Falling yields for single-A and triple-B bonds with longer maturities on Tuesday signaled the municipal market was ready to pause after

The plunging yields also demonstrated that tax-exempt bonds had reached attractive levels for investors, market watchers said.

"There's a ton of value in the tax-exempt marketplace, and taxable buyers are recognizing it," John Mousseau, managing director and portfolio manager at Cumberland Advisors, said about low-rated investment-grade credits. "Investors say: I've got to buy some bonds in here, because now I'm getting compensated for the risk."

The dramatic muni selloff that started in May and accelerated this month, particularly after the Federal Open Market Committee meeting last week, slowed on Tuesday and reversed on Wednesday.

For higher-yielding credits with longer duration, the turnaround arrived on Tuesday. A-rated yields on bonds maturing in more than 24 years dropped eight to 10 basis points from Monday, Municipal Market Data numbers showed, while triple-B-rated debt with maturities beyond 15 years plunged 10 to 16 basis points.

"It was most likely a beta reversal from the heavy hits lower-rated paper had sustained previously," a portfolio manager in Minnesota said. "There are buyers stepping in those credits due to outsized moves."

On Wednesday, both continued to rally. The longer duration single-As plunged 23 basis points from Tuesday and the triple-Bs dropped an additional 30 basis points on the long end.

A Michigan State Building Authority issue that priced in the primary earlier in the week with 5% coupons was very well received, he added. "Triple-A paper has caught up" on Wednesday.

New low-investment-grade credits did well in the market Wednesday. Investors

Yields were lowered 10 basis points from pre-marketing levels released Tuesday evening on credits maturing after 2019. In repricing, yields were tightened as much as 14 basis points. Traders said the deal was six-and-a-half times oversubscribed.

Prices for triple-B credits also remained attractive for Wednesday's primary market deals. Bank of America Merrill Lynch priced more than $200 million of toll revenue senior lien bonds for the Riverside County, Calif., Transportation Commission, which were rated BBB-minus. Bonds maturing in 2044 and 2048 were 16 times oversubscribed, with yields lowered 20 basis points, a trader in Los Angeles said.

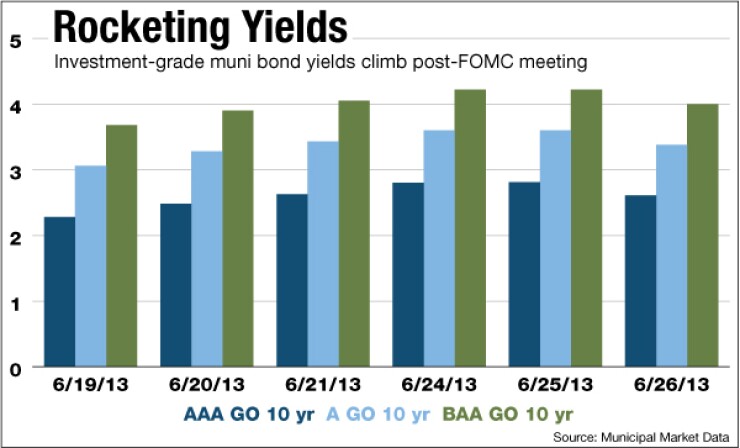

Municipal bond yields beyond the front end of the curve have risen dramatically since May, and particularly since last week's FOMC meeting.

The 10-year triple-A yield vaulted 53 basis points from June 19 to June 25; the 30-year yield rocketed 55 basis points over the same period, MMD numbers show.

The heaviest week of the selloff tripped relative-value triggers for muni investors, Chris Mauro, head of us municipals strategy at RBC Capital Markets, wrote in a research brief. Consequently, munis now look cheap next to other fixed-income instruments.

By Tuesday's close muni ratios to Treasuries had risen to 108% at the 10-year and 114% at the 30-year, Mauro wrote. That compared with 98% and 99%, respectively, on June 3.

"While we acknowledge that the fixed income markets are currently very volatile and that a heavy municipal new issue calendar has the potential to further pressure the muni market," he said, "we find the current relative value story in municipals very compelling."

Some, though, were skeptical of recent market valuations. Much of the drop in low-investment-grade yields could be based on a few thousand trades in a market with millions of Cusips, said Tom Metzold, co-director of municipal investments at Eaton Vance.

Still, single-A and triple-B credits represent prime hunting ground for typical crossover buyers, he added. "I do think you see the typical crossover buyer coming in more on A- and BBB-rated credits, because that's where the yield-ier stuff is," Metzold said. "Crossover buyers will look there first."

Those credits are rife with industrial development bonds that have taxable and tax-exempt paper outstanding, Metzold said, making it easier for crossover buyers to evaluate, because they can compare the two credits to identify opportunities.