-

Voters in seven California cities approved marijuana taxes Tuesday.

November 8 -

Some House Republicans pledged to work with Democrats to save PABs, advance refundings in tax reform legislation.

November 8 -

Smaller hospitals and colleges and affordable-housing developers will be more challenged in distributing their bonds under proposed tax reforms.

November 8John Hallacy Consulting LLC -

Kansas City voters advanced a proposed P3 to rebuild the city's airport terminal.

November 8 -

To work well, public policy in a democracy must be transparent and allow time for debate, input and analysis. The given time frame on the House GOP tax bill, which will have broad ramifications for infrastructure development, healthcare and higher education costs and affordable housing, provides little opportunity for a democratic process of debate and compromise to take place.

November 8 Consultant

Consultant -

In a document rife with broken promises and misstatements about the muni market, the “Tax Reform” proposal beats up on the municipal bond market and state and local bond issuers to an extent never envisioned prior to the publication of that proposal.

November 8 Court Street Group Research

Court Street Group Research -

State Treasurer John Chiang wants a study to consider a state bank for the legal pot industry.

November 7 -

House Ways and Means Committee Republicans rejected an effort to keep the full deduction for state and local taxes.

November 7 -

The Oklahoma governor urged lawmakers to end a six-week-long special session by closing a $215 million budget gap.

November 7 -

Gov. Rick Scott said his final budget will request $180 million in tax cuts.

November 7 -

The House GOP bill, if passed, would lower feasibility of P3s, Fitch said.

November 6 -

Municipal yields were down by as many as seven basis points amid concern that tax reform may crimp supply.

November 6 -

Advance refundings were 27% of market last year, PABs were 19% and most were 501(c)(3)s.

November 6 -

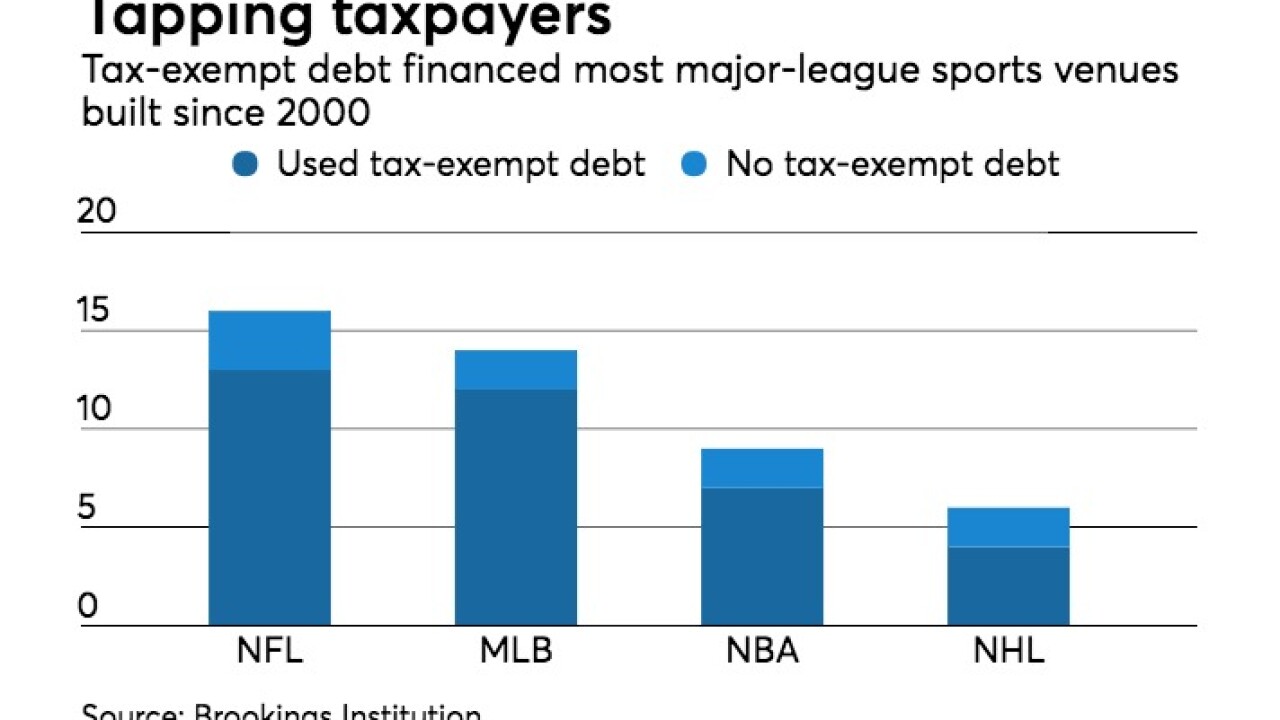

Construction of the bond-financed stadium for the Raiders was to begin this fall.

November 6 -

“This is a work in progress,’’ said Rep. Jackie Walorski, R-Ind.

November 6 -

Arlington, Texas planned to issue $500 million of tax-exempt bonds in 2018 for a Major League Baseball venue.

November 6 -

Retail and institutional municipal bond investors hope volume of nearly $9 billion is a sign of consistent elevated weekly volume for the remainder of the year.

November 6 -

With nearly $9 billion in volume, thanks to a large refunding deal, market participants expect issuance will remain strong as issuers try to beat tax reform.

November 6 -

Already facing the potential loss of several key financing tools and a 20% corporate tax rate that would cheapen the relative value of tax-exempt munis, there could be even more pain in store for the municipal market when the Senate weighs in.

November 3 -

The House Ways and Means Committee begins deliberations on the 429-page tax reform bill noon Monday.

November 3