-

State governments generally are better prepared for an economic downtown than at any other time since the National Association of State Budget Officers began keeping records in 1988.

June 13 -

States struggle to reap the full benefits of the multibillion-dollar legal marijuana industry becuase of conflicts with federal law.

June 11 -

Deputy Governor Dan Hynes says the recent legislative session put the state on an "upward trajectory," but underfunded pensions dog the state.

June 11 -

Water, health care and housing lead the agenda in budget discussions.

June 10 -

State lawmakers at this year’s session provided $993 million for 1,600 bond-funded projects around the state.

June 10 -

State lawmakers punted the touchy subject of reimposing tolls to Gov. Ned Lamont, who may call a special session.

June 7 -

Soaring liabilities for post-employment benefits other than pensions are adding further weight to the state’s fiscal challenges.

June 6 -

The highest-ranked states were mostly west of the Mississippi River, driven by expanding economies and population growth.

June 5 -

Karel Citroen, head of municipal credit research at Conning, talks about states and credit quality.

June 5 -

"The elephant in the room is still there," an analyst says.

June 5 -

Texas surpassed $3 billion in sales tax revenue, the highest total for any month on record.

June 4 -

New revenue and fewer one-shot revenue solutions make the fiscal 2020 budget more acceptable to analysts, but dark long-term clouds remain.

June 4 -

The Ohio House’s two-year operating budget bill boosts spending for higher education adding an extra $21.8 million for higher education next year and $20 million in 2021.

June 4 -

The $178 million bond sale comes as a legislative concurrence panel plans to negotiate the commonwealth’s proposed $42.7 billion fiscal 2020 budget.

June 4 -

Lawmakers authorized more than $23 billion of borrowing and approved a $45 billion six-year capital plan.

June 3 -

While Texas Republican leaders have expressed muted opposition to President Trump's plan to impose tariffs on Mexico, state Comptroller Glenn Hegar warned of threats to the state's economy.

June 3 -

Bills to limit the revenue flexibility of local governments and put more state funding toward schools were driven by a desire to limit property taxes.

June 3 -

State Controller Betty Yee blames the state's new digital accounting system for delaying the comprehensive annual financial report.

May 31 -

Minority Republicans had gummed up progress by forcing the House clerk to read every line of every bill, before two members broke ranks.

May 30 -

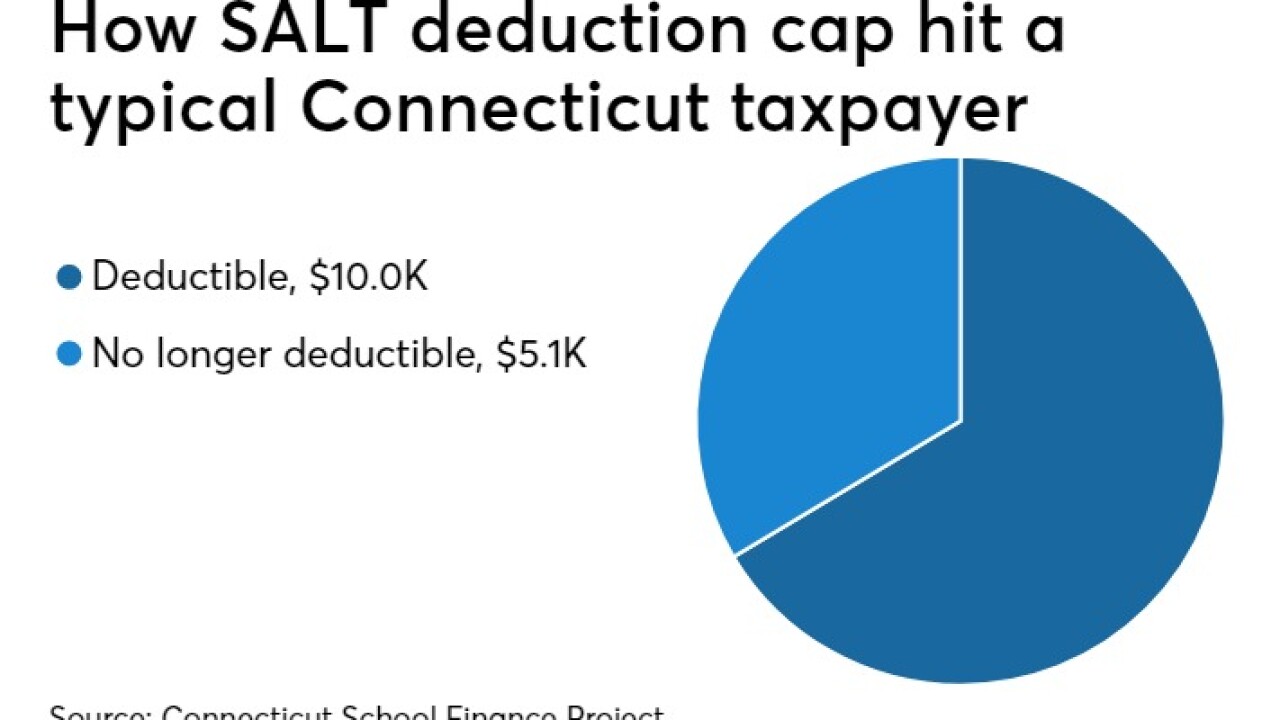

Gov. Ned Lamont and Connecticut lawmakers are studying a proposal to essentially exchange much of the state’s income tax for a payroll tax.

May 30