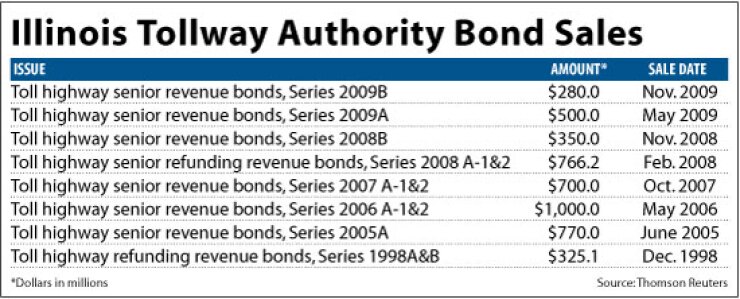

CHICAGO — The Illinois State Toll Highway Authority will enter the market as soon as tomorrow with roughly $400 million of fixed-rate refunding bonds, the first of two sales planned this year to restructure a chunk of the agency’s synthetically fixed-rate debt to reduce bank and liquidity risks.

Bank of America Merrill Lynch and Siebert Brandford Shank & Co. are joint book-running senior managers. Morgan Stanley and William Blair & Co. are co-senior managers. First Southwest Co. is financial adviser and PFM Asset Management LLC is swap adviser.

“We have a goal to reduce our synthetically fixed-rate debt by 50% due to our reduced level of comfort with a portfolio that has $1.6 billion of liquidity needs,” said tollway finance chief Mike Colsch.

The authority board authorized the restructuring last year, but the finance team decided to wait in hopes that interest rates would move in their favor on the mark-to-market costs of terminating swaps on the bonds to be refunded.

The negative valuation has come down and based on recent market conditions the termination fees would cost the tollway some $20 million to $25 million, according to Colsch and capital budgeting specialist William O’Connell.

“We waited until we got into a range we feel comfortable with,” Colsch said.

None of the floating-rate bonds are held by the liquidity banks and all are trading close to the Securities Industry and Financial Markets Association index.

The tollway has 10 floating-to-fixed interest rate swap agreements on $1.6 billion of debt. They carried a total negative valuation of $117 million at the end of April.

“We continue to believe that having some synthetically fixed bonds in our portfolio makes sense,” Colsch said.

The authority has not settled on the maturities to be refunded but they will come from its Series 1998B, Series 2007A, and Series 2008A bonds. Most of the principal amortizes between 2025 and 2031, with smaller amounts due between 2018 and 2024.

The tollway expects to pay a higher interest rate than it currently pays under the swap contracts that range from 3.76 % to 4.32 %, but to authority officials the increase is worth the comfort of shifting to a fixed cost structure.

The authority also was facing increased liquidity support and remarketing fees, as liquidity contracts are up for renewal this year and next. Those costs were expected to rise to about 100 basis points from between 28 and 57 basis points under the current contracts.

Officials also stressed that the overall interest cost on the $3.6 billion of borrowing tied to the authority’s $6.1 billion capital program remains below the 5.25% rate anticipated in order to maintain two times debt-service coverage and strong ratings as the agency launched the program six years ago.

The second refunding for roughly $400 million is expected later this year and will be led by co-senior managers Citi and Jefferies & Co.

Ahead of the sale, Moody’s Investors Service affirmed the Aa3 rating on the transaction and the tollway’s $4 billion of debt. The rating did not change in Moody’s recent recalibration of municipal ratings.

“The rating reflects the authority’s status as an essential component of the Chicago area’s transportation network, a long history of strong debt-service coverage and operating reserve levels, on-budget and on-schedule capital plan implementation, as well as increased revenue concentration in commercial traffic,” analysts wrote.

Fitch Ratings and Standard & Poor’s affirmed the credit’s AA-minus. Fitch assigns a negative outlook, while Standard & Poor’s affirmed its stable outlook. “The ratings reflect our view of the tollway system's essentiality, and strong financial risk profile," said Standard & Poor's analyst Adam Torres. "The ratings also reflect what we consider strong annual debt service coverage and strong liquidity.”

The issuer’s challenges include a reliance on increased toll revenues from commercial traffic and the risk posed by slowing traffic growth that would pressure debt-service coverage levels. Toll revenues were up in fiscal 2010 through April by 4.3% over the previous year, an increase expected as construction is completed, additional lanes are opened and congestion eases.

Officials anticipate annual revenue growth of 3.9% through 2016 and then a slowdown is expected. If on target, the authority will maintain a two times coverage ratio of debt through 2025, Moody’s wrote.

The rating agency said it considers the swap agreements a manageable risk. The authority is not required to post collateral, and termination risk is remote, as it would require a downgrade of the tollway and the counterparties below Baa1.

In the case of the 1998 swap agreements, termination may be triggered by a downgrade of the authority or counterparties below A3, or, under certain circumstances, a downgrade of the Series 1998B’s bond insurer, Assured Guaranty.

The authority has no new-money debt plans after wrapping up borrowing last year for its $6.1 billion rebuilding and expansion of the 286-mile Chicago-area toll highway system. Under the program, most of the system is being rebuilt and toll booths are being shifted to an open-road tolling system with an electronic congestion-relief system.

Net tolls and other revenues of the system secure the bonds, and debt service is secondary only to operational costs. The authority raised tolls for commercial traffic and non-users of the electronic device known as an I-Pass to pay for the program.

A proposed $1.8 billion second phase to the capital program, which calls for the construction of carpool or “green” lanes and other projects, was put on hold following accusations in court documents that former Gov. Rod Blagojevich used the program to shake down contractors for contributions.

The tollway is now under new leadership — though the finance team remains intact — with many board members and the board chairman appointed by Gov. Pat Quinn.

The board is led by planning professional and former Governor’s State University president Paula Wolff. The new executive director is former Quinn aide Kristi Lafleur. Two Quinn board appointees — William Morris and Maria Saldana — are longtime Chicago-based public finance bankers.

With new leaders, the highway agency has reviewed its debt policies, and with two public finance bankers on the board, Colsch now makes monthly board presentations.

“It’s fair to say with the addition of two board members from the industry that we have a bit more robust dialogue and discussion about debt management than before, which I think is helpful to us,” he said.

The tollway earlier this spring announced the creation of a transition team to advise the agency on its future direction and to examine policies and operations. A report is expected this fall.