-

"Demand for low-duration tax-exempts has been so strong that short maturity benchmark yields are now lower than the after-tax yields for comparably rated benchmark taxable muni and corporate bonds," said CreditSights strategists Pat Luby and John Ceffalio.

August 15 -

New-issue volume grows to $10.7 billion led by a $2.7 billion taxable Massachusetts ESG deal, $1.35 billion of Oklahoma natural gas taxables, $1.25 billion from the Regents of the University of California and $1.1 billion from New York City.

August 12 -

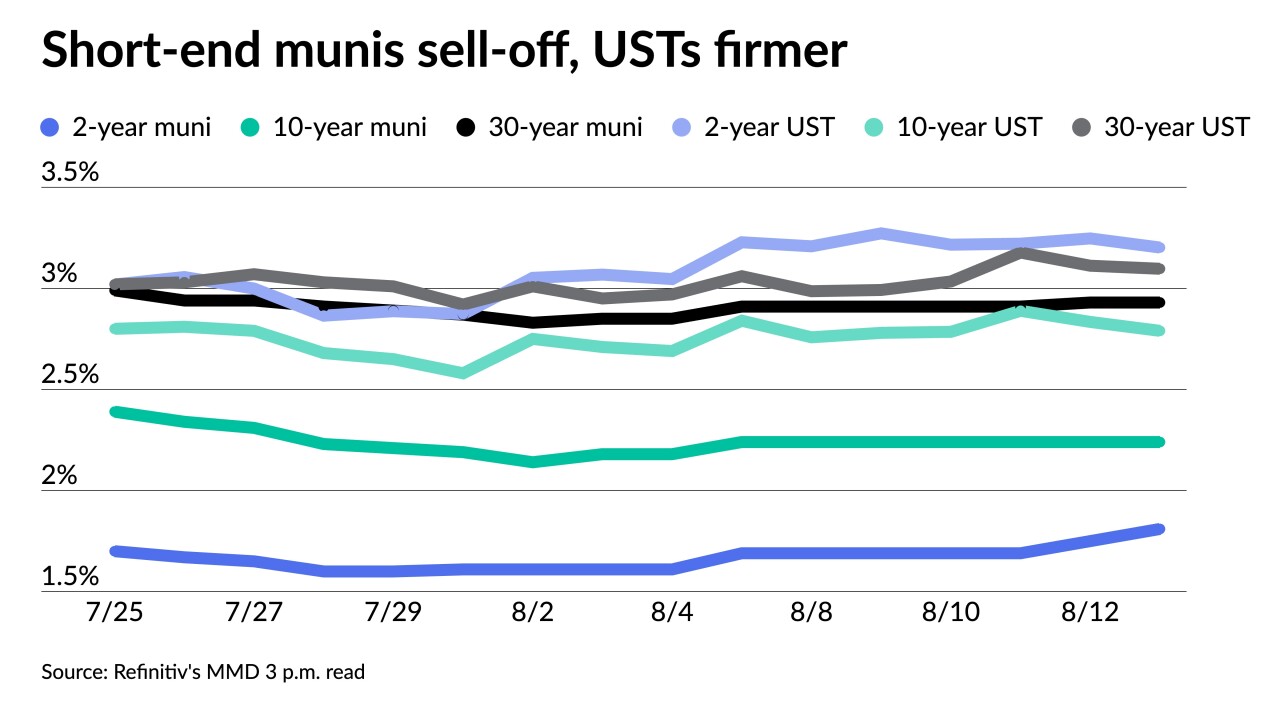

Pressure on the short end of the muni curve is being exacerbated by a 3.24% two-year Treasury note, from a correction to floating rate notes and dealer positions.

August 11 -

The Investment Company Institute reported investors poured in $1.589 billion into muni bond mutual funds in the week ending August 3, the highest level since November.

August 10 -

Several large new issues priced. Municipal yields were little changed, U.S. Treasuries were weaker on the short end and stocks ended in the red ahead of the much-anticipated July inflation figure.

August 9 -

Weekly supply is holding below $5 billion, reinvestment needs are still in effect from large redemptions and fund flows are leaning more positive, noted FHN Financial's Kim Olsan.

August 8 -

Investors will be greeted Monday with an increase in supply with the new-issue calendar estimated at $5.941 billion, up from total sales of $1.700 billion.

August 5 -

Investors poured $1.094 billion into municipal bond mutual funds in the latest week, versus the $236.491 million of inflows the week prior. It marks only the second time this year inflows eclipsed $1 billion.

August 4 -

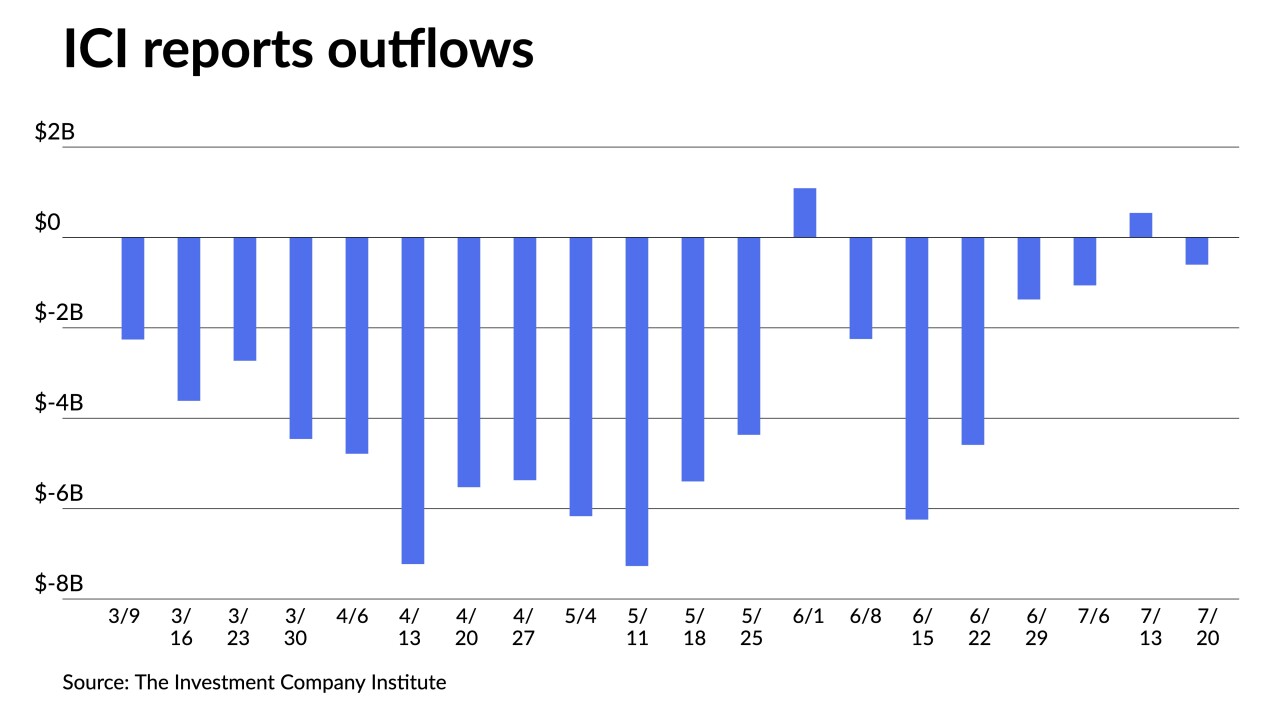

The Investment Company Institute reported investors pulled $246 million out of muni bond mutual funds in the week ending July 27 compared to the $602 million of outflows in the previous week.

August 3 -

The large primary was led by two $700-plus million of revenue bonds from the Port of Seattle and the Georgia Ports Authority.

August 2 -

Summer redemption season starts winding down; Net negative supply stands at $18.777 while 30-day visible is at $12-plus billion.

August 1 -

Municipals will end July with positive returns across all sectors. The Bloomberg Municipal Index shows a 2.49% return in July, moving year-to-date losses lower to 6.71%.

July 29 -

Investors added $236.491 million to municipal bond mutual funds, per Refinitiv Lipper data, versus the $698.782 million of outflows the week prior. High-yield saw inflows hit nearly $550 million.

July 28 -

Municipals are poised to end July in the black. Demand for muni product has been strong this summer, with analysts expecting supportive market technicals through August with a likely continuation of positive performance.

July 27 -

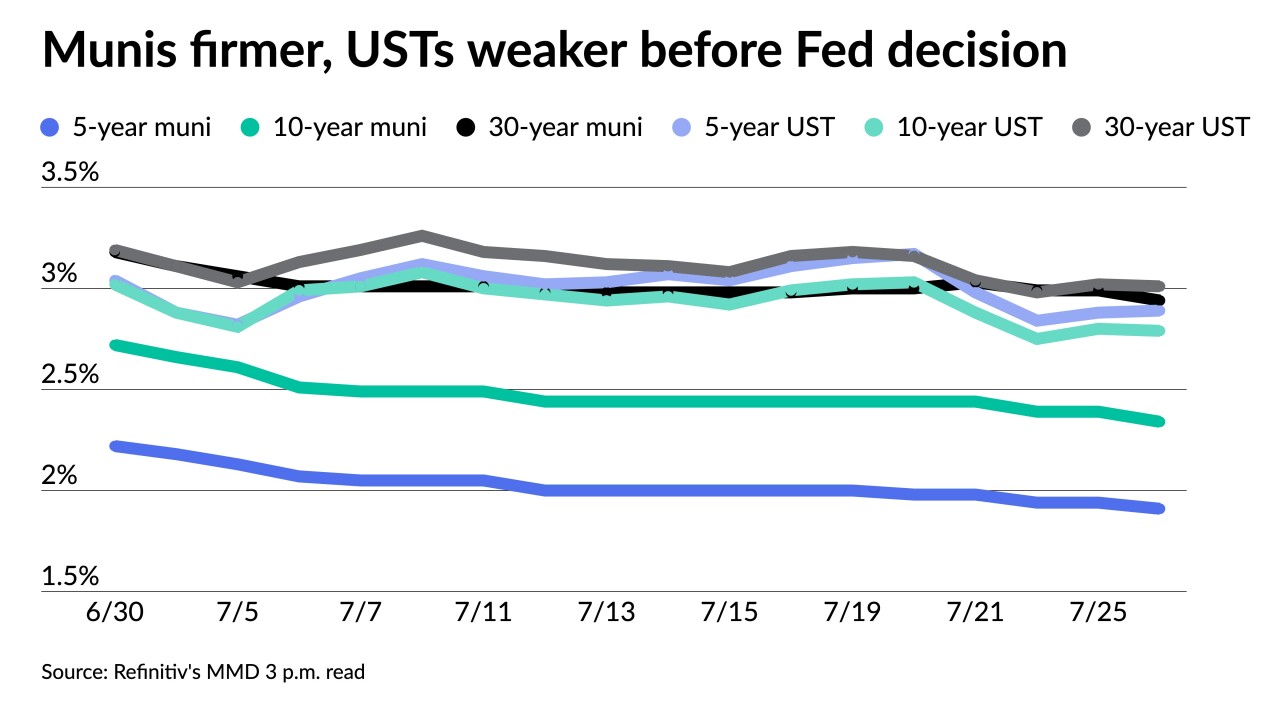

Investors sit on the sidelines, waiting to see how much the Fed will hike rates. The consensus appears to be another 75 basis point rate hike, though a full point hike could be on the table.

July 26 -

With the Fed rate decision coming this week, issuers are sitting on the sidelines in both primary and secondary Monday with little changed yield curves.

July 25 -

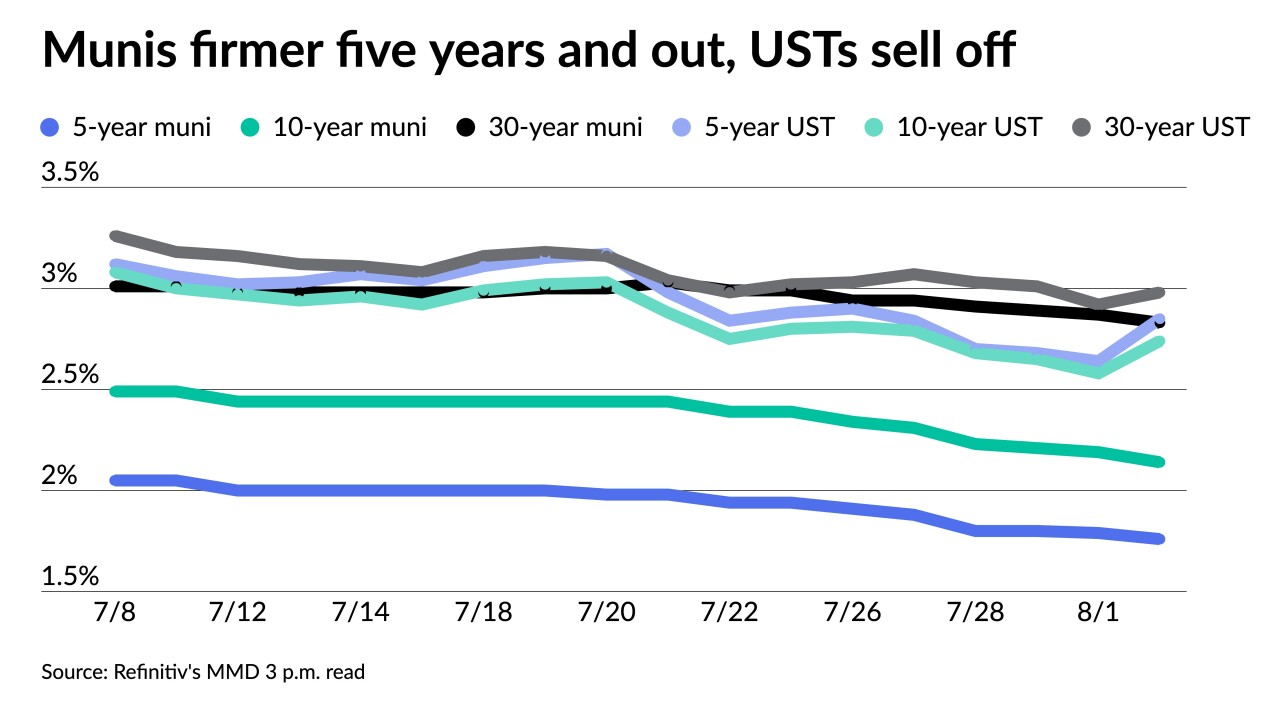

Munis were firmer to end the week but underperformed U.S. Treasuries.

July 22 -

As passengers return and revenues climb toward pre-pandemic norms, the Port Authority of New York and New Jersey has billions of capital construction on tap at the region's largest airports.

July 22 -

The bank in recent months shuttered its muni proprietary trading unit — which used the firm’s own cash to trade and invest — as part of a push to focus on providing more of its balance sheet to larger, institutional clients, according to people familiar with the matter.

July 22 -

Investors pulled $698.782 million out of municipal bond mutual funds, per Refinitiv Lipper data, versus the $206.127 million of inflows the week prior. High-yield saw small inflows.

July 21