-

While supply falls next week as investors await their first Fed rate cut in four years, it should pick up after the FOMC, Barclays PLC said, adding the 30-day visible pipeline "is at relatively manageable levels at the moment." Bond Buyer 30-day visible supply is at $10.09 billion.

September 13 -

Municipal bond mutual funds saw inflows as investors added $1.258 billion to funds — the second-largest inflow figure year-to-date after $1.413 billion of inflows for the week ending Jan. 31.

September 12 -

The August consumer price index showed inflation remains above the Federal Reserve's target level and makes a 50-basis-point rate cut next week unlikely, economists said. Further, many expect the market will be disappointed going forward, as future cuts will likely be shallower than expected.

September 11 -

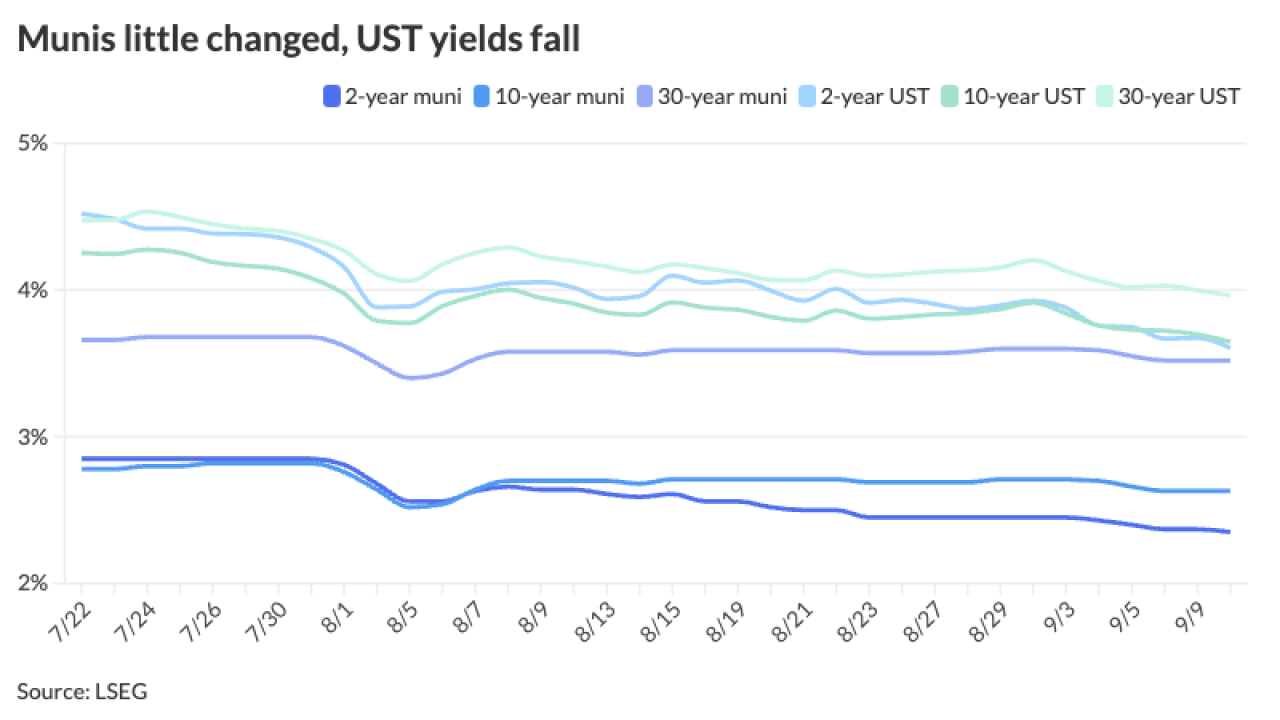

Municipals lagged the UST moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

September 10 -

"Despite the underperformance of tax-exempt yields last week, we could see some more pressure on both spreads and ratios due to the heavy supply calendar," said Vikram Rai, head of municipal markets strategy at Wells Fargo.

September 9 -

Municipal supply continues to grow as Bond Buyer 30-day visible supply sits at $20.02 billion and the municipal market will see one of the largest weeks of new-issuance at an estimated $13.35 billion, led by three billion-plus deals from Washington, D.C. ($1.6 billion), the New York City Transitional Finance Authority ($1.5 billion) and Illinois ($1 billion).

September 6 -

Ciraolo, who spent more than 17 years at Goldman Sachs, has been brought on as a senior vice president in corporate and municipal short-term securities to help expand SWS' taxable muni franchise through commercial paper trading.

September 6 -

Municipal bond mutual funds saw inflows as investors added $956 million to funds after $1.047 billion of inflows the week prior, according to LSEG Lipper.

September 5 -

Most weeks in September are expected to see around $10 billion of issuance, which could easily grow if a prepaid gas deal is thrown into the mix, said Jason Appleson, head of municipal bonds at PGIM Fixed Income. Bond Buyer 30-day visible supply sits at $16.46 billion.

September 4 -

Summer redemption season has ended, and "without the huge amounts of maturing and called bond principal flowing back to investors, demand in the last months of the year will be more reliant on new money coming into the market than it was in June, July and August," said Pat Luby, head of municipal strategy at CreditSights.

September 3 -

Investors will see more than $7.8 billion of supply to start off September, following a record issuance month in August. The calendar is led by the North Texas Tollway Authority's $1.126 billion of system revenue refunding bonds while high-grade Massachusetts leads the competitive slate with $850 million of exempt and taxable general obligation bonds.

August 30 -

The muni market is "well-positioned for strategic opportunities, with strong inflows driven by the current narrative and eased secondary selling pressure," said James Pruskowski, chief investment officer at 16Rock Asset Management.

August 29 -

The Investment Company Institute reported more than $1.3 billion of inflows into muni mutual funds. The last time inflows topped $1 billion, per ICI data, was for the week ending Feb. 7. LSEG Lipper has reported weeks with $1 billion plus inflows on July 31 and May 8.

August 28 -

ICE's and MarketAxess's networks are "complementary," said Peter Borstelmann, president of ICE Bonds, as the former is "deep and rich" in the retail wealth segment, while the latter is "deep and rich" in the institutional space.

August 28 -

"On the whole, the municipal market continues to provide an attractive entry point for investors," said AllianceBernstein strategists. "And with the Fed clearly communicating that a September rate cut is imminent, the future is bright for the municipal market."

August 27 -

"The forward calendar shows issuance will be above average over the next few weeks, while reinvestment cash is set to drop off," Birch Creek strategists said.

August 26 -

The calendar next week largely continues "the elevated pace of primary market volume seen since May, against a backdrop of broadly supportive fund flows (LSEG inflows for eight consecutive weeks), somewhat better dealer positions (although still heavy), mid-August reinvestment to spend, but lighter late summer attendance," said J.P. Morgan strategists led by Peter DeGroot.

August 23 -

Along with the influx of supply, the muni market remains "constructive" due to attractive yields, said Catherine Stienstra, head of municipal bond investments at Columbia Threadneedle Investments.

August 22 -

All eyes are on Jackson Hole and Fed Chairman Jerome Powell's speech this week, noted Cooper Howard, a fixed-income strategist at Charles Schwab.

August 21 -

"Investor reception will remain the ultimate arbiter of muni performance and … the current state of the tax-exempt space to be well-positioned, even though munis are likely to continue to underperform USTs," said Jeff Lipton, a research analyst and market strategist.

August 20