-

The continuing resolution through mid-March is expected to include $$90 billion in disaster funding.

December 17 -

A week ahead of inauguration day, Scott Colbert, executive vice president, director of fixed income and chief economist at Commerce Trust, takes a look at how the Federal Reserve and the economy will fare in President-elect Donald Trump's second run in the White House.

-

Analysts are confident the Fed will lower rates at this week's meeting, but their views on what next year holds don't share the same consensus.

December 17 -

Justices appeared open to narrowing the scope of federal environmental impact reviews during oral arguments on a bond-financed Utah railway to move crude oil.

December 17 -

The future of key policies and upcoming budget battle tactics are taking shape based on several leadership changes and announcements in recent days.

December 13 -

The MSRB is looking for industry input regarding proposed rules changes for Rules G-17, G-32 and G-47.

December 12 -

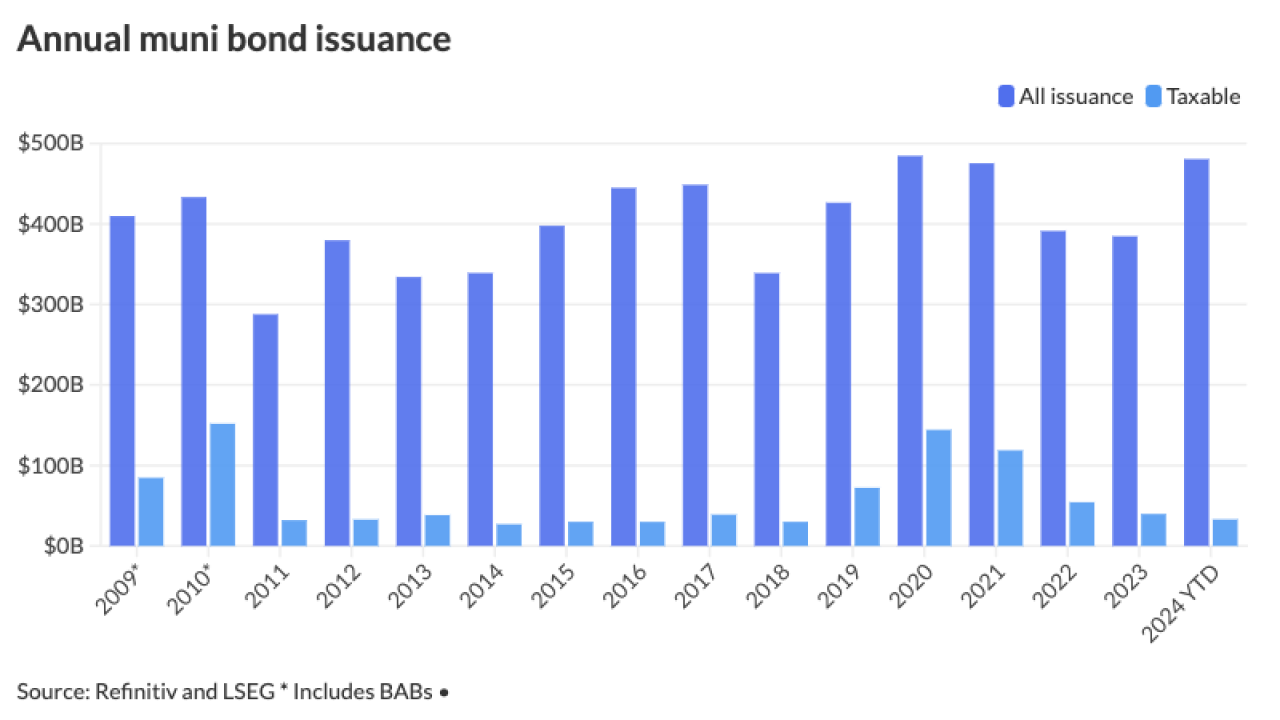

Most on the Street expect issuance to come in around $500 billion, but a few think volume will be much higher, primarily because of potential changes to the tax exemption. Most firms expect refunding volumes to also grow in 2025.

December 12 -

Municipal investors are more focused on the final new-issues coming down the pike and repositioning books as 2024 heads to a close. ICI reported another week of inflows into municipal bond mutual funds.

December 11 -

Washington D.C. is lobbying Congress for an extra $47 million in expenses for the upcoming inauguration of President Trump while also raising concerns about the effects of debt ceiling squabbles on the city's credit rating.

December 11 -

California's high-speed train has become one of the nation's most politicized infrastructure projects.

December 10