Demand for municipal bonds has been so strong in 2016 that not even the arrival of income tax season could put a stopper on the flow of money into the industry.

Money has flowed into muni funds for 30 straight weeks, according to Lipper FMI, the longest stretch since January 2009 when Lipper reported 22 weeks of inflows that lasted through tax season and ended in October 2010.

The market previous saw an extended period of positive flows over 16 weeks between January 2014 and April 2015, which lasted through two tax seasons, according to Lipper.

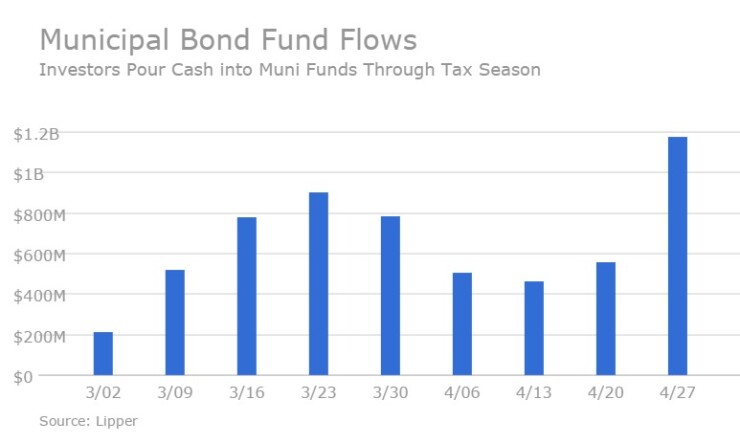

That streak continued in the week ended April 27, with weekly reporting funds garnishing $1.173 billion of inflows. That came on the heels of $555.910 million of inflows in the week ended April 20, and $463.733 million of inflows in the previous week, according to Lipper

While Uncle Sam gave taxpayers an extra three days to file their taxes this year, they were more focused on the solid performance of municipal bonds than they were about possibly considering liquidating cash from either municipal mutual funds or municipal money market funds to pay those tax liabilities, as they may have in the past.

Investors seeking out lower volatility and solid returns in a market with a lack of supply and improving credit condition prompted investors to buck the usual trend, analysts said.

"We usually don't see such consistent inflows this time of the year," Anthony Valeri, investment strategist at LPL Financial Inc. said on Wednesday, noting that inflows into municipal bond mutual funds have averaged $1.1 billion per week year to date, which is higher than recent years.

"Anytime you get a billion that is a big number, but to have a billion, on average, is huge," he said.

Valeri said the demand in 2016 is primarily fueled by a decline in tax-related selling, and to a lesser extent, some other market conditions.

"The best explanation I have is that investors are chasing performance and lower volatility versus other comparable asset classes," Peter Block, managing director of credit strategy at Ramirez & Co. said on Monday.

"Munis have posted solid returns this year, and on a rolling 12 month basis," he said. "More importantly, except for certain spots on the curve, munis have the best risk-adjusted returns over this time versus Treasuries and investment-grade corporate."

The equity sell-off in February and the subsequent strong rebound fueled by lower oil prices also helped municipals as investors sought more stability, especially in the fixed-income component of their portfolios, Block said.

Investors realized less gains so there was less need for tax-related selling, Valeri said.

"The potential for tax selling season was more limited because last year didn't generate a lot of taxes," he said.

That far overshadowed any role weak market technicals, like selling pressure, had in disrupting the typical outflow pattern associated with tax season in years past.

"The valuations cheapened heading into March due to the strength of Treasury market to start the year, and that played a role," but not as much as the lack of tax selling, Valeri said.

If patterns continue to defy tradition going forward, demand may even be able to flourish despite the low municipal yields and historical evidence that June has been among the weakest months over the last 10 and 20 years.

June has been the second weakest month for the Barclays Municipal Index over the last 20 years, posting negative .03% returns, second only to March, in which the index posted returns of negative .07% over the 20-year period, according to Valeri.

"June is always a stumbling block," he said. Over the last 10 years, June was the weakest month for the index when it posted negative .55% returns, he added.

This year between March 11 and April 26, tightening credit spreads, improving credit conditions at the state and local level, and a steady drop in new municipal volume, kept demand thriving, Michael Ginestro, head of municipal research and fixed income at Bel Air Investment Advisors, said on Wednesday.

The Los Angeles-based wealth management advisory firm to high net worth individuals, families, trusts and foundations, oversees and manages over $7 billion in assets for more than 300 high-net worth clients.

Ginestro said during that time period, credit spreads tightened 23 basis points for triple-A-bonds and 26 basis points for Baa-rated bonds, yet $7.3 billion still flowed into the municipal asset class.

"What drove this steady demand in spite of the seasonalities we typically see are two things: a continued improvement in credit conditions and a steady drop in new municipal supply," Ginestro said.

Property and sales taxes increased 3.9% and 4.7%, respectively in 2015, and total new issuance in the first quarter of 2016 was down by 12% to $96 billion compared to a year ago, he said.

"The decline was entirely due to a drop in refunding," he added, noting that while sales of new issuance rose by 26.9% to $37.4 billion, pure refunding volume dropped by 26.8% to $40.5 billion.

While the pace of demand has been substantially strong lately, the experts say it should ultimately be sustained and extend into the upcoming spring reinvestment season ahead of June and July 1 – historically the two strongest months for municipal demand.

"Those months have consistently been strong from reinvestment demand and from a lack of new issuance over that time period," Valeri of LPL said.

He said future demand will continue to be stoked by the strong fundamentals in the municipal bond market compared to other asset classes, but wouldn't be surprised to see somewhat of a pullback from the current strong pace since municipal yields are not far from record lows.

The 10 and 30-year municipal triple-A benchmarks were yielding 1.66%, and 2.63%, respectively, on Tuesday, according to Municipal Market Data.

Typically, demand tapers off when the 10-year municipal benchmark is under 2% and the 30-year under 3%, he said. "Historically, that's the types of yield that has restrained demand," Valeri said.

In addition, the comparison to other asset classes, namely Treasuries, is still relatively favorably, but fading quickly given how resilient municipals have been in April relative to the modest weakness of Treasuries," Valeri said.

That being said, he doesn't believe the earlier year's strength should derail potential demand in what historically are two of the strongest months for demand on record year over year.

"Current demand has been strong, but not excessive," he said. "It's not enough to preempt that typically-strong June- July period," Valeri said.

"It may take away some of the thunder, but at this pace it still seems like it will be a tailwind," he added. "There's nothing on the horizon except a big Treasury sell-off, but nothing that would disrupt that trend."

Overall, Ginestro said low municipal volume and volatility, and uncertainty in the stock market, will prompt steady municipal demand as spring nears.

The caveat of low fixed-income returns in general, Valeri added, is "more of a reminder to investors to keep their return expectations in check" than a warning or deterrent to investing in municipals given their relatively attractive valuations.

"For the most part, I do see it continuing and very much positive over the remainder of the year, but probably not at the same pace year to date," Valeri said. "The passage of tax season served as a bit of a reminder of the tax advantages of munis, which I think investors often forget or put on the back burner."