JEA received 16 responses to its request for bids from potential buyers of its electric and water systems in northeast Florida.

Companies interested in purchasing some or all of the utility’s assets turned in responses to JEA’s

Some large investor-owned utilities have disclosed their bids, but JEA hasn't yet made the names of all bidders public.

It had planned to keep the names secret but recently changed course. The utility is in the process of contacting all responders to the invitation to ask if they will allow their names to be released, spokeswoman Gina Kyle said Thursday.

“If they say yes, and make it to the next phase, their names will be released at the Public Evaluation Team meeting,” she said. That meeting is scheduled for Monday afternoon.

The team will determine which bidders complied with the rules set by JEA, and those that will continue on to the negotiations phase of the procurement process.

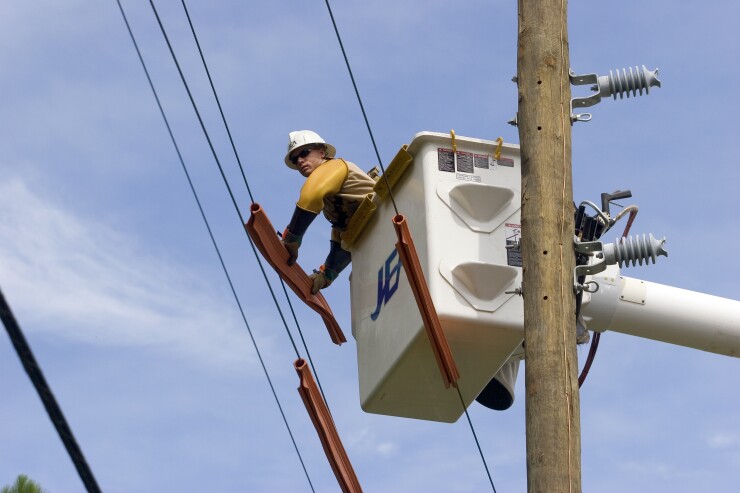

Formerly the Jacksonville Electric Utility, JEA is a 125-year-old municipal utility with 466,000 electric customers and 900 square miles of service area, a territory for which some investor-owned utilities have disclosed that they submitted bids.

Among the bidders to disclose their interest are Juno Beach, Florida-based NextEra Energy, owner of Florida Power & Light Co.; North Carolina-based Duke Energy Corp.; and Halifax, Nova Scotia, Canada-based Emera Energy Services Inc., which owns Tampa, Florida-based TECO Energy.

JEA also has 348,000 drinking water customers and 271,000 wastewater system customers.

A series of requirements must be fulfilled by bidders. More than $3 billion must be paid to the city Jacksonville, an amount that is 50% greater the net present value of JEA’s annual contribution to the city over the next 20 years.

A minimum of $400 million must to be paid to JEA’s customers as a cash distribution; the new owner must provide at least three years of guaranteed base rate stability; and there must be commitments to the city and public school system to provide electricity from 100% renewable sources by 2030.

JEA also wants a commitment to provide 40 million gallons of water per day from alternative water sources by 2035, as opposed to groundwater aquifer; comparable compensation and benefits for full-time employees who remain with the new owner; and a commitment to keep its new headquarters and employees in downtown Jacksonville.

Prospective owners will also have to deal with JEA’s debt, which was about $3.6 billion plus interest rate hedges, according to a report on the value of the utility by PFM in February 2018. The report also said debt associated with JEA’s 20-year power purchase agreement with Georgia’s MEAG would cost a new owner about $1.2 billion to assume.

Jacksonville and JEA are in Georgia federal court challenging the legality of the power purchase agreement with MEAG, while work continues on two reactors being built at Plant Vogtle.

This is the third time in seven years that JEA has attempted to privatize itself. Any deal, however, must be approved by the City Council and by voters in a referendum.

The privatization effort is underway even though JEA has a concurrent process to build a new $72.2 million headquarters in downtown Jacksonville.

JEA’s board has approved a lease with Ryan Companies US Inc. to construct a nine-story building that JEA will lease. The lease has an exit clause if the utility wants to back out. That decision is due Oct. 23.