-

The Senate Finance Committee on Tuesday brought small business leaders together to discuss the pitfalls of complying with dozens if not hundreds of local tax regimes.

June 14 -

While the path back to pre-pandemic office life remains uncertain, a protracted remote work reality may be a harbinger for future credit rating downgrades of cities heavily dependent on commuter-driven revenues.

June 2 -

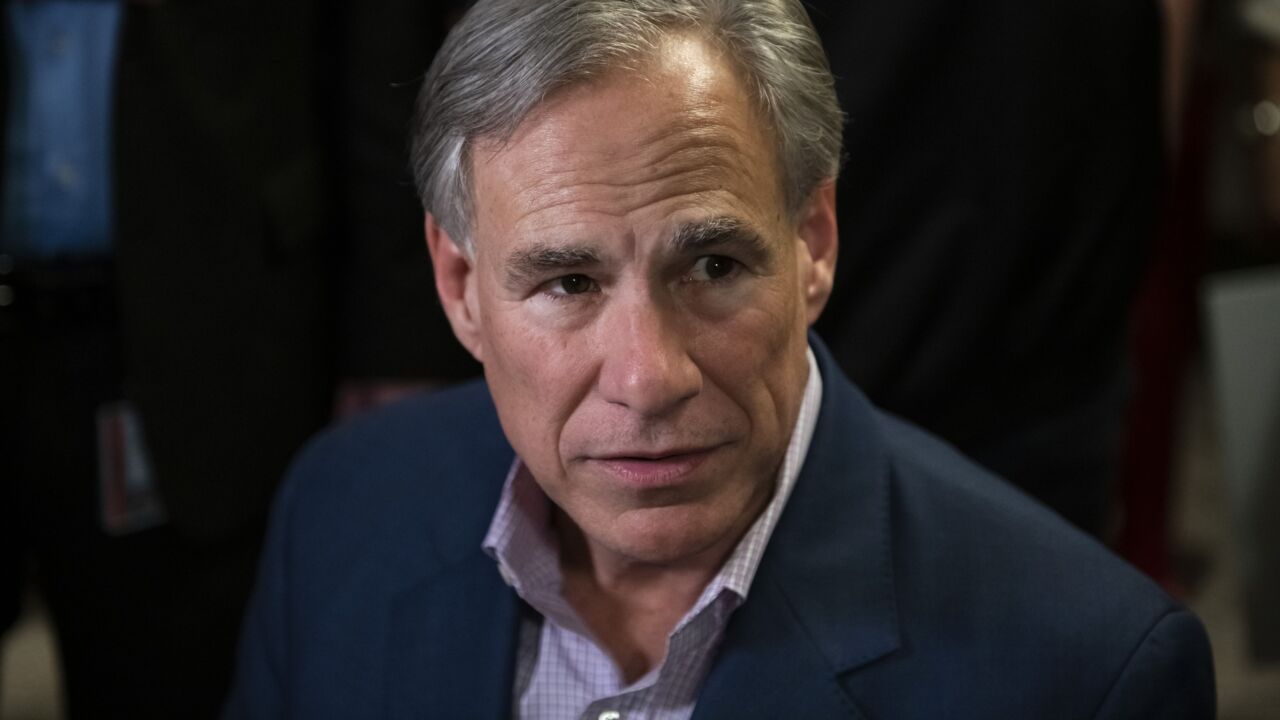

Rising home values are putting the spotlight on property taxes in Texas, where state lawmakers are eying tax relief options even as previously approved measures slow the growth in tax bills.

May 26 -

The latest Congressional effort challenging the state and local tax deduction cap would stop the IRS from restricting state legislation that offsets the policy.

May 23 -

Toll roads, registration fees and mileage-based fees are seen as the most sustainable options for replacing declining fuel tax revenue, but feasibility issues and political pressures complicate the way ahead.

May 23 -

Panelists at the NFMA 2022 annual conference said they aren’t holding out for advance refunding to be reinstated anytime soon.

May 19 -

Almost $25 million of bond funds provided for school technology and security enhancements to state school districts this year from the 2014 Act.

May 19 -

Gov. Newsom doubled down on an $11.5 billion gas rebate plan opposed by fellow Democrats in his May budget revision.

May 13 -

A third of states lost population in 2021, a trend that is likely to continue and one that will have significant impact on the way in which state finance officials operate in the years to come.

May 9 -

Lawmakers and advocates of U.S. tax credits like tax-exempt debt aren't getting many answers from Treasury about an impending global tax regime that diminishes the value of the tax tools.

May 6 -

The development could potentially affect the tax-exempt status of bonds issued for the school, though it will likely be resolved before that happens.

May 5 -

Audit times for municipal bond issuers are on the rise, with the median reaching 164 days in 2020 compared with 147 in 2009.

May 3 -

The legislative clock is ticking as midterm campaigning ramps up, but the lame duck session offers a fresh opportunity.

May 2 -

The city has received a notice from the IRS seeking evidence bond proceeds were used on the construction, rehabilitation or repair of public school buildings.

April 28 -

Arizona governor Doug Ducey has standing to sue the U.S. Treasury, his office told a federal court, after the federal agency moved to dismiss a suit brought after it warned that federal pandemic funds shouldn’t be used to undermine federal mask and school mandates.

April 25 -

The court's decision leaves issuers back to looking for a legislative solution.

April 19 -

By dampening corporate interest in tax incentives, the new global minimum tax would hurt low-income housing and drive up issuer borrowing costs, a group of 29 organizations said in the letter to Yellen.

April 6 -

California Gov. Gavin Newsom and his party's leaders have proposed conflicting plans to give residents relief from gas taxes.

March 28 -

The Internal Revenue Service will permanently allow TEFRA hearings to be held remotely.

March 21 -

The MSRB has issued a warning that with the rise in interest rates in recent months, bonds trading at a discount may be less liquid than those trading at par.

March 18