-

Bank of America and Wells Fargo will lead underwriting for $1.8 billion of sales tax and revenue bonds issued through the Kansas Development Finance Authority.

January 8 -

University Park joined four other cities in placing measures on the May 2 ballot asking voters to decide whether to withdraw from Dallas Area Rapid Transit.

January 7 -

Platte County, Missouri, formally withdraws from public financing of a shopping center that sparked court battles after its sales tax revenues began to falter.

January 7 -

Kutak Rock is promoting several members of their public finance and tax teams as part of a move that sees 28 attorneys move into partnership roles in eleven offices.

January 5 -

The Glenwood-Lynwood Public Library District was four weeks late on a Dec. 1 debt service payment amid delays to Cook County property tax billing.

December 31 -

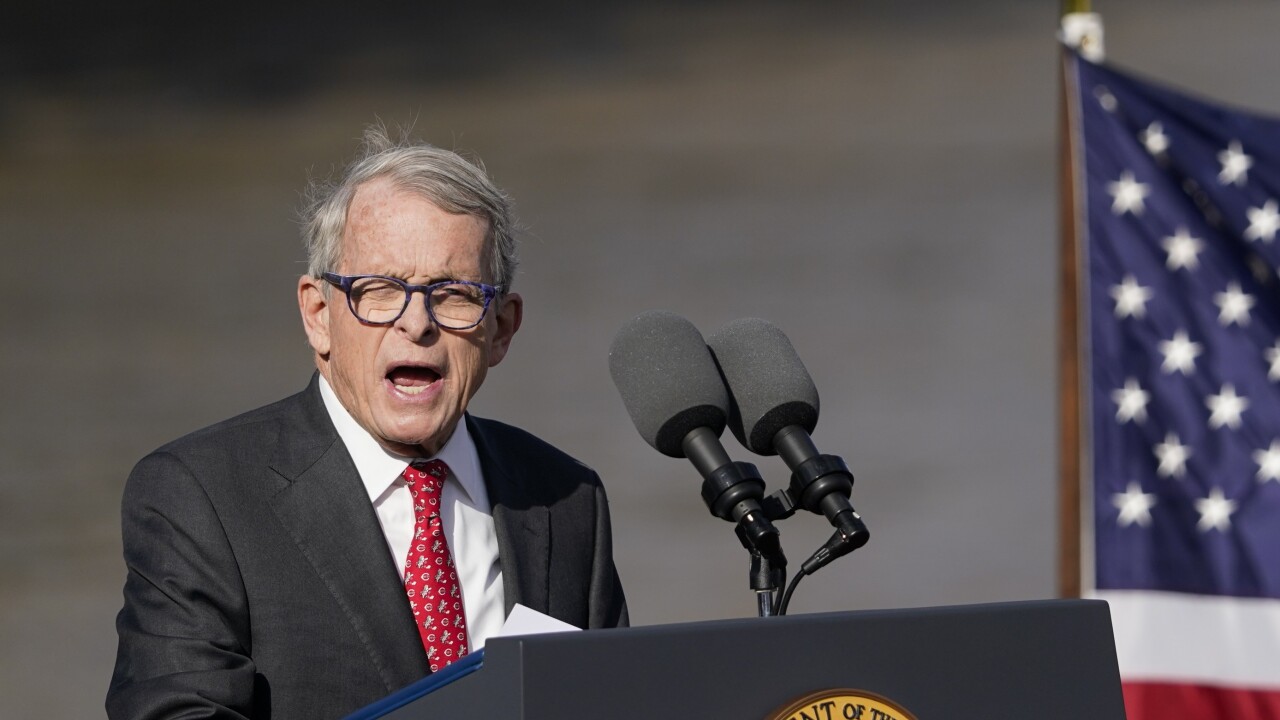

When Ohio Gov. Mike DeWine signed property tax reform bills, there was hope in Columbus it would appease voters who backed a push to abolish property taxes.

December 31 -

The loss of federal jobs combined with delays in accessing employment data are contributing to flat revenue estimates for the Washington, D.C., government.

December 30 -

An election year for Congress adds a deadline clock to questions about budget reconciliation, tax policy, and politics while bond issuers ponder challenges and opportunities.

December 26 -

State tax policy is playing a role in the location of data centers which have turned into a lightning rod attracting debt financing, local opposition, and federal involvement.

December 23 -

The Kansas City Chiefs will leave Missouri for Kansas, where sales tax and revenue bonds will help finance a $3 billion domed stadium expected to open in 2031.

December 23 -

Unless there is a massive selloff in the next two weeks, there will not be a major spike in market participants using tax-loss harvesting through year-end, said Ben Barber, director of municipal bonds at Franklin Templeton.

December 23 -

The Governmental Accounting Standards Board has issued an end of the year Statement which addresses inconsistencies in the financial reporting and definition of an accounting wormhole.

December 22 -

Illinois Gov. JB Pritzker signed a raft of major bills into law over the past week, culminating with the Northern Illinois Transit Authority Act.

December 18 -

A looming government shutdown marks an uncertain future for the country as economists and muni leaders point to the positive effects of stubborn inflation on state tax revenues.

December 17 -

Property taxation is being targeted in a growing movement across the nation for cuts or elimination to address homeowner angst over rising tax bills.

December 16 -

As more states weigh legislative action to decouple from the provisions of One Big Beautiful Bill Act, Treasury Secretary Scott Bessent launches an outreach mission to counter what he calls, a "blatant act of political obstructionism," that will lead to higher state taxes.

December 11 -

The changing climate is increasing insurance rates for residents and cities and lowering property values in areas that face more frequent and intense disasters.

December 11 -

State legislators are prepping for a coming storm of budget turmoil caused by shifting Medicaid policy as the era of historic tax cuts appears to be ending.

December 10 -

A 2025 state law prohibits cities from increasing their property tax revenue if they fail to produce a timely annual financial audit.

December 9 -

Four of Dallas Area Rapid Transit's 13 member cities took action to ask voters in May whether they want to withdraw from the agency.

December 9