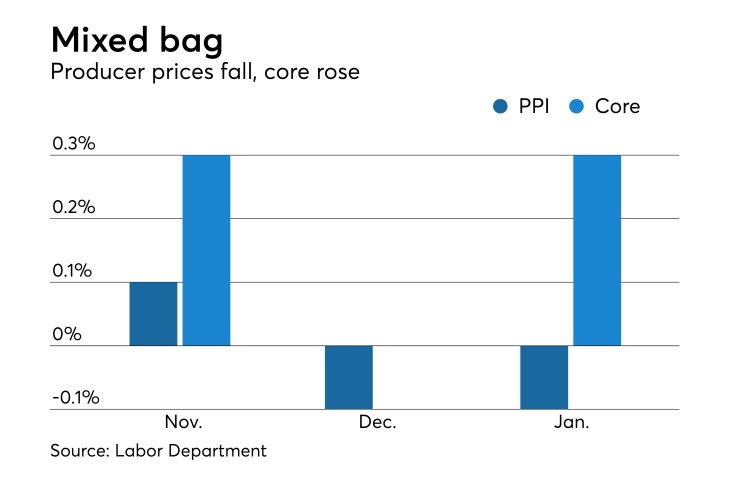

WASHINGTON — The January producer price index data was weaker than expected, falling 0.1% overall. However, there was a 0.3% gain excluding food and energy.

Analysts had expected overall PPI to rise by 0.1% and prices to be up 0.2% excluding food and energy prices in January. The reason for the headline miss was a stronger than expected decline in energy prices and a large decline in food prices. These were partially offset by a strong gain for trade services.

Energy prices fell 3.8%, food prices fell 1.7%, and trade services rose 0.8%. Removing those categories, PPI ex. trade services, food, and energy was up 0.2% after a flat reading in the previous month.

The year/year rate of inflation for final demand PPI was 2.0%, down from 2.5% in December, while PPI ex food and energy was 2.6% year/year, slightly below 2.7% in the previous month. The year/year rate for prices also excluding the volatile trade services category was 2.5%, down from the 2.8% rate in December.

The personal consumption price measure in the data, which some analysts use as a preview measure for the PCE price index, was down 0.1% overall in January, but up 0.3% ex. food and energy, and was flat also excluding trade services.

These followed modest declines in both overall and ex. food and energy PCE prices in December, which suggests no clear risk for the December PCE inflation data.

Within the core, there were modest upward movements in a number of categories. Passenger car prices rose 0.5%, while light truck prices rose 0.3%.