Ziegler, the oldest healthcare-focused investment bank in the country, is becoming one of the biggest players in the specialty as well.

The Chicago based company which made its first healthcare financing in 1928, has been pointing to its track record and performance in the sector as reasons healthcare clients should consider Ziegler instead of the bigger firms.

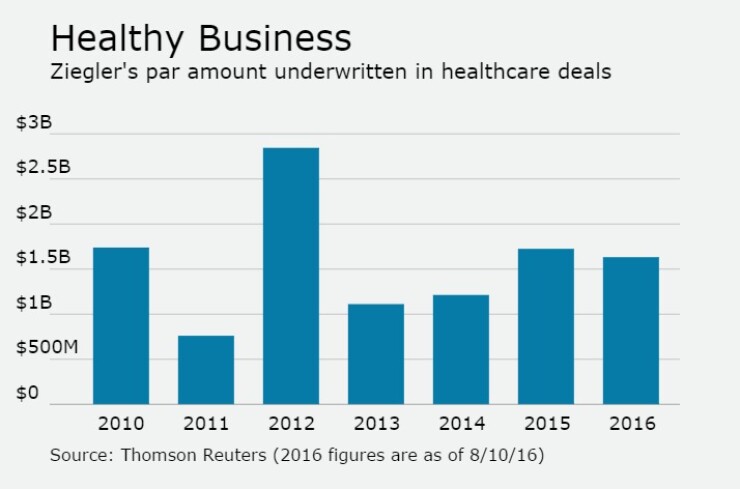

Ziegler currently ranks fourth in the underwriter's league table for healthcare, ahead of giants such as Citi, Wells Fargo and Goldman Sachs. According to data from Thomson Reuters, so far year to date, Ziegler has a par amount of $1.63 billion of underwritten deals in healthcare. Its 38 deals are the most in the sector by any firm. The firm ranks 22nd overall in municipal underwriting, up from 28th a year earlier.

"This year has represented ascension for us ahead of some of the larger firms in the healthcare rankings," said Mike Quinn, managing director for Ziegler's healthcare investment banking team. "We are starting to see an evolution in terms of how investment banking hiring decisions are getting made. The primary factors for investment banker selection have historically been around platform and brand, whereas we believe that the decision ought to be based primarily on performance."

Quinn said the firm's healthcare clients are measured on financial performance, clinical outcomes and patient satisfaction, and that Ziegler also ought to be judged on performance, rather than its net capital or the size of its retail distribution network.

In 2011, Ziegler was 11th in the underwriter's yearend league table healthcare rankings with $760 million, and 7th in 2015 with $1.72 billion.

"When we compete again a larger firm we might lose a beauty contest but, when we show the client how we execute including comparative pricing on our underwritten bond transactions, and you look at how our performance on our strategic advisory and capital sourcing engagements have supported our client's overall respective missions and goals, we have a compelling story to tell," said Quinn.

Quinn said the firm isn't focused on its ranking in the league tables but rather its ability to support the financing and strategic advisory needs of their clients in an effort to help them maintain their independence and grow.

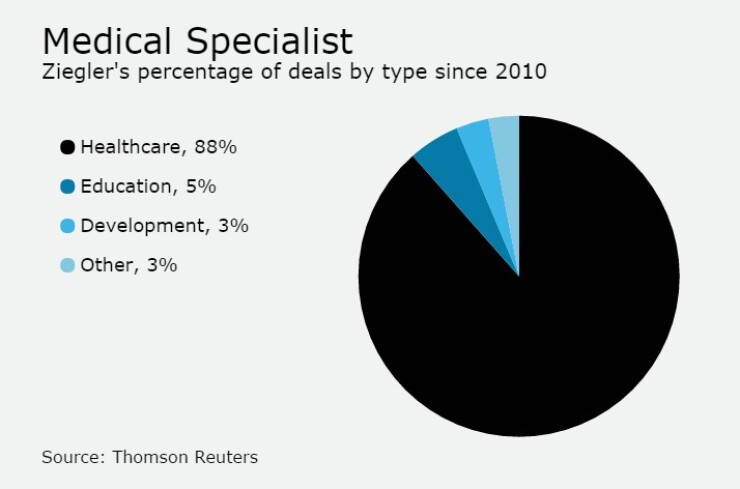

Ziegler has over 100 years of history, as the firm started in 1902 and did its first healthcare financing 26 years later. Since 2010, $11.15 billion out of the firms $11.88 billion has come in healthcare deals.

"The firm has seen a recent resurgence and we have established new relationships across the care continuum," Quinn said. "For hospitals, we have established important new relationships with stand-alone hospitals, regional systems and large multi-state systems to complement our long standing client relationships that in some cases span decades."

Quinn said that the firm's narrow healthcare focus and expertise have helped the firm surpass firms that are much larger.

"Including our well-established dominance in senior living and post-acute care leading to a holistic approach to the sector, and our unparalleled ability to assist our clients with the development and dissemination of their optimal credit story which we see as the single most important determinant of successful capital markets execution at a given point in time," he said.

Quinn also noted the lack of viable credit enhancement in the healthcare sector available like there was pre-financial crisis.

"Investors do their homework and rely some on ratings, but they are making their own credit calls," Quinn said. "We take pride in helping our clients package and market their optimal credit story to investors. During the hiring decision process, we show prospective clients our history, and they can see how many of our clients have earned rating upgrades and access to capital at a comparatively low cost when they have teamed up with us."

Ziegler clients include Adventist Health Systems West and Adventist Health System Sunbelt, which were attracted by the firm's thoughtful and rational approach.

"The reality is, they are a boutique investment bank for health care and Mike knows that and works hard to bring value to his clients," said Brandon Seibold, treasurer, Adventist Health System West. "If you look at [the big banks] he is competing against, effort has to be above and beyond."

Adventist West and Ziegler are currently preparing for an estimated $270 million par amount of transactions, which will include one current refunding and three advanced refundings, to help with interest expense and cash flow savings from both debt service reserve funds release and interest savings.

Adventist West has undergone a transformation in the past five years as it brought in a new chief executive officer, chief operating officer, and a relatively new treasurer in Seibold. Ziegler, as its underwriter, has been essential in communicating these change to the market, Seibold said.

"We are getting our message out to the investor community and Ziegler helps us articulate the market's reaction to the improving credit." he said. "Mike consistently reminds investors Adventist Health is on an improving trajectory and one should always look to buy credits as they are improving."

Although Ziegler is a national firm, with roots in the Midwest where the firm's market share is especially strong, Quinn said the firm has an opportunity to grow elsewhere.

"Texas lends itself to more business in the future, as there is more demand due to improving demographics and less regulation," Quinn said. "We have also began to get good and new traction on the west coast."

Quinn said Ziegler's best and most marketable attribute may be its list of high performing clients, both new and well-established.

"When smart people hire you, you must be doing something right," he said. "Smart clients tend to hire us and a lot of our clients outperform."