-

Supply is slightly lower this week at nearly $10 billion but not by much, with the pace of supply suggesting $500 billion of issuance for the year could still happen, said Tripp Kaiser, a managing director at Municipal Market Analytics, Inc.

October 8 -

Muni yields were cut up two to five basis points, depending on the curve, while UST yields rose five to seven basis points, pushing the 10-year UST yields above 4%.

October 7 -

Municipal bond mutual funds saw inflows of $1.879 billion in the latest week, marking the 14th consecutive week of inflows and the highest level of 2024, per LSEG data, reiterating the strong investor support for this market.

October 3 -

The biggest theme within the muni market — and what is responsible for its performance — is the amount of cash on the sidelines, with $6-plus trillion in money market funds and close to $2.5 trillion in certificates of deposits, said Julio Bonilla, a fixed-income portfolio manager at Schroders.

October 2 -

Through the integration, Investortool's clients can calculate analytics based on predictive trade levels, filter the live market based on "what's rich or what's cheap" compared to the predictive price and power automation, said James Morris, senior vice president at Investortools.

October 2 -

The larger supply calendar should be "taken down well given the persistent inflows into our market and investors are still sitting on plenty of cash," said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

October 1 -

With supply ballooning, reinvestment dollars at lows of the year, J.P. Morgan's Peter DeGroot argues the next few weeks could offer the best opportunity to buy bonds of the year – and possibly the rate cycle. DeGroot talks about this, plus potential impacts of shifting investor behavior on market liquidity, and what the upcoming election might mean for tax policy and the muni market. Lynne Funk hosts.

October 1 -

"As September draws to a close, some dynamics may prevail in October but others could undergo a shift," said NewSquare Capital's Kim Olsan. "One aspect that will continue is the level of supply coming to market."

September 30 -

Municipal triple-A yield curves closed out the week with few changes, valuations were little changed, but at attractive levels, and the forward calendar climbs to more than $10 billion to open the fourth quarter.

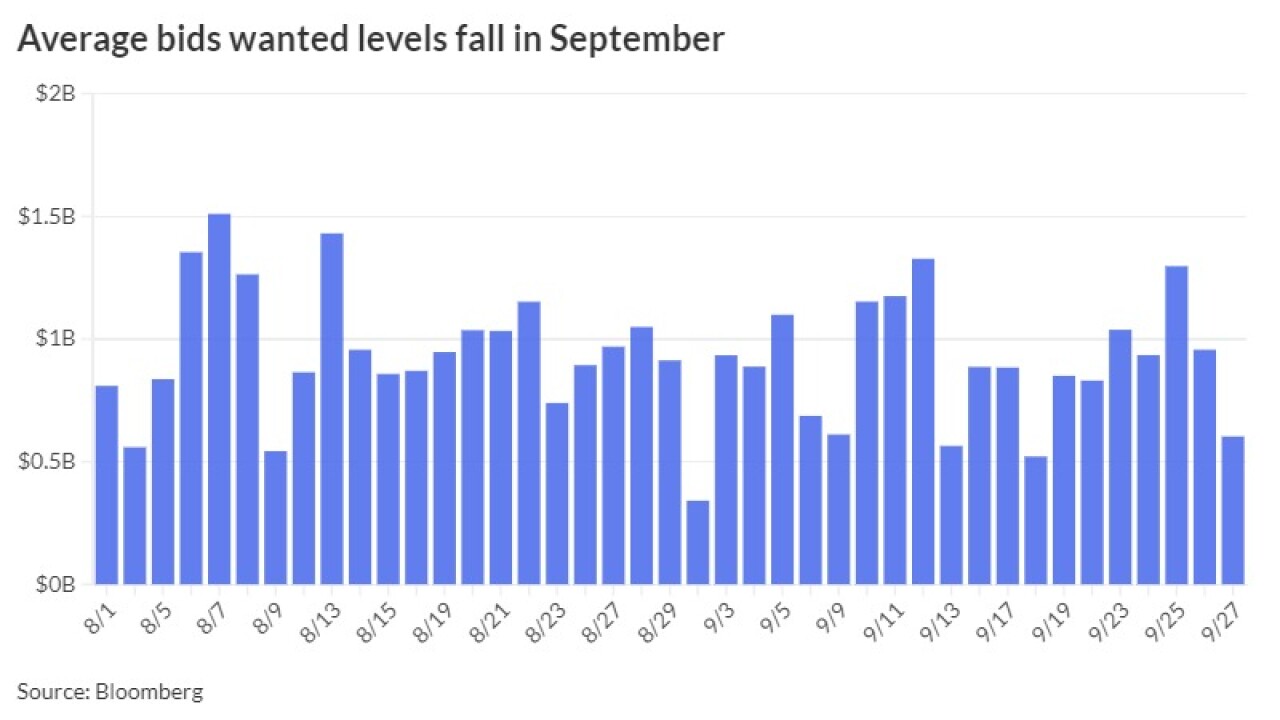

September 27 -

High-yield muni issuance totals $20 billion year-to-date, "reflecting normalization from relatively depressed levels in 2023 ($7.6 billion over the comparable period), and now virtually equal to the trailing five-year average for the period ($20.1 billion)," said J.P. Morgan strategists, led by Peter DeGroot.

September 26 -

The Investment Company Institute reported $1.329 billion of inflows into municipal bond mutual funds for the week ending Sept. 18 after $1.402 billion of inflows the week prior. Exchange-traded funds saw $55 million of inflows after $1.048 billion of inflows the previous week.

September 25 -

Demand for munis looks "fairly stable" for now, particularly after the 10- to 25-basis-point rally ended in the 30 days before the Federal Reserve cut rates last week, Municipal Market Analytics, Inc. said, noting the "bull-steepening adjustment" looks like the 30-day move before the beginning of the Fed's last cutting cycle, at the end of July 2019.

September 24 -

Several factors make the current market "an attractive entry point" into the muni market, AllianceBernstein strategists said. For one, municipal valuations are cheap to fair value relative to U.S. Treasuries, partially due to the surge of supply in 2024.

September 23 -

"Active ETFs are becoming an integral part of investor portfolios around the world, with financial advisors increasingly incorporating them into their models-based practice," a BlackRock spokesperson said.

September 23 -

"Should September's positive returns hold as we expect, it would mark the fourth consecutive month of positive total returns — the first such period since the five-month period spanning from March through July 2021," BofA strategists Yingchen Li and Ian Rogow said.

September 20 -

While the municipal market barely budged following the Fed's decision to cut rates 50 basis points, Thursday saw muni yields rise up to two basis points, depending on the scale, but still lagged the weakness in USTs. LSEG Lipper reported $716 million of inflows into municipal bond mutual funds.

September 19 -

The product is designed to give SOLVE's customers visibility into "next-trade" pricing data for more than 900,000 munis.

September 19 -

For municipals, Wednesday "marks a crucial step forward, perfectly aligned with the current risk landscape," said James Pruskowski, chief investment officer for 16Rock Asset Management.

September 18 -

Fed rate cuts "should lead to positive price action for both taxable and tax-exempt bonds, and current nominal yields remain well above where they were when the Fed was more dovish, implying generous room to rally from here," said Matt Fabian, a partner at Municipal Market Analytics, Inc.

September 17 -

Despite the underperformance to USTs, munis saw positive momentum during the first two weeks of September with the asset class returning 0.68% so far this month and 1.99% year-to-date.

September 16