project revenue refunding bonds.

California (Aa1/AAA/AA) is coming to market with a large variable-rate deal. Siebert Williams Shank is set to price the $100 million of Series 2020A variable-rate GOs due 2048 on Wednesday.

The Port of Oakland, Calif., is coming to market with $531.08 million of bonds in two deals on Thursday. BofA is set to price the $344.29 million of Series 2020R (A1/A+/A+/NR) taxable senior lien refunding revenue bonds and $186.79 million of Series 2021H forward delivery intermediate lien refunding revenue AMT bonds.

In the competitive arena, the City and County of Denver, Colo., will sell $401.68 million of bonds in two offerings on Tuesday. The sale consists of $231.755 million of Series 2020B Better Denver GO refunding bonds and $169.925 million of Series 2020A Elevate Denver GOs.

On Friday, Citigroup received the written award on the California Earthquake Authority’s (NR/NR/A/AA-) $300 million of Series 2020B taxable revenue bonds. The bonds were priced at par to yield 1.127% and 1.227% in a split 2021 maturity, 1.327% in 2022 and 1.477% in 2023.

“This helps to strengthen earthquake insurance in California so that homeowners can continue to be well protected,” said State Treasurer Fiona Ma. She said the bonds were well received by investors, generating over $2.6 billion in orders. The all-in true interest cost for the bonds was 1.64%.

Secondary market

Some notable trades Friday:

Jersey City, N.J., BANs, 2s of 2021, traded at 0.32%-0.31%. Houston 5s of 2025 traded at 0.32%. On November 5 they traded at 0.38%-0.35%. Montgomery County, Md., 4s of 2030 traded at 0.88% versus 0.90% Thursday. Loudon County, Va., 5s of 2031 traded at 0.89% versus 0.92% Thursday.

Large blocks of North Carolina, Maryland GOs and New York City TFA subs were trading Friday. North Carolina 5s of 2023 traded at 0.18%, 5s of 2028 at 0.55% (a month ago at 0.70%), 5s of 2029 traded at 0.66% (original 0.84%), 5s of 2030 traded at 0.76% (original 0.94%). Maryland GO 5s of 2028 traded at 0.60% versus 0.62% Thursday, 5s of 2029 at 0.72%, 5s of 2030 at 0.82% versus 0.87% Thursday.

New York City TFA recovery bond 5s of 2022 traded at 0.25% after 0.23% original. NYC TFA sub 5s of 2029 tradedat 1.03%-1.00% versus 1.10% Tuesday, 5s of 2036 at 1.67%-1.66% versus 1.73% Tuesday, 5s of 2037 at 1.71%-1.70%.

High-grade municipals were mostly stronger Friday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were unchanged at 0.17% in 2021 and 0.18% in 2022. The yield on the 10-year muni fell two basis points to 0.81% while the yield on the 30-year dropped two basis points to 1.55%.

The 10-year muni-to-Treasury ratio was calculated at 90.7% while the 30-year muni-to-Treasury ratio stood at 94.5%, according to MMD.

The ICE AAA municipal yield curve showed short maturities slipping one basis point to 0.16% in 2021 and 0.18% in 2022. The 10-year maturity dropped two basis points to 0.81% and the 30-year yield fell two basis points to 1.57%.

The 10-year muni-to-Treasury ratio was calculated at 92% while the 30-year muni-to-Treasury ratio stood at 95%, according to ICE.

The IHS Markit municipal analytics AAA curve showed yields dipping across the curve, at 0.17% and 0.18% in 2021 and 2022, respectively, and the 10-year at 0.82% with the 30-year yield at 1.56%.

Treasuries were mixed as stock prices traded up.

The three-month Treasury note was yielding 0.10%, the 10-year Treasury was yielding 0.89% and the 30-year Treasury was yielding 1.64%. The Dow rose 1.38%, the S&P 500 increased 1.25% and the Nasdaq gained 0.80%.

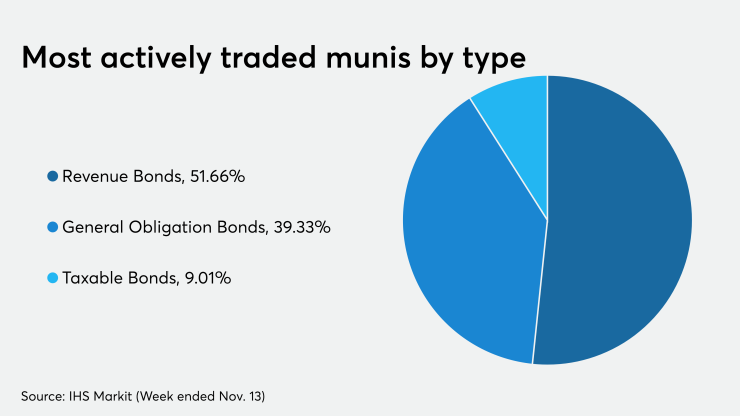

The most active bond types traded this week were revenue bonds, followed by GOs and taxables, according to IHS Markit.

Bond Buyer indexes mixed

The weekly average yield to maturity of the The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell three basis points to 3.58% from 3.61% in the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields rose four basis points to 2.28% from 2.24% from the previous week.

The 11-bond GO Index of higher-grade 11-year GOs increased four basis points to 1.81% from 1.77%.

The Bond Buyer's Revenue Bond Index jumped 10 basis points to 2.70% from 2.60%.