-

States collected more than $45.2 billion in motor fuel taxes in 2017, compared with $36.8 billion 10 years earlier, according to the Federal Highway Administration.

July 2 -

Online wagers dominate in-person bets to drive New Jersey's still-modest but rising take from sports betting.

June 14 -

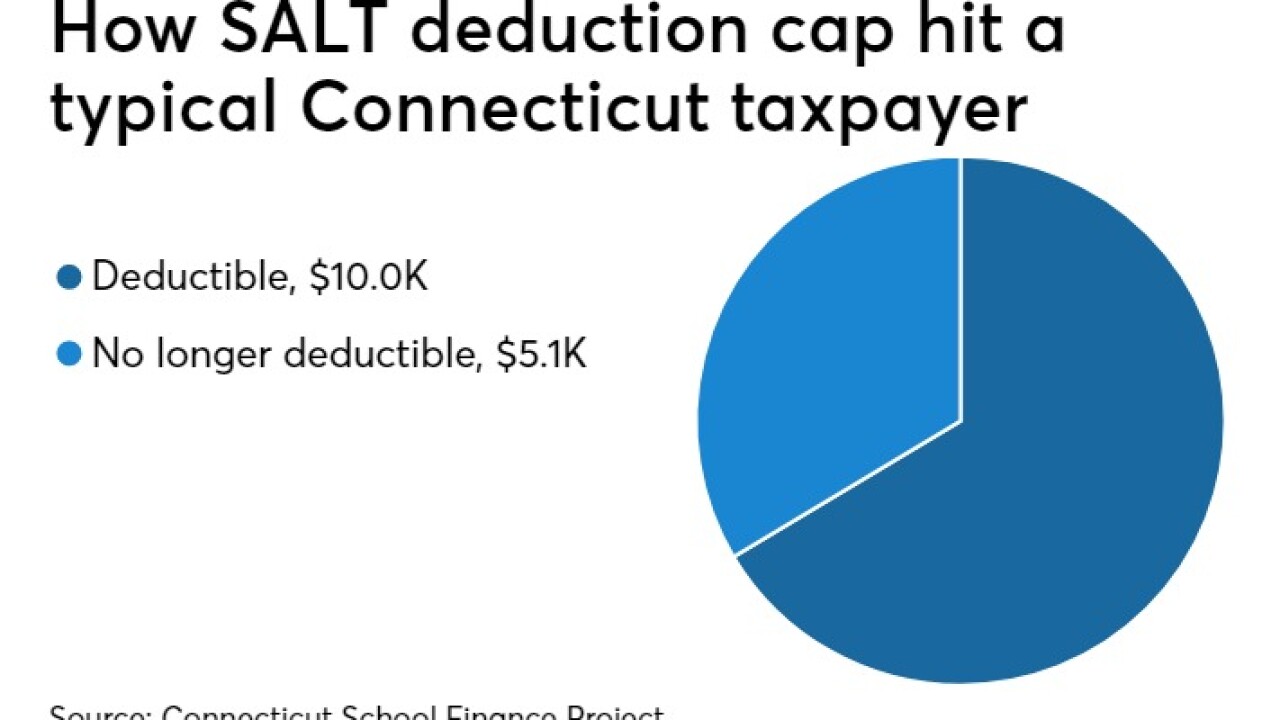

The limit on the SALT deduction caused an estimated 10.88 million individual taxpayers to lose $323.1 billion in tax deductions for the 2018 tax year, the Treasury Inspector General for Tax Administration reported in February.

June 12 -

Gov. Ned Lamont and Connecticut lawmakers are studying a proposal to essentially exchange much of the state’s income tax for a payroll tax.

May 30 -

Lawmakers have to wait another week for the governor's five-year infrastructure plan.

May 9 -

Lower gas prices, remote working, easy driving and new competition from ride-share companies are taking slices of the pie.

April 24 -

Virginia and Florida and other states are responding to complaints about using tolls to pay for costly road improvements.

April 10 -

The Civic Committee of the Commercial Club of Chicago says its plan would put the state on path to fiscal solvency and double-A ratings.

February 6 -

The governor said his proposed fiscal 2020 budget represents a 4% increase over this current budget, of which 80% is one-time costs.

January 10 -

States have reversed deterioration found last May.

November 6 -

The state recorded $31.94 billion of sales tax revenue, according to state Comptroller Glenn Hegar.

September 6 -

NASBO Executive Director John Hicks said that deposits made to rainy days funds from budget surpluses will likely bring the total to more than $58 billion for fiscal 2018.

August 29 -

The document details a $1.2 billion structural imbalance in the state budget labeled as “balanced” by Democrats and Republicans alike,

August 17 -

The tax would fund the voter-approved Medicaid expansion that was supposed to take effect July 2.

July 6 -

Muni analysts doubt that either major-party candidate for governor has the solutions to Illinois' many fiscal problems.

June 22 -

Only nine states reported making midyear budget cuts totaling $830 million this year compared to 22 states that cut $3.5 billion in 2017.

June 14 -

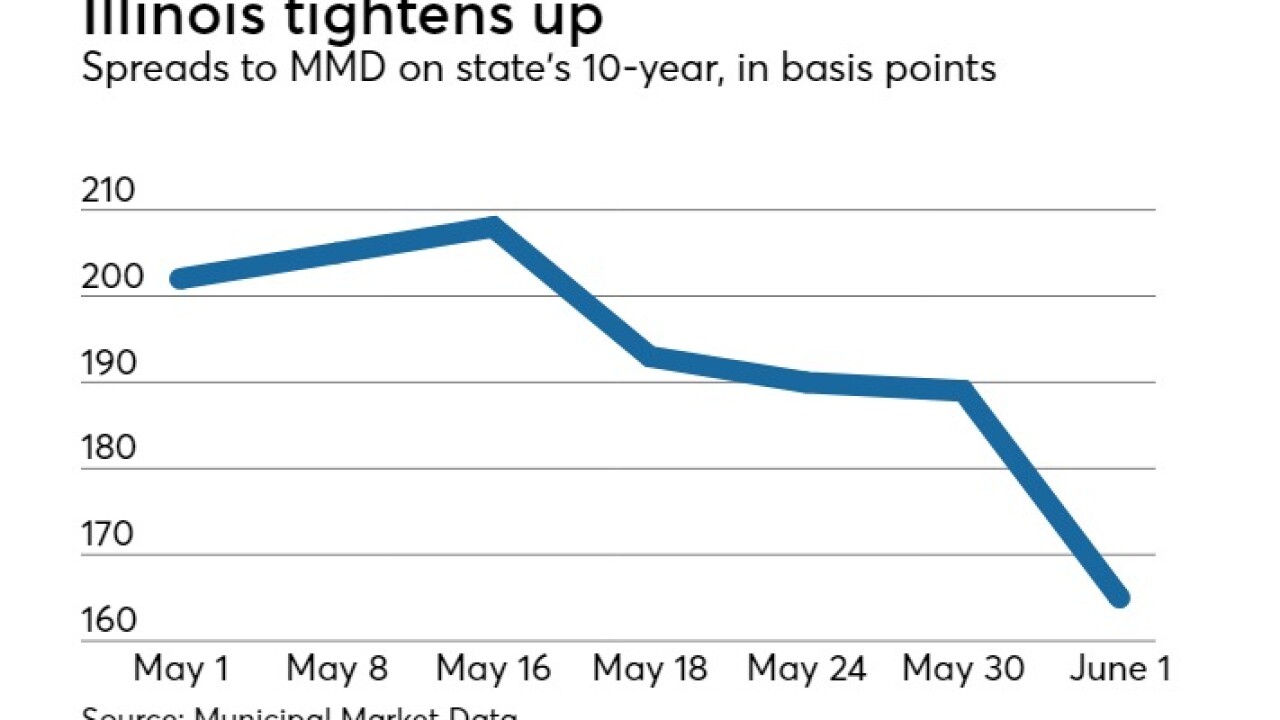

Municipal analysts see the holes in the spending plan, but secondary market traders reacted positively.

June 5 -

What's in the next Illinois budget is more important to S&P Global Ratings than whether it is passed soon.

May 29 -

New York, New Jersey and Connecticut are the first states to have created charitable funds that taxpayers can contribute to in order to claim a charitable deduction in lieu of paying state and local taxes.

May 24 -

The IRS notice warns that federal law, not state law, controls how payments for federal income tax purposes are characterized.

May 23