DALLAS — After gulping down the rival Bexar Metropolitan Water District, the San Antonio Water System is ready to take advantage of low interest rates with a $245.6 million refunding.

The deal comes as the city of San Antonio, owner and operator of SAWS, prepares for the largest bond election in its history. The proposed $596 million bond authorization is expected to go to the voters May 12.

The refunding bonds for SAWS will be priced through negotiation with Citi and Wells Fargo as senior managers with Ramirez & Co., Rice Financial Products Co., Southwest Securities and Stifel, Nicolaus & Co. as co-managers.

First Southwest Co. is co-financial advisor with Estrada Hinojosa & Co. Fulbright & Jaworski is co-bond counsel with Escamilla Poneck & Cruz.

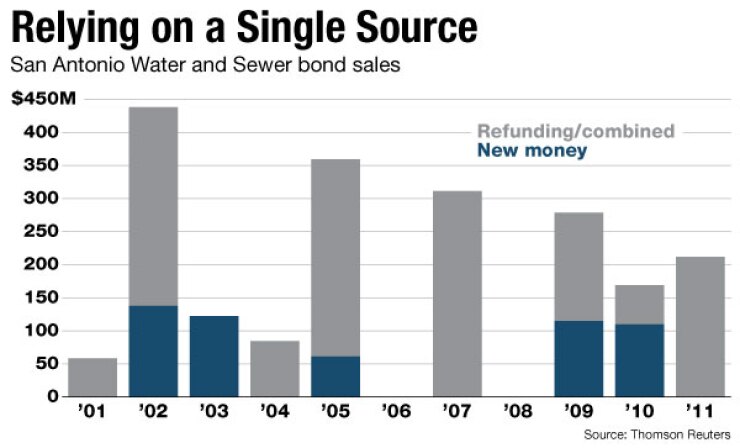

After this issue, San Antonio will have nearly $1.5 billion outstanding in senior water system debt. The city issued two refunding deals in 2011 worth a combined $211.6 million. In 2010, the city issued $110 million of Build America Bonds.

The city has $386.3 million of junior-lien water debt outstanding, according to the preliminary official statement.

A separate subordinate lien has about $235 million outstanding.

This year’s refunding, expected to close by the end of the month according to the POS, earned ratings of AA from Standard & Poor’s, Aa1 from Moody’s Investors Service and AA-plus from Fitch Ratings, all with stable outlooks.

SAWS expects its fiscal 2012 annual debt-service cost of $122.2 million to climb to about $200 million by 2015 and eventually to as much as $380 million by 2027, according to Standard & Poor’s.

“In order to address this significant rise in annual debt service requirements, management projects annual rate adjustments through 2027 and projects the average residential bill to increase steadily,” analyst James Breeding noted.

Analysts also pointed to the challenge of combining the Bexar Metropolitan Water District with the current system.

Bexar Met provides water service to an area in and around San Antonio that is not served by SAWS.

It was dissolved by its voters in a November 2011 ballot measure that effectively turned control of the Bexar Met system over to SAWS management.

Last week, Bexar Met officials turned over the keys to SAWS, making the merger official.

“We do not at this time expect SAWS to pledge the revenues of its system to any Bexar Met obligations,” Breeding wrote.

Amid one of the worst droughts in 50 years, SAWS has been urging its 360,000 water customers to conserve as much as possible as it develops new technology to maximize its water supplies.

“Successful conservation efforts have enabled pumping levels of the Edwards Aquifer to stabilize despite rapid population growth, but SAWS remains heavily reliant on this single water source,” Fitch analyst Gabriela Gutierrez wrote in her report.

The utility is operating under a $1.4 billion capital improvement program over the next five years.

“Fitch believes credit concerns regarding the system’s sizeable CIP are somewhat offset by the system’s planned use of available reserves for about 23% of the capital program, although this is slightly lower than the 28% planned use of reserves at the last rating,” Gutierrez said in the report.