-

The state recorded $31.94 billion of sales tax revenue, according to state Comptroller Glenn Hegar.

September 6 -

NASBO Executive Director John Hicks said that deposits made to rainy days funds from budget surpluses will likely bring the total to more than $58 billion for fiscal 2018.

August 29 -

The document details a $1.2 billion structural imbalance in the state budget labeled as “balanced” by Democrats and Republicans alike,

August 17 -

The tax would fund the voter-approved Medicaid expansion that was supposed to take effect July 2.

July 6 -

Muni analysts doubt that either major-party candidate for governor has the solutions to Illinois' many fiscal problems.

June 22 -

Only nine states reported making midyear budget cuts totaling $830 million this year compared to 22 states that cut $3.5 billion in 2017.

June 14 -

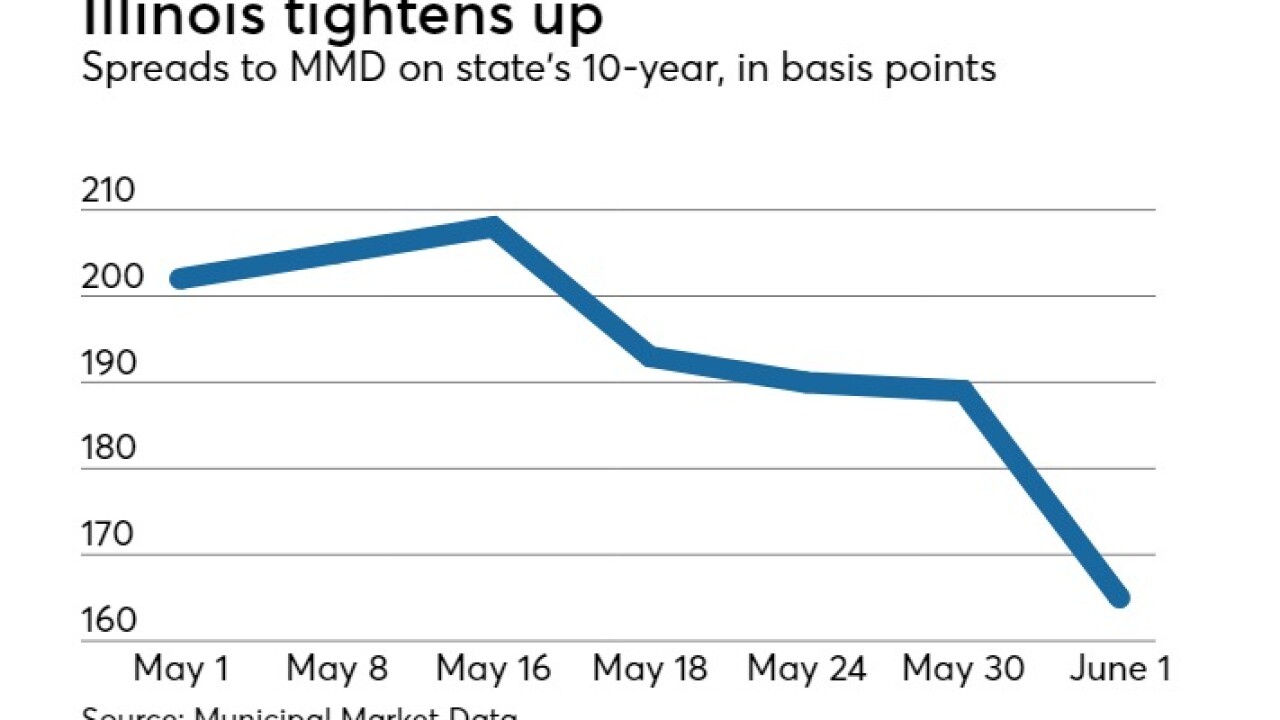

Municipal analysts see the holes in the spending plan, but secondary market traders reacted positively.

June 5 -

What's in the next Illinois budget is more important to S&P Global Ratings than whether it is passed soon.

May 29 -

New York, New Jersey and Connecticut are the first states to have created charitable funds that taxpayers can contribute to in order to claim a charitable deduction in lieu of paying state and local taxes.

May 24 -

The IRS notice warns that federal law, not state law, controls how payments for federal income tax purposes are characterized.

May 23 -

If New York State legalizes marijuana, New York City could see as much as $336 million annually in new tax revenue.

May 15 -

The flat state income tax rate is embedded in the state constitution.

May 8 -

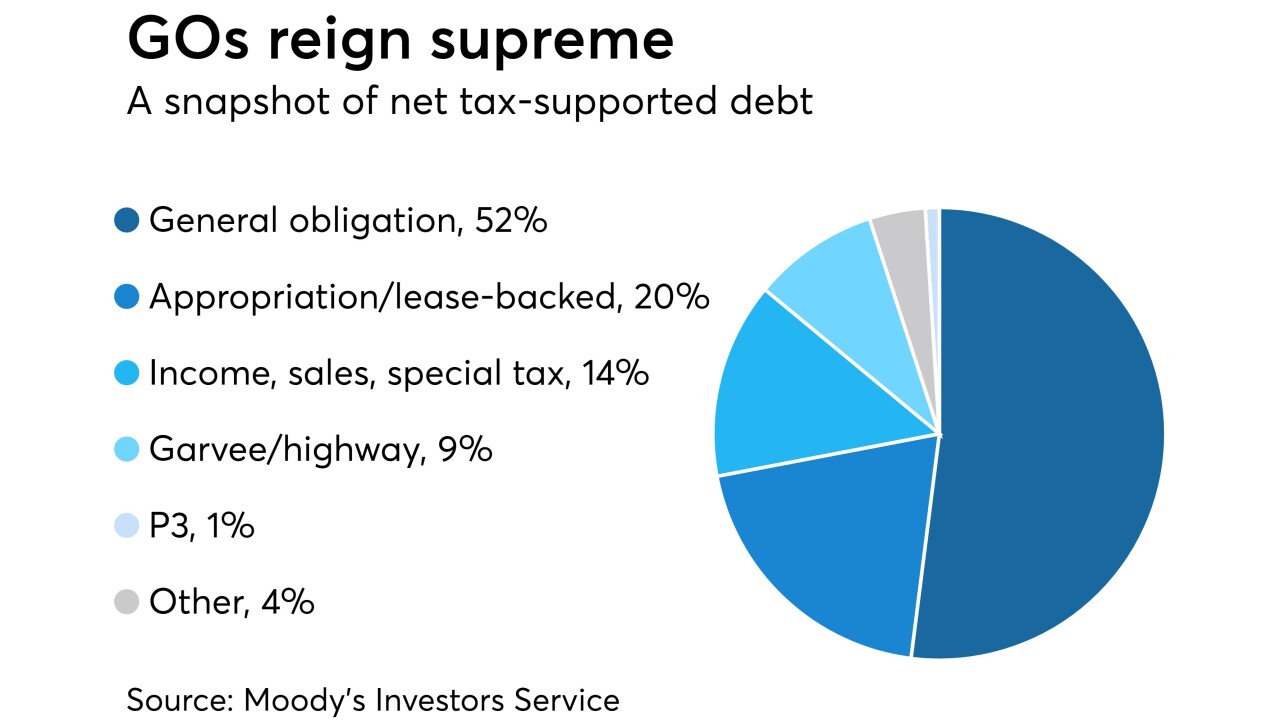

Pension costs and slow growth in state revenues contributed to a fifth straight year of net tax-supported debt growth of under 2%.

April 25 -

Alaska's credit quality and the future of some existing and proposed bonding programs hang in the balance as lawmakers wind down the clock in Juneau.

April 12 -

For the first time in nearly 30 years, Oklahoma has raised taxes to deal with a teachers strike, a credit positive step, says Moody's Investors Service.

April 9 -

Employers in New York also are allowed to implement a 5% payroll tax as a way of paying some of their employees’ state income taxes.

April 6 -

The report illustrates how federal, state and local laws must be changed if the Supreme Court rules in favor of South Dakota and against Wayfair Inc. in an online sales tax case.

March 27 -

States are poised to see increases in their corporate tax base because of the federal tax overhaul, according to a new study.

March 20 -

After years tight budgets that followed tax cuts and revenue shortfalls, Oklahoma teachers and government employees are threatening to walk off the job.

March 19 -

After several years of sluggish revenue growth, U.S. states enacted cautious budgets for fiscal 2018, according the National Association of State Budget Officers.

December 14