-

February volume was $26.481 billion in 594 deals versus $37.052 billion in 981 issues a year earlier, bringing total volume for the first two months of the year to $51.426 billion, or 20% less than 2021.

February 28 -

An unfortunate custom in municipal finance is to discount every cash flow with the same rate, namely by the yield of the refunding issue. This underestimates the worth of nearby savings, and overestimates that of savings in the distant future.

February 10 Andrew Kalotay Associates Inc.

Andrew Kalotay Associates Inc. -

January issuance declined by 14.7% year-over-year amid a rising-rate and volatile environment.

January 31 -

Skokie held on to its double-A tier ratings as it preps a pension obligation bond issue to bring its public safety pension funding ratios to 90%.

January 19 -

The U.S. Treasury selloff caught up to tax-exempts with two to three basis point cuts to scales, but munis still outperform.

January 4 -

Municipals triple-A benchmarks continue the trend of ignoring other markets to start 2022. The new year will likely usher in slower growth and continued inflationary pressures, analysts said.

January 3 -

2022 volume projections are clouded by many uncertainties. What is not murky is that demand for municipals is unlikely to fade.

December 30 -

Chicago's captured a new low in recent history on tax-exempt spreads but the taxables, which were downsized by $500 million, faced a tougher road amid Treasury volatility.

December 10 -

Total November volume was up 58.3% to $33.818 billion versus $21.359 billion a year earlier, but the figure is average over a 10-year period. A combination of factors from policy uncertainty in Washington to fears of rising rates led to the increase.

November 30 -

A majority of firms anticipate less volume in 2022 than the record hit in 2020, but how policies from Washington and the path of overall economic activity in a still-recovering global economy with COVID overhang make predicting volume more difficult.

November 29 -

The Thanksgiving holiday-shortened week, next-to-no supply and few economic data releases should keep munis steady.

November 19 -

The speculative grade bond sale is part of the financial process of returning the Phoenix-based university to nonprofit status after years as a for-profit.

November 15 -

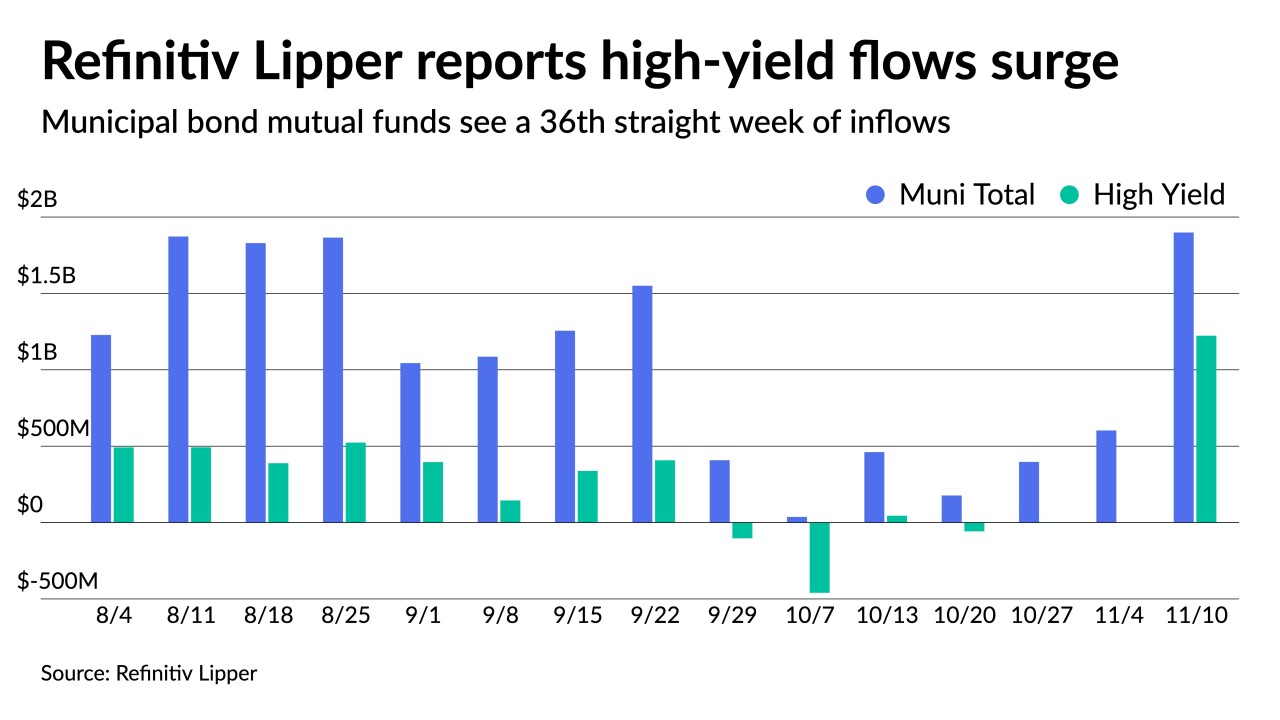

Investors put nearly $2 billion into municipal bond mutual funds for the most recent week with high-yield reversing a downward course to hit $1.2 billion following just $1 million a week prior.

November 12 -

A lighter, $5 billion calendar, heavy on healthcare, kicks off November. Most participants agree volatility in U.S. Treasuries will be a leading factor for municipal market performance. Uncertainty in Washington also isn't helping the asset class.

October 29 -

October has, on average, been the heaviest new-issue month of the year. Analysts said the lower volume, particularly taxables, was led by many issuers sitting on the sidelines, waiting for a potential package from Washington, D.C.

October 29 -

Seventy-seven percent of respondents to a Bond Buyer survey said there should be universal ESG standards and just over half said ESG is “critical” or “very important." Consensus on how to and who should create such a language is less clear.

October 19 -

The lion's share of the deal is taxable, with a $20 million tax-exempt new money series; proceeds from the taxables will refund outstanding debt.

October 6 -

The increase in yields and spread widening across municipal sectors has given some pause to high-yield investors after months of stagnation.

October 5 -

Municipals took a breather Monday, largely ignoring stock market volatility and softer U.S. Treasuries, ahead of a solid $9 billion new-issue week.

October 4 -

September issuance was down more than 32% from the same month in 2020; total issuance so far this year is at $346.48 billion, down 2.4% compared to last year.

September 30