DALLAS - The Grand River Dam Authority will enhance its ability to provide electrical power to municipal and industrial customers in Oklahoma, Arkansas, and Kansas with proceeds from this week's negotiated sale of $568.3 million of revenue bonds by the Oklahoma state agency.

The GRDA will use $306.7 million of the proceeds to purchase a 36% share in an already operational power plant in its service territory. The remaining $261.6 million will finance the agency's capital improvement program through 2011.

Chief executive officer Kevin Easley said the acquisition will enable the authority to meet current demands as well as projected increases.

"It is no secret that GRDA has been aggressively seeking new generation options for over two years," he said. "Power demands within our existing customer loads have grown steadily since the 1990s."

The sale includes $549.2 million of 20-year tax-exempt revenue bonds and $19.1 million of taxable revenue bonds that will mature in 2010.

The tax-exempt bonds are rated A2 by Moody's Investors Service and A by Standard & Poor's and Fitch Ratings. The two-year taxable bonds carry short-term ratings of F1 from Fitch and MIG-1 from Moody's. Standard & Poor's assigned an A rating to the short-term taxable bonds.

Standard & Poor's increased its rating on the authority's debt to A from A-minus on Aug. 14, and Fitch did the same two weeks later.

The bonds are set for a retail sales period today, with institutional sales scheduled for Wednesday.

Senior managers on the underwriting team include Citi and Capital West Securities Inc. Underwriters also include BOSC Inc. and Wells Nelson & Associates Inc. Hawkins Delafield & Wood LLP is bond counsel.

The authority's financial team is still evaluating several bids for bond insurance.

The GRDA currently has $496 million of outstanding debt, all of which will mature by 2014.

The additional 400 megawatts of generating power that will be added to the utility's power supply with the purchase of the gas-fired power plant near Luther, Okla., should eliminate the GRDA's need to purchase expensive power on the spot market during high demand periods or when low water levels at its hydroelectric facilities curtail power production.

Electricity from the GRDA's two coal-fired plants currently meets most of its customer demand, with purchases on the spot market accounting for about 6% of demand over the past 10 years. Power from the hydroelectric facilities helps meet peak demands, and allows the utility to sell power on the wholesale spot market.

However, a severe drought that began in summer 2005 dropped the water levels at the power dams, curtailing electrical generation at the facilities. As a result, the GRDA had to purchase expensive power on the spot market to meet up to 20% of customer demand while water levels were low in the second half of 2005 and the first six months of 2006.

"Our consulting engineers tell us that the power we get from this plant will meet our needs for the next eight to 10 years," said Carolyn V. Dougherty, chief financial officer and treasurer at the GRDA. "We'll use the hydropower capacity that will be available to get into other markets that we couldn't before.

"We're also adding natural gas to our fuel mix, along with coal and hydropower, with the plant purchase," she said. "Plus, the plant is already built and operational, so we don't have the construction cost risks that are normally associated with a power project."

Dougherty said the authority expects to issue $60 million of debt in 2010 and $100 million in 2012 to finance its capital improvement program.

She said the taxable series is necessary because of a provision in the federal tax code that prohibits the use of proceeds from tax-exempt bonds to purchase power plants unless the customers receiving the power have been customers of the utility for at least 10 years.

"We have some customers that have been with us only eight years, so we had to issue the taxable bonds to account for their share of the output from the plant," Dougherty said. "We've asked for a private-letter ruling from the Internal Revenue Service that would allow us to issue tax-exempt debt for the entire acquisition, but we were told not to expect to get a decision before October. We might issue tax-exempt debt to refund those bonds in 2010, or we might have enough cash on hand to pay them off."

The recent ratings upgrades by Fitch and Standard & Poor's were significant acknowledgments of the authority's financial strength, Dougherty said.

The GRDA approached technical default on its bonds in 2003 and 2004 due to a low debt-coverage ratio, but margins improved with a 4.5% rate increase in 2004 and a 7.1% increase in 2006.

"We got a new chief executive officer in 2004, and I had to tell him we needed to raise rates," Dougherty said. "That's not a good thing to tell your boss on his first day, but we had no choice. We had been subsidizing our rates for 10 years with cash reserves, and we were facing a large planned maintenance outage project for one of our coal-fired units, and no money had been set aside for it."

Even with the increases, the GRDA's wholesale rate is competitive at approximately 4.5 cents per kilowatt-hour, she said.

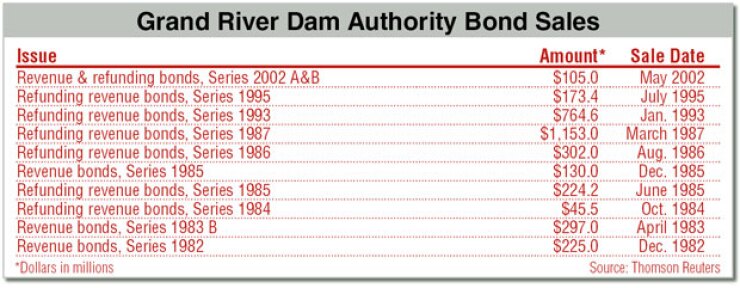

"We've come a long way, thanks to strong leadership, support from our customers, and a change in the corporate culture," Dougherty said. "The last time we issued revenue bonds, in 2002, we were a BBB-plus credit and now we're an A credit."

Customers will benefit from the GRDA's better credit ratings, she added.

"A better credit rating equals tremendous savings in bond-related costs," Dougherty said. "Over the life of the bond, the difference between an A-minus and A rating can be millions of dollars, because the better rating means lower finance and insurance charges."

CEO Easley said the preparations for this week's bond issue began four years ago, including converting existing customer contracts of varying lengths to a uniform 35 years.

"Recommending rate increases and realigning departments and procedures is not an easy thing to do," he said. "But those were necessary steps to improving the GRDA's financial standing."

The authority provides wholesale power under firm contracts to 15 municipalities in its service territory of northeastern Oklahoma, as well as to Coffeyville, Kan., and Siloam Springs, Ark.

The GRDA also sells power to the Oklahoma Municipal Power Authority, which serves about 35 cities in western Oklahoma, under a firm 25-megawatt contract, and to the Northeast Oklahoma Electric Cooperative, which accounts for almost 10% of GRDA's total power sales.

The GRDA will own 36% of the 1,230-megawatt Red Bud Power Plant. The Oklahoma Gas & Electric Co., which has a 51% ownership interest, will operate the facility. Oklahoma Municipal Power holds the remaining 13% interest.