-

Deston High School defaulted on series 2021A, 2022A and 2022B bonds.

September 25 -

Anthony Woodward is the co-founder and CEO of RecordPoint, an innovative, fast-growing Australian SaaS solution focused on helping organizations discover, govern, and control their data for tighter compliance, more efficiency, and less risk. With a background in both technology and the law, Anthony has also held positions at Unique World, Commander, and Freehills. He also co-hosts the FILED podcast and writes the FILED newsletter, focusing on the intersection of data privacy and governance. Anthony is regarded as one of the leading thinkers on the intersection of data and privacy.

September 25 -

How Congress and the Trump administration navigate the next several months carries implications for municipal issuers and investors.

September 25 -

Bond lawyers, municipalities, and transportation officials are moving towards greater use of public private partnerships for infrastructure projects bogged down by capital constraints and high risk.

September 25 -

S&P Global Ratings cut the Toms River Regional School District to A-minus from A, ending a negative CreditWatch but assigning a negative outlook.

September 25

Pamela Frederick and Adam Barsky will share their views on the importance of the tax-exemption, how it benefits state and local governments, taxpayers, and U.S. retail investors -- and keeps the country competitive on a global scale.

Glenn Lee is warning the city government of a $21.6 million drop in year-to -date collections and a grim financial forecast of years to come due to falling employment levels.

The Trump administration wants to shed federal office space, and bonds backed by those leases are feeling the heat.

Tom Wright, president and CEO of the Regional Plan Association, talks with Chip Barnett about the ongoing Gateway transportation project and its importance to the tri-state region. He also discusses the challenges and opportunities in transit, infrastructure, affordable housing, climate change and ESG. (30 minutes)

Daniel Berger, Senior Municipal Strategist at Refiniv Municipal Market Data, talks about what’s in store for the municipal bond market in the second half of this year. Are munis set to rally in the next few months? He looks at market volatility and talks about who holds muni bonds, bond fund outflows and discusses muni to Treasury ratios and the yield curve. Gary Siegel and Chip Barnett host. (15 minutes)

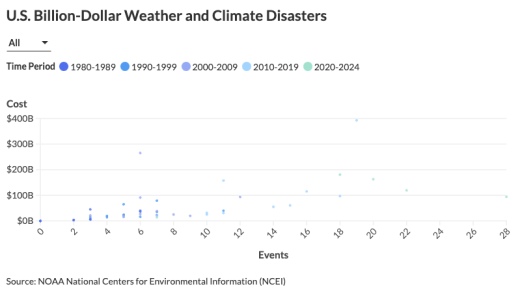

The steady demand for municipal bonds in high-risk areas underscores the complex relationship between climate change and financial markets.

Oppenheimer's Head of Public Finance Beth Coolidge and Columbus Auditor Megan Kilgore delve into the future of public finance and human infrastructure on a wide range of topics, from affordable housing and workforce development to public health, climate resiliency, and digital access.

As extreme weather events occur with more frequency across the country, Michael Gaughan, executive director of the Vermont Bond Bank, says municipal bond banks can help smaller communities deal with the effects of them. Gaughan speaks with The Bond Buyer's Lynne Funk on the effects of climate change and how the various levels of government can work together to address it.

Daniella Levine Cava, Mayor of Miami-Dade County, Florida, talks with Chip Barnett about the county's robust economy as it recovers from the COVID-19 pandemic. She talks about how the seaport and airport are booming and looks at some challenges ahead such as environmental and housing issues. Taped live in Miami on Dec. 7. (10 minutes)

Branding experts argue against ditching ESG. Instead, they say, the finance industry needs to better explain what ESG is.

A previous measure prohibiting government contracts with companies that "discriminate" against the firearm industry fell short of passing the 2022 legislature.

-

The state will tap reserve funds, close tax loopholes and cut spending to address a more than $1 billion shortfall in its fiscal 2026 budget.

August 29 -

Federal Reserve Gov. Christopher Waller criticized his fellow Federal Open Market Committee members for not cutting interest rates in July, but said he is "hopeful" that easing monetary policy soon can keep the labor market from "deteriorating."

August 29 -

The world's biggest opera house has been downgraded for the second time this year.

August 29 -

The GOP reconciliation bill will cut $888 million in revenue from Oregon, state economists said, because its state tax laws conform with federal law changes.

August 29 -

With the break in issuance this week, the market has firmed a bit, said Tim McGregor, managing partner at Riverbend Capital Advisors.

August 28