-

Long-term municipal bond volume is on pace to set a new record of yearly issuance, thanks in part to issuers rushing to market before the election and a continued taxable boom.

October 30 -

The election results will be the most important effect on the municipal market for the next six months, S&P Live Market Survey says.

October 28 -

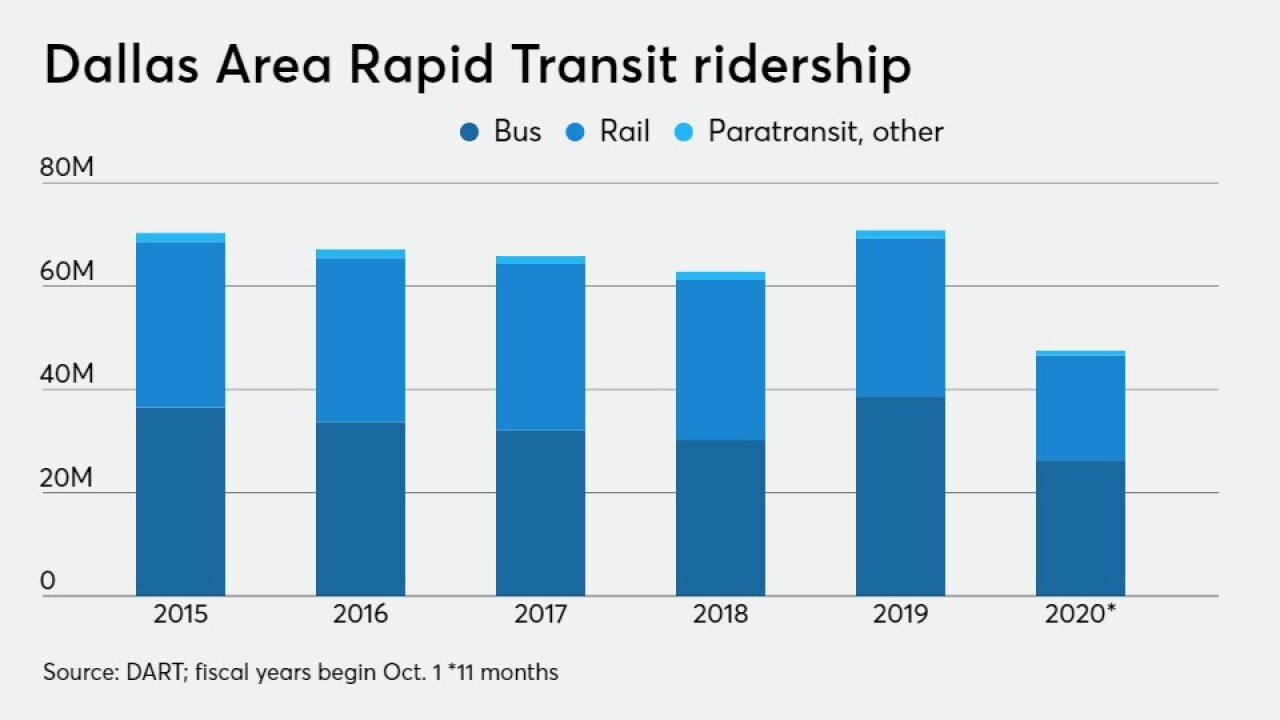

"We have no need for cash-flow relief or restructuring," said the treasurer of Dallas Area Rapid Transit, which continues to expand its rail services.

October 26 -

The No Place Like Home bonds, backed by a long-standing income tax surcharge, fund supportive housing for homeless people with mental health issues.

October 22 -

Arizona-based Banner Health adds another hospital to its system as it offers investors $607.6 million of taxable revenue bonds.

October 19 -

The municipal market's volume registered its fourth consecutive month of greater-than-$40 billion and the largest on record total for the month of September.

September 30 -

Atlanta airport bonds and a Puerto Rico housing issuer were some new offerings of note on Tuesday.

September 29 -

In taking advantage of historically low taxable municipal bond rates, Florida's deal should be attractive for yield-starved investors, state official says.

August 31 -

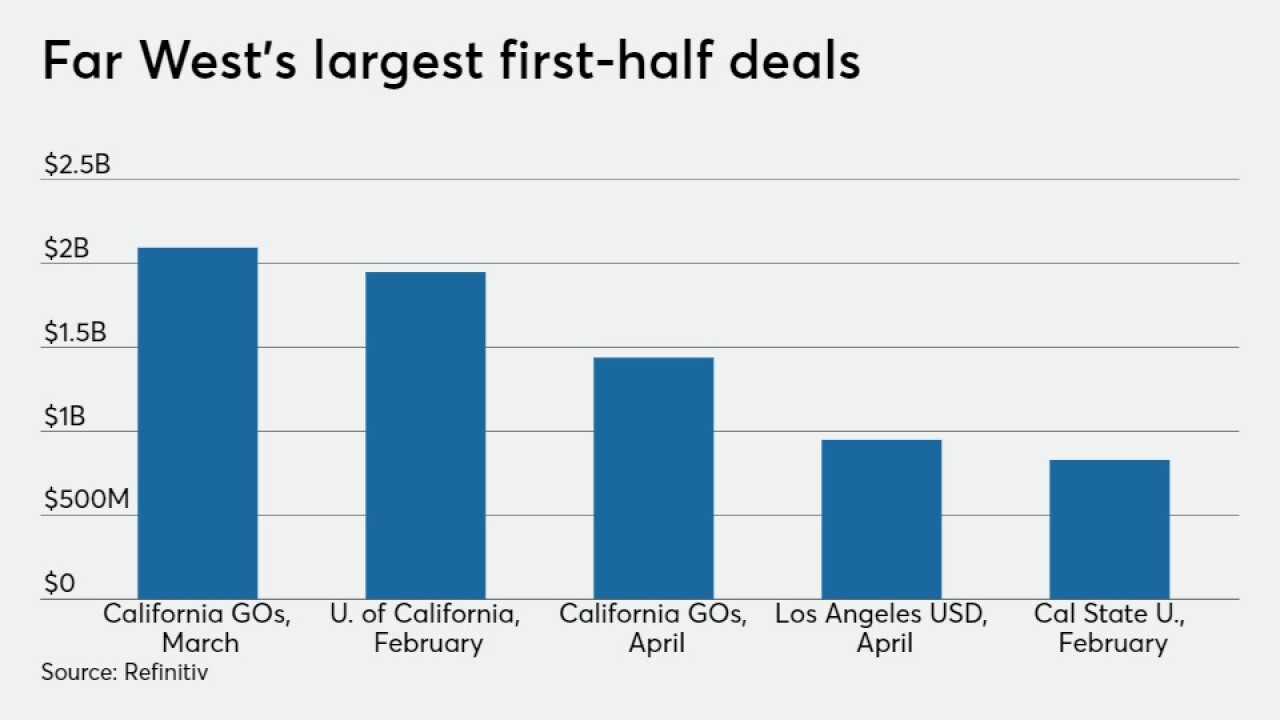

Municipal issuers in the Far West sold $38.7 billion in bonds during the first six months of 2020, 8.8% more than they did the year before.

August 27 -

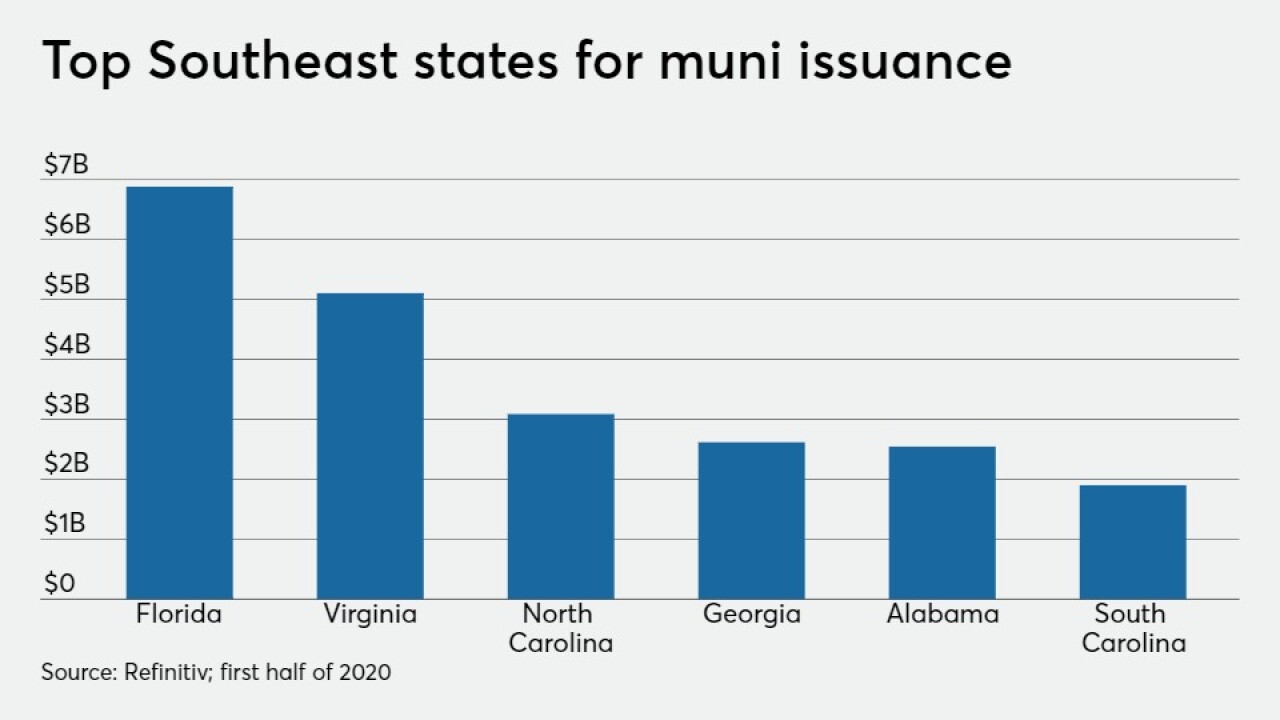

Municipal bond issuers in the Southeast sold $27.7 billion of debt, down 7% year-over-year as the region saw fewer big transportation and prepay gas deals.

August 26 -

The region's municipal bond issuers borrowed $40.4 billion during the first half of the year as record low rates more than tripled refunding activity.

August 25 -

A surge in taxable muni volume has overall issuance 18% higher in the first half of 2020.

August 24 -

The housing and transportation sectors had the biggest declines in municipal bond volume.

August 24 -

The structure in which bonds are backed by a lease of city streets is being used in the Southern California cities of Torrance and West Covina.

August 20 -

Its $125 million taxable social bond follows a $1 billion Ford Foundation deal as part of a multi-foundation pledge in response to the COVID-19 pandemic.

August 17 -

Municipal issuers continue to swarm the muni market with taxable muni deals, as July accounted for $42.6 billion — the highest total for the month since at least 1986.

July 31 -

San Francisco International Airport will issue $291 million in refunding bonds amid belt-tightening efforts driven by a massive drop in passengers.

July 30 -

The authority realized $67 million in savings on its refunding.

July 10 -

UMB claims the bonds for the Kansas hotel project are in default because the developer failed to secure a $52 million loan required by the bond indenture.

July 6 -

The Bi-State Development Agency, which manages St. Louis public transit, took a two-notch downgrade from S&P Global Ratings over the pandemic's impacts.

July 2