-

While fundamentals remain strong — with credit upgrades outpacing downgrades by 3.5 times so far in 2024 — technical factors have been "less supportive," Principal Asset Management strategists said in a report.

October 24 -

"The identity of the marginal buyer may be shifting, and with that the market's valuation of structure and liquidity," said Matt Fabian, a partner at Municipal Market Analytics.

October 22 -

Demand for munis remains "insatiable," said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

October 21 -

"Buyer interest comes as forward supply is projected around $20 billion (the high water mark over the last year) while offsetting calls and maturities sit about $2 billion lower, creating a net supply surplus," said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

October 17 -

The muni market enters the last quarter of 2024 in "excellent shape," said GW&K Investment Management partners John Fox, Brian Moreland, Kara South and Martin Tourigny.

October 16 -

Supply ramps up this week to an estimated $13.361 billion, with several billion-dollar pricings on tap.

October 15 -

Municipal triple-A yield curves played catch up to USTs Friday to close out a week of more mixed economic data that has economists constantly reevaluating their Federal Reserve policy expectations with little consensus.

October 11 -

Municipal bond insurers wrapped $28.921 billion in the first three quarters 2024, a 26.8% increase from the $22.814 billion insured in the first three quarters of 2023, according to LSEG data.

October 11 -

Analysts remain divided about what the stronger-than-expected consumer price index will mean for Federal Reserve policymakers since the Fed appears to be concentrating on the labor market.

October 10 -

Data from the Municipal Securities Rulemaking Board indicates that trade volume may stay high after a consistent third quarter.

October 10 -

With munis establishing "directional footing" in the fourth quarter of this year, the technical backdrop is still the market driver for 2024, said Jeff Lipton, a research analyst and market strategist.

October 9 -

Supply is slightly lower this week at nearly $10 billion but not by much, with the pace of supply suggesting $500 billion of issuance for the year could still happen, said Tripp Kaiser, a managing director at Municipal Market Analytics, Inc.

October 8 -

Muni yields were cut up two to five basis points, depending on the curve, while UST yields rose five to seven basis points, pushing the 10-year UST yields above 4%.

October 7 -

Municipal bond mutual funds saw inflows of $1.879 billion in the latest week, marking the 14th consecutive week of inflows and the highest level of 2024, per LSEG data, reiterating the strong investor support for this market.

October 3 -

The biggest theme within the muni market — and what is responsible for its performance — is the amount of cash on the sidelines, with $6-plus trillion in money market funds and close to $2.5 trillion in certificates of deposits, said Julio Bonilla, a fixed-income portfolio manager at Schroders.

October 2 -

Through the integration, Investortool's clients can calculate analytics based on predictive trade levels, filter the live market based on "what's rich or what's cheap" compared to the predictive price and power automation, said James Morris, senior vice president at Investortools.

October 2 -

The larger supply calendar should be "taken down well given the persistent inflows into our market and investors are still sitting on plenty of cash," said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

October 1 -

With supply ballooning, reinvestment dollars at lows of the year, J.P. Morgan's Peter DeGroot argues the next few weeks could offer the best opportunity to buy bonds of the year – and possibly the rate cycle. DeGroot talks about this, plus potential impacts of shifting investor behavior on market liquidity, and what the upcoming election might mean for tax policy and the muni market. Lynne Funk hosts.

October 1 -

"As September draws to a close, some dynamics may prevail in October but others could undergo a shift," said NewSquare Capital's Kim Olsan. "One aspect that will continue is the level of supply coming to market."

September 30 -

Municipal triple-A yield curves closed out the week with few changes, valuations were little changed, but at attractive levels, and the forward calendar climbs to more than $10 billion to open the fourth quarter.

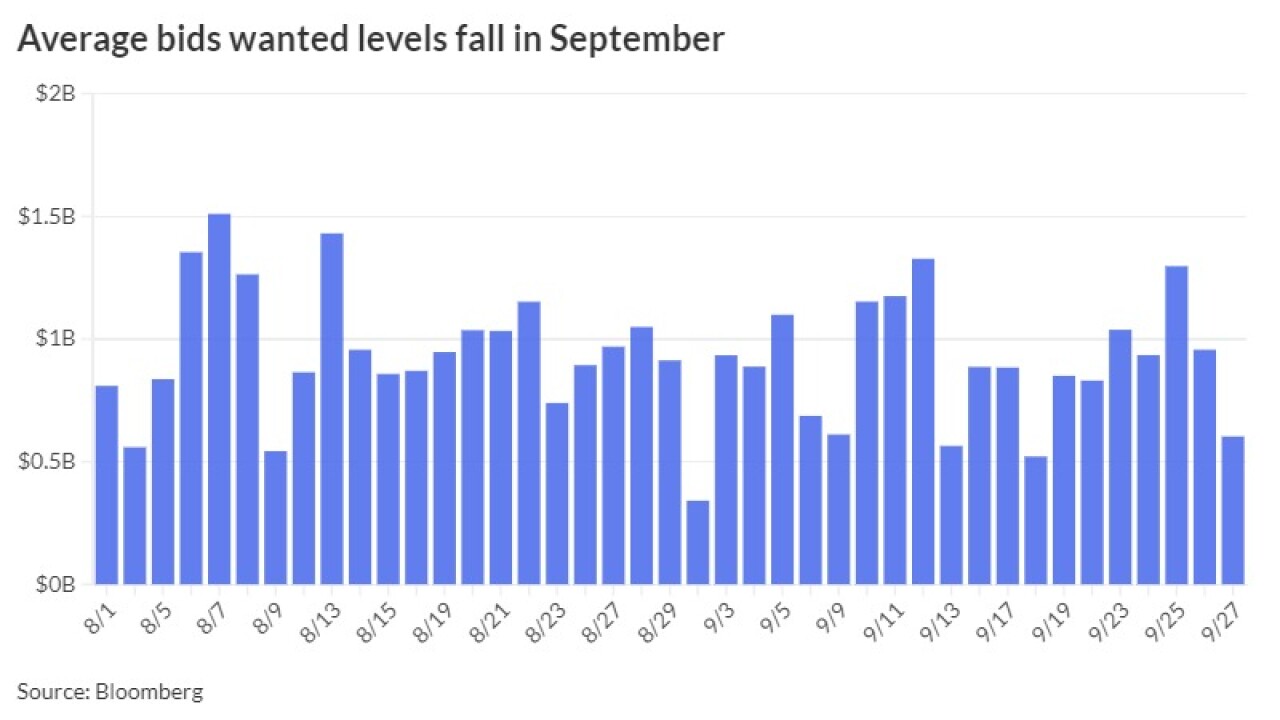

September 27