-

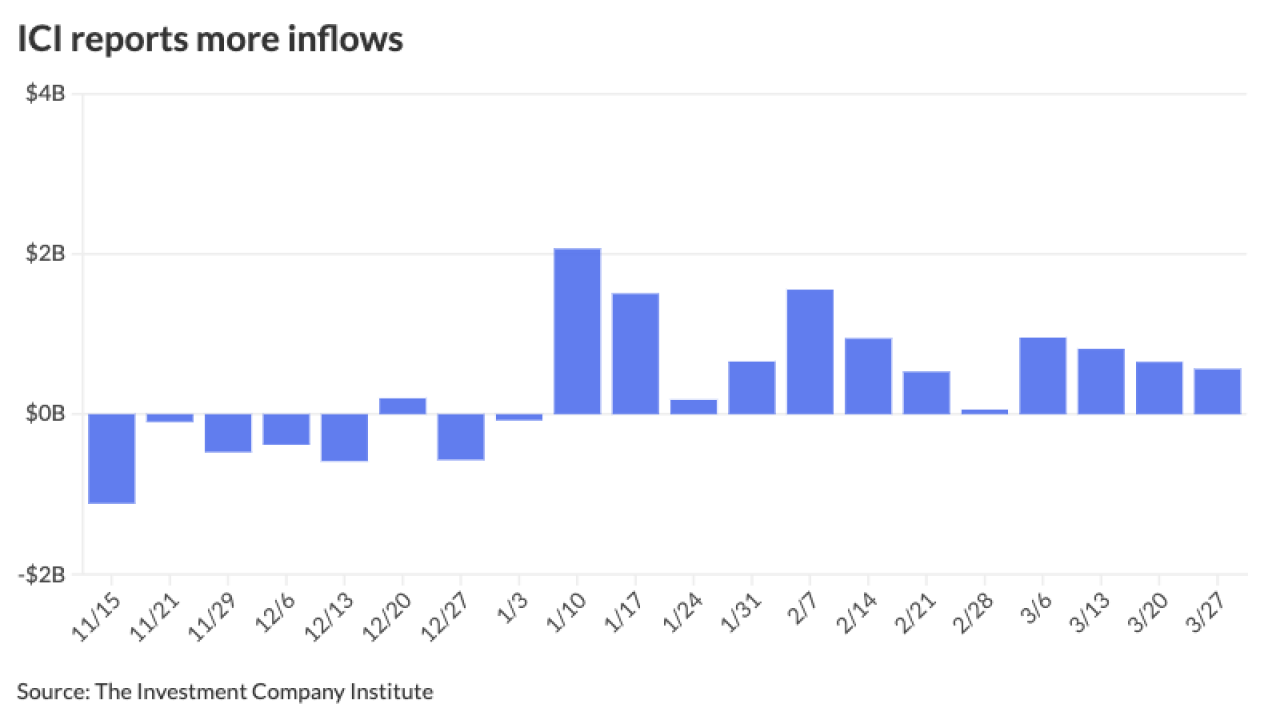

Municipal bond mutual funds saw the seventh consecutive week of inflows and the 14th week of inflows for high-yield funds.

April 11 -

"The news is sparking an equity market selloff while sending bond yields to the stars as investors dial down their Fed easing expectations again, this time to only two rate cuts this year," said José Torres, senior economist at Interactive Brokers.

April 10 -

Wednesday's CPI report will "shed more light on the path of inflation and the potential timing for rate cuts this year," said Cooper Howard, a fixed income strategist at Charles Schwab.

April 9 -

The deal comes amid market inflows and a dearth of high-yield supply, but demand will depend, as always, on the price, investors said.

April 9 -

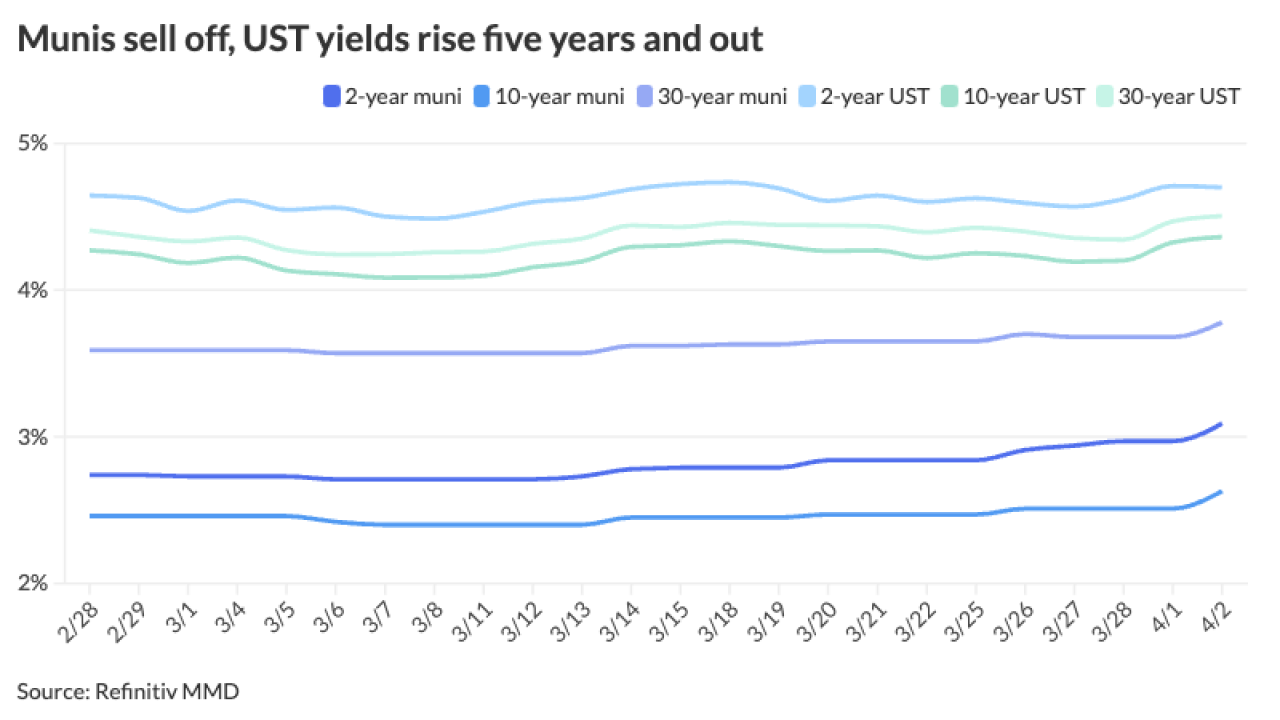

Muni to UST ratios also continue to rise across the curve, inching closer to more normal averages.

April 8 -

As another economic indicator pushed investors closer toward the assumption that rate cuts are farther away, the relationship between munis, USTs and the vast amount of capital sitting on the sidelines becomes more challenging to navigate, particularly ahead of the tax-filing deadline and growing new-issue calendar.

April 5 -

Some buying returned to the market Thursday from the buy-side and asset managers as dealers attempted to sell bonds, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

April 4 -

"Most spots on the muni AAA HG curve are at or near year-to-date highs, and the muni HG curve showed significant underperformance across the curve in March, relative to the broader fixed income market, after sizable muni outperformance in February," said J.P. Morgan strategists.

April 3 -

Before Tuesday's selloff, muni yields have been rising over the last several weeks due to "outsized" new-issue supply, said Anders S. Persson, Nuveen's chief investment officer for global fixed income, and Daniel J. Close, Nuveen's head of municipals.

April 2 -

John Hallacy of John Hallacy Consulting and Rich Ciccarone, president emeritus of Merritt Research Services, talk with Chip Barnett about the municipal bond business over the past 40 years. They take a look back at where the industry has been, where it is and where it will be going.

April 2