BRADENTON, Fla. — Moody's Investors Service Wednesday joined Fitch Ratings and dropped its underlying rating on Orlando, Fla.'s highly leveraged tourist-tax revenue bonds into junk territory, while Standard & Poor's placed the rating on negative watch.

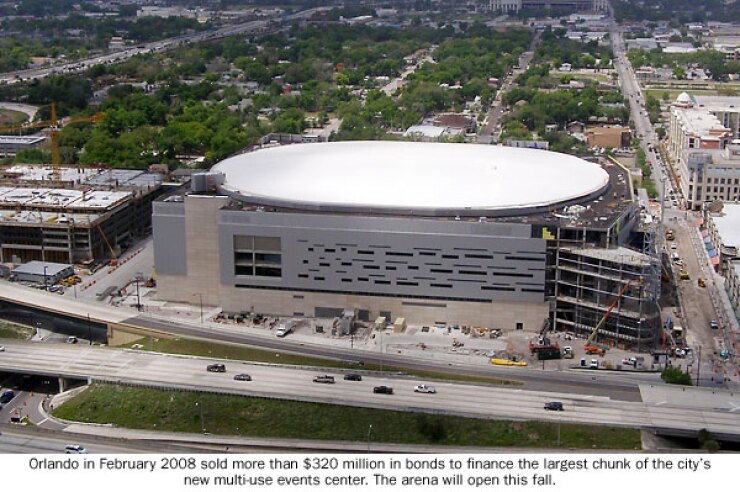

The bonds were sold in February 2008 to finance the largest chunk of the city's new $480 million downtown multi-use events center that also will be the new home of the National Basketball Association's Orlando Magic.

The arena will open this fall. But the recession is playing havoc with tourism and the tourist-tax revenues Orlando leveraged for the arena project.

Orlando has been in contact with the bond insurer, Assured Guaranty Corp., said the city's chief financial officer, Rebecca Sutton. She also pointed out that under the covenants for all the tourist-tax bonds a draw on debt service reserves is not considered a default.

Sutton added that there has been a recent uptick in collections and the hospitality industry is reporting an increase in bookings.

In February 2008, Orlando sold $199.25 million of Series A senior tourist-tax revenue bonds, $33.65 million of second-lien subordinate Series B bonds, and $87.24 million of third-lien subordinate Series C bonds. All of Orlando's tourist-tax bonds are insured by Assured.

Citing "recent sizable declines" in pledged revenues that are eroding debt-service coverage, Fitch

Fitch said the city would be required in fiscal 2011 to dip into reserves to make payments. If collections stabilize, pledged revenue and liquidity reserves should be sufficient for debt-service payments on the A bonds for the foreseeable future.

However, if collections do not improve, Fitch said the liquidity reserve and debt-service reserve fund for the Series B bonds could be depleted and a default could occur as early as on Nov. 1, 2012.

Fitch said its rating reflected "the high leverage of the revenue stream," but also said the long-term profile of Orange County's tourism industry is positive.

Fitch said the city reported hotel occupancy rates for the region fell 7.9% during calendar year 2009, showing the stress on the region's tourism economy.

On Wednesday,

"The tourist development tax is a passive tax collected by the county and based on temporary lodging and tourism activity and bears relationship to the city's overall financial performance or credit position," Moody's wrote.

Standard & Poor's, the only agency to rate all three series of Orlando's tourist-tax bonds, placed its ratings on negative watch.

"We have received information that, in our opinion, may demonstrate significant revenue deterioration of pledged revenues and potential reliance on the bonds' liquidity reserve in order to meet debt service requirements," said analyst John Sugden-Castillo.

Standard & Poor's currently rates Orlando's Series A tourist-tax bonds A-plus, the B bonds A, and the C bonds BBB-plus. The agency said it expects to resolve the rating status of the bonds after evaluating recent information received from the city.

The tourist-tax bonds are part of the complex financing for the arena. Orange County agreed to increase the local tourist tax to 6% from 5%, and through a contract provides Orlando one-half of that one percentage point increase. The county pledges all or a portion of the first 5% of the local tourist taxes to its convention center bonds, which are not affected by the action on Orlando's bonds.

Orlando's implied GO rating remains at AA-plus from Fitch, Aa2 from Moody's, and AA from Standard & Poor's.