ATLANTA - The Kentucky Housing Corp. on Tuesday plans to begin issuing $60 million of bonds in a deal that is expected to fare exceptionally well with retail investors in the state.

That's because the authority has natural triple-A ratings, stemming partly from the sound underlying assets.

Pricing will begin on Tuesday with a retail order period. Pricing will be completed on Wednesday when the deal is opened up to institutional investors. Moody's Investors Service and Standard & Poor's rate the KHC's single-family program triple-A and those ratings are expected to be affirmed by the deal's pricing, said Rick McQuady, the interim chief executive officer and chief financial officer for the corporation. There is no rating from Fitch Ratings.

The deal will be composed of $50 million of bonds that are not subject to the alternative minimum tax. They are Series E. The remainder of the bonds, Series F, will be AMT bonds. Merrill Lynch & Co. and Citi are the co-senior managers for the deals. Kutak Rock is bond counsel.

Proceeds are being used to fund single-family home mortgages. The bonds will be secured by pledged receipts of principal and interest on mortgage and construction loans received by the corporation.

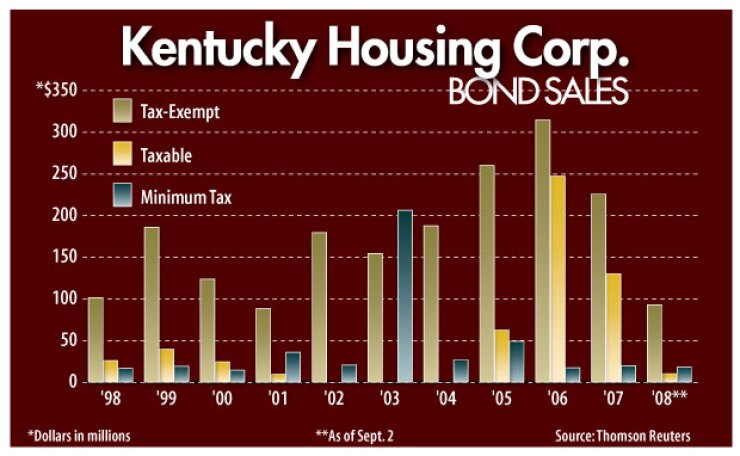

In the past, McQuady said that the KHC had to rely on issuing some taxable debt to fund its needs, which led to higher borrowing costs for the agency and higher rates for borrowers of its products.

A huge benefit that helped the corporation keep costs down came earlier this summer with the passage of federal legislation governing housing bonds and the alternative minimum tax.

In July, President Bush signed a law allowing housing authorities to issue housing bonds that would be exempt from the AMT. The new law gives states access to shares of an additional $11 billion of capacity for housing bonds under the private-activity bond cap. It also allows for proceeds of tax-exempt bond sales to be used for low-income rental housing. Provisions are also made for the temporary refinancing of subprime mortgages.

Also this summer, the KHC sold $40 million of debt that was subject to the alternative minimum tax. A second series totaling $10 million was sold as non-AMT. That deal was not affected by the new law because it sold before it took effect. Strong retail demand for non-AMT bonds bodes well for the next transaction, where the $50 million will not be subject to the AMT. McQuady said that because of the new federal law, that deal served to attract a significant number of Kentucky investors.

"We had $22 million in orders" for the non-AMT portion of the June deal, he said. "It shows that we have a product that Kentucky investors are looking for."

For this upcoming deal, corporation officials say that they have already begun receiving calls about the strength of their underlying assets.

"We're proud of how our portfolio is performing and that's becoming more of an issue," McQuady said, referring to the crisis in the credit markets. "We are getting calls from small investors as well as the more sophisticated investors about the underlying assets for our bonds, so we're happy to tell our story."

In the case of the KHC, an investor outside Kentucky said that the natural triple-A would serve to mitigate any concerns about how the agency is being affected by the credit crunch. The agency has had the triple-A ratings since 1993.

Following next week's deal, the market will be able to pick up more debt from the issuer by the end of November or early December.

The Kentucky Housing Corp. has about $2 billion of outstanding debt. The law providing for it allows the authority to have up to $5 billion of debt outstanding at any time.

In addition to funding its single-family loan program, the corporation is also taking steps to issue tax-exempt bonds for multifamily housing.

The KHC currently has a request for proposals, due Sept. 15, seeking a qualified nonprofit entity to be established as a general partner/managing member that will be responsible for the creation, development, and management of a 100-unit, statewide lease purchase program, according to the RFP.