WASHINGTON – Municipal bonds would be hurt under Republican presidential candidates' tax reform proposals because the plans would lower or eliminate individual and corporate income tax rates, congressional observers said.

The more a plan would lower income tax rates, the more it would be detrimental to munis, they said.

None of the candidates' tax proposals or comments about tax reform specifically mentions munis. Some candidates have provided more information than others, but no candidates' tax reform plans are extensively detailed. However, the Republican plans generally would lower tax rates and reduce tax preferences. Some of the plans would lower income tax rates more than others.

For example, Sen. Marco Rubio from Florida would lower the top individual rate of 35%, former Florida Gov. Jeb Bush and Ohio Gov. John Kasich would reduce the top individual rate to 28%, New York businessman Donald Trump and Louisiana Gov. Bobby Jindal would have a top rate of 25%, and Sen. Ted Cruz from Texas would have a single individual income tax rate of 10%. Former Arkansas Gov. Mike Huckabee would replace the income tax with a federal sales tax.

The two key tax reform issues for the muni market are if rates would be reduced so much that munis would become unattractive or if the tax exclusion for munis would be restricted or eliminated, said Frank Shafroth, director of the Center for State and Local Leadership at George Mason University.

Lowering rates "removes the incentives for purchasing state and local bonds," Shafroth said.

To the degree that the proposals cut rates, they "create real challenges for the tax-exempt bond market," said Howard Gleckman, a senior fellow at the Urban Institute. However, if tax reform plans keep the tax exemption for munis, it could be one of the few remaining tax shelters left, he said.

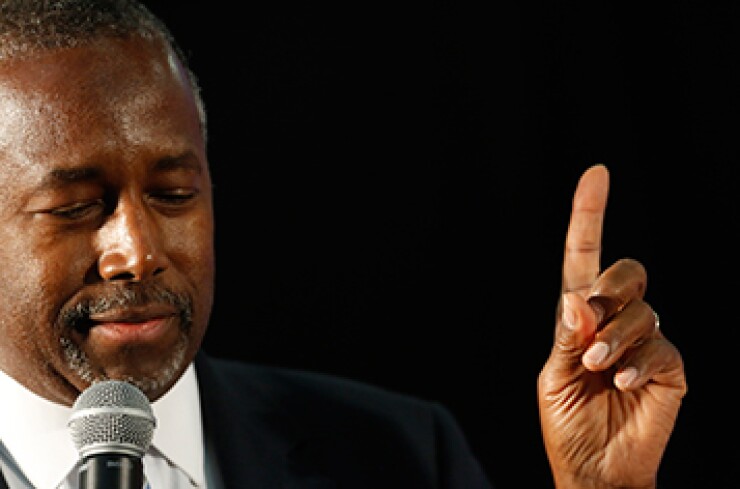

While candidates have not specifically said they would limit or eliminate the muni exemption, some have said that they would broadly eliminate tax preferences. Retired neurosurgeon Ben Carson, who resides in Baltimore, Md., has said he would eliminate all deductions and loopholes, and former Hewlett-Packard chief executive officer Carly Fiorina, who lives in Mason Neck, Va., has said she would eliminate essentially all tax preferences. Other candidates, such as Bush, have focused on saying that they would eliminate itemized deductions, which does not include munis.

The Tax Foundation estimated the revenue and other effects of some of the Republican candidates' proposals. All of the proposals for which the group calculated estimates would lose revenue under static scoring. Only the plan of Sen. Rand Paul, from Kentucky, would raise revenue under dynamic scoring, which takes into account the macroeconomic effects of the proposals.

Ultimately, if a candidate's plan would lose money, "they'll be pressure to not make it a budget buster" and have it be as close to revenue-neutral as possible, said Micah Green, co-chair of Steptoe & Johnson's government affairs and public policy group. The larger the rate reduction, the more pressure there would be to curb tax expenditures, he said.

Candidates, if elected, would need to find some way to pay for lowering rates, which would probably lead to cuts to tax expenditures or spending, Shafroth said.

To get to the tax rates discussed, "everything has got to be on the table," said a tax lobbyist who declined to be identified.

Green said that it's very important for muni issuers to clearly articulate that the ultimate beneficiaries of tax-exempt bonds are the taxpayers who benefit from lower borrowing costs. The market can't be in favor of higher tax rates, he added.

"The municipal marketplace has to be conscious of the political drivers of tax reform to lower marginal tax rates and yet do so in a manner that ensures states and localities can still get lower borrowing rates as a result of the tax exemption on municipal bonds," he said.

Cruz and Paul have proposed types of value added taxes. If the country moves to a VAT and income tax rates are reduced, the incentive to purchase munis "diminishes significantly," Shafroth said.

About half of states rely more on sales and use taxes than income taxes. Those states would be disproportionately hurt by a VAT, Shafroth said. A VAT would make it harder for those states to raise their sales taxes, and it would make goods in those states more expensive, decreasing demand for them, he said.

The Democratic presidential candidates haven't released comprehensive tax reform proposals, though former Secretary of State Hillary Clinton said she would offset a plan to reduce student debt by limiting tax preferences for the wealthy.

Democratic candidates talk about making changes to provide relief to the middle class, which places scrutiny on any preference that looks like it benefits the wealthy over the middle class, Green said.

Jessica Giroux, general counsel and managing director of federal regulatory policy for the Bond Dealers of America, said that as the number of candidates narrows, BDA and the Municipal Bonds for America coalition will try to educate the candidates about the importance of the tax exemption.

Perhaps the good news for the muni market is that tax reform is difficult to accomplish. The tax lobbyist said he thinks there is only a small chance that a bill that follows a candidate's proposal will actually be enacted.

Bill Daly, director of governmental affairs for the National Association of Bond Lawyers, agreed, saying that the possibility that any of the plans would be enacted as proposed is slim because they would generally lose trillions of dollars. He also said that "historically, there hasn't been an appetite for a federal VAT."

But Green noted that, because tax reform has become an issue in the election and new House Speaker Paul Ryan, R-Wis., has made tax reform a priority means, there is likely to be a serious debate on the issue in the coming years.

Infrastructure

Two candidates that have talked about federal spending on infrastructure are Bernie Sanders, an independent seeking the Democratic nomination, and Trump.

Earlier this year, Sanders introduced legislation to allocate $1 trillion to transportation and water infrastructure projects over eight years.

Sanders has "really staked out ground" in this area, said Susan Collet, president of H Street Capitol Strategies.

Trump has also said that the country needs to spend money on infrastructure. "He's a developer" so he understands why infrastructure is important for a good business climate, Collet said.

Candidates interested in infrastructure may propose some type of stimulus legislation, and past stimulus bills have included the creation of and changes to tax-credit bonds, Collet said.

On the other hand, New Jersey Gov. Chris Christie has delayed spending on infrastructure in his state. And Kasich has gotten a robust transportation budget passed in his state but has proposed devolution, or shifting transportation policy authority and revenue from most of the federal gas tax from the federal government to the states. Rubio and Cruz have both co-sponsored devolution legislation.

Collet noted that Christie and Kasich are running on fiscal responsibility platforms and are likely to rein in spending, though it is unclear what that would mean in terms of the muni exemption.

Shafroth said "it's really weird" that Kasich, a governor and Midwesterner, is proposing devolution. The idea that the country should have 50 state infrastructure systems instead of a national system is "ludicrous" in today's global economy, and the two biggest infrastructure presidents, Abraham Lincoln and Dwight Eisenhower, were both from the Midwest, he said.