-

The sales tax increase will bring in an extra $30 million to cover a projected $28 million budget shortfall.

June 19 -

U.S. Conference of Mayors President Stephen Benjamin talks about the ways to get Congress to bring back advance refundings for municipal bond issuers. The mayor of Columbia, S.C., also discusses a Smart Cities agenda that’s focused on growing cities through improved infrastructure. John Hallacy is host.

June 19 -

Only nine states reported making midyear budget cuts totaling $830 million this year compared to 22 states that cut $3.5 billion in 2017.

June 14 -

An advisory panel suggested modifying the fee structure for tax law violations to encourage more issuers to self-report them.

June 11 -

States could gain $8 billion to $33.9 billion in additional annual revenue if the high court rules in favor of South Dakota, while a loss would mean the status quo.

June 8 -

The latest Federal Reserve data shows the first decline in bank holdings of municipal securities in nearly a decade, a result of tax reform, according to experts.

June 7 -

Rvenue soar 10.2% in May compared to a year earlier, accompanied by strong growth in oil and gas income.

June 5 -

Municipal analysts see the holes in the spending plan, but secondary market traders reacted positively.

June 5 -

Tax administrators will consult with governors and governors, in turn, will consult with their legislatures before responding to any of several possible rulings in the case by the high court, officials said.

June 1 -

The MSRB's controversial commentary about selective disclosure got some support from a top SEC official on Wednesday.

May 30 -

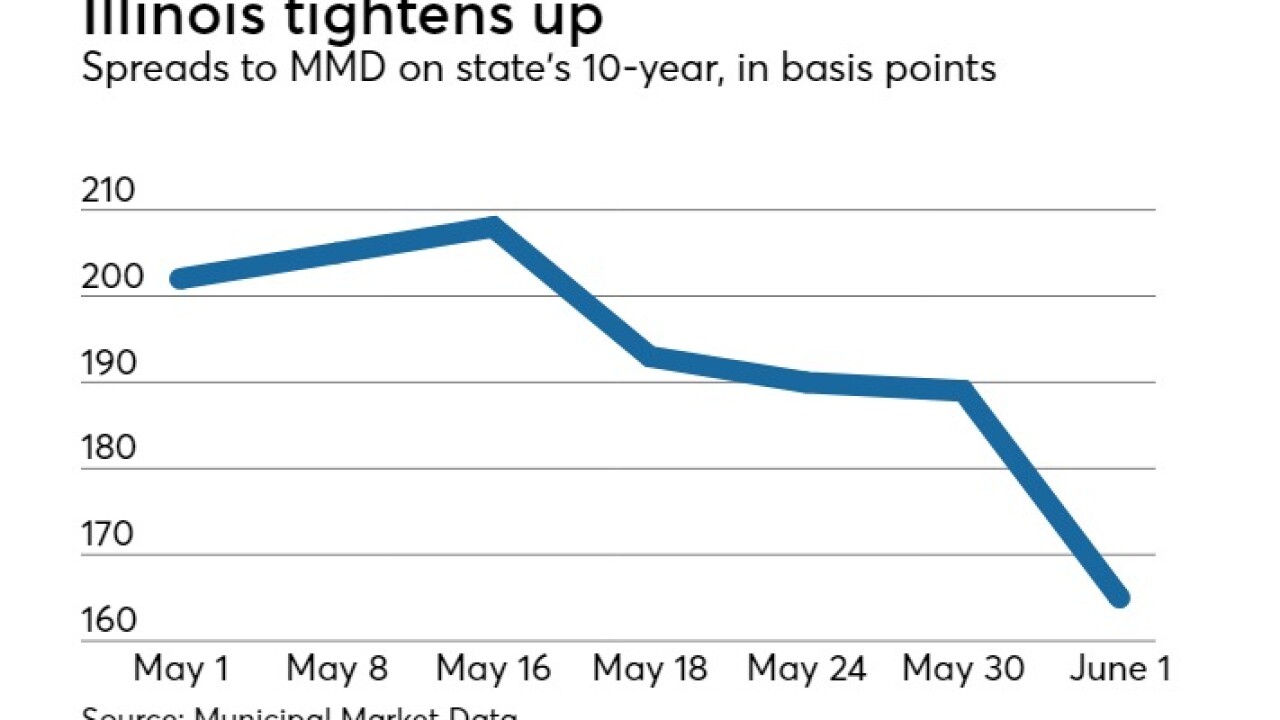

What's in the next Illinois budget is more important to S&P Global Ratings than whether it is passed soon.

May 29 -

Currently at least 33 states provide 113 different tax credits that are already federally deductible.

May 29 -

Bond lawyer Jonathan Ballan chimes in on creative bond deals, tax-law changes, mortgage financing, mass transit and his recent move to Cozen O’Connor. He also makes a heartfelt plea for municipal and political leaders to weigh in and help “stop the carnage” from the opioid crisis. Paul Burton hosts.

May 29 -

The IRS has produced dozens of "issue snapshots" for the tax-exempt bond community, charities and non-profits, retirement plans, Indian tribal governments and federal, state and local governments.

May 25 -

New York, New Jersey and Connecticut are the first states to have created charitable funds that taxpayers can contribute to in order to claim a charitable deduction in lieu of paying state and local taxes.

May 24 -

The IRS notice warns that federal law, not state law, controls how payments for federal income tax purposes are characterized.

May 23 -

Rising short-term rates and a lower corporate tax rate have already pushed some municipal issuers out of bank loans and back into the traditional muni space, analysts said.

May 21 -

The Puerto Rico Economic Empowerment Act of 2018 would implement some of the recommendations made by a congressional task force as well as provisions left out of disaster relief legislation, according to the two Republican senators who offered it.

May 17 -

Bruising political fights over Obamacare and tax reform may have killed the chances for Trump's infrastructure plan, leaving state and local governments to lead the way.

May 17 -

Local, county and state officials said they took initial steps Wednesday in what will become a much larger contingent of elected officials who will jawbone their federal counterparts with testimonials about the cost savings attributable to advance refundings.

May 16