-

"The main question for investors recently has been: will we see bank selling of municipals that exerts pressure on the market, and what kind of market effects could occur," Barclays strategists said.

March 15 -

"The muni market is no different than others, where fear and greed drive the trends," said Peter Delahunt, StoneX's managing director.

March 14 -

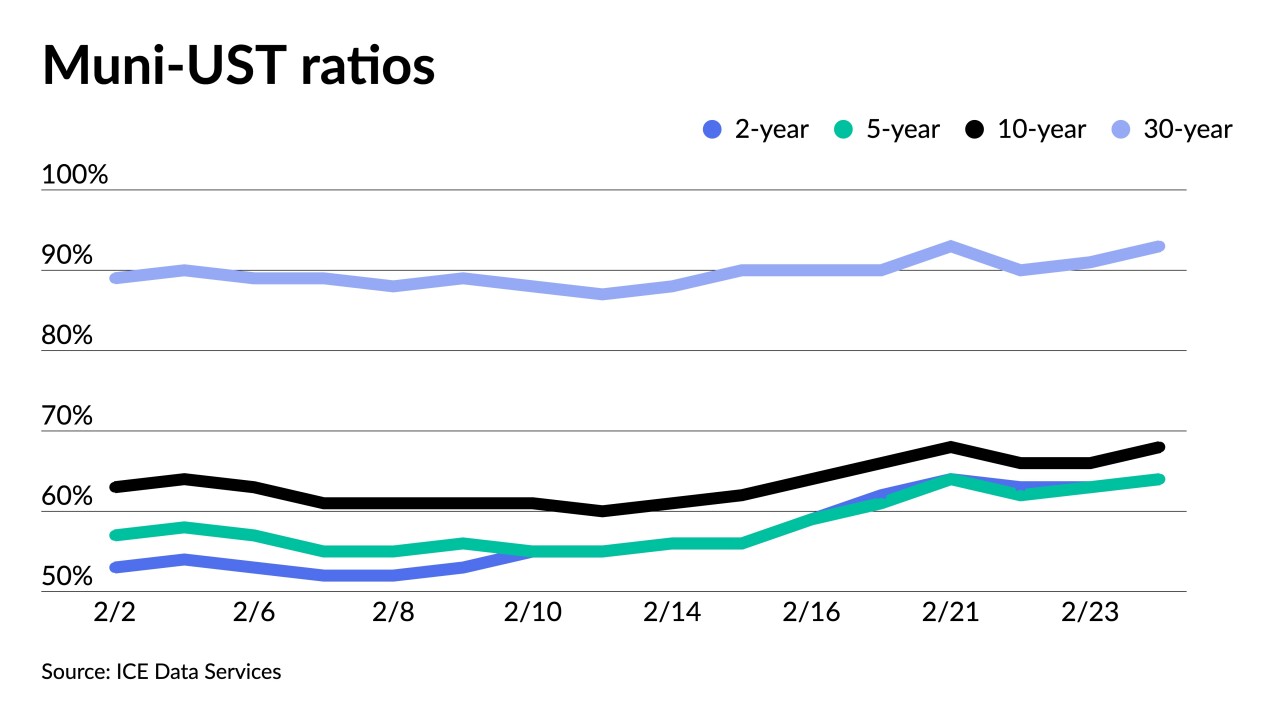

Triple-A benchmarks have fallen five to 10 basis points, depending on the scale.

March 13 -

Investors will be greeted Monday with a new-issue calendar estimated at $6.041 billion.

March 10 -

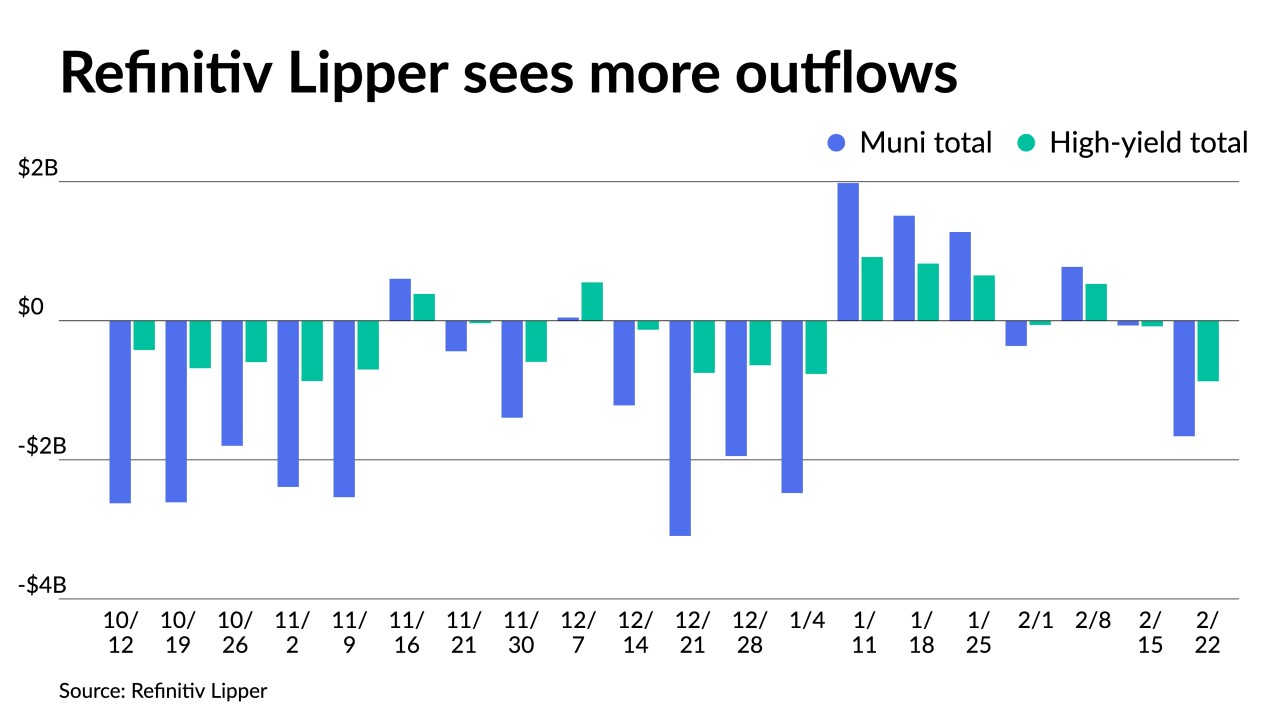

Outflows continued as Refinitiv Lipper reported $307.815 million was pulled from municipal bond mutual funds in the week that ended Wednesday after $905.030 million of outflows the week prior.

March 9 -

The two-year UST is now a full point above the 10-year UST, something that hasn't happened since 1981.

March 7 -

Ellis Phifer, managing director and senior strategist in the fixed income research department at Raymond James, talks with Chip Barnett about the state of the bond markets. (Taped Feb. 16; 15 minutes)

March 7 -

Federal Reserve Chair Jerome Powell will testify beore Congress twice this week and Friday brings the latest employment report.

March 6 -

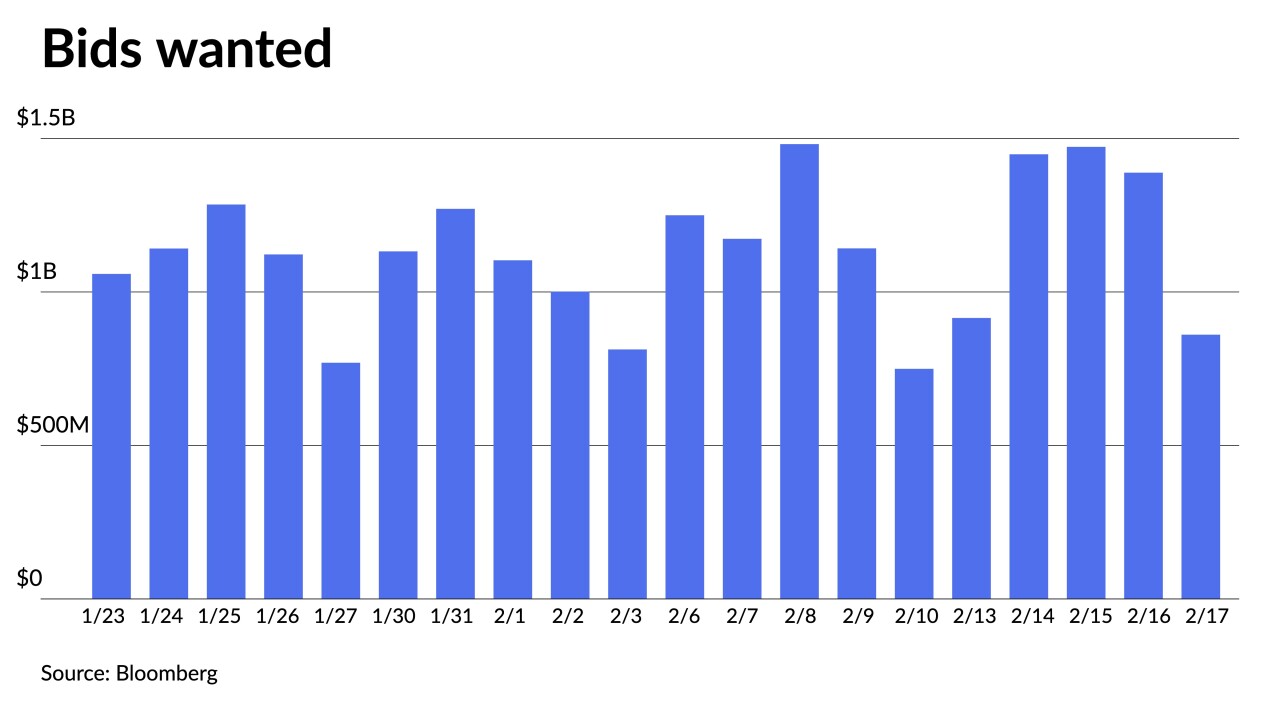

The "week's substantial primary market calendar of $10-plus billion will be a big test for where market demand stands," said Tom Kozlik, head of public policy and municipal strategy at HilltopSecurities Inc.

March 3 -

The 10- and 30-year Treasuries haven't reached these levels since November.

March 2 -

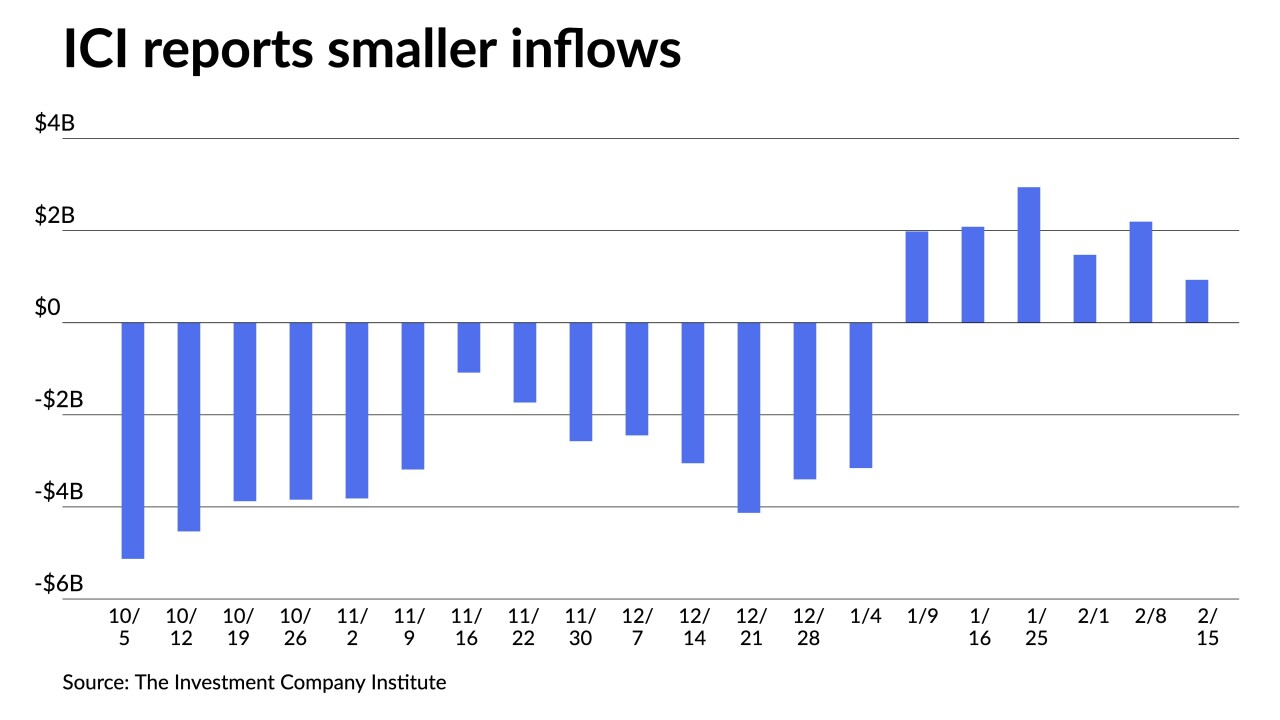

Outflows returned, with the Investment Company Institute reporting investors pulled $1.148 billion from mutual funds in the week ending Feb. 22, after $931 million of inflows the previous week.

March 1 -

The bond markets are witnessing a rare situation that could hinder spending on infrastructure projects around the country, said Amanda Hindlian, president of fixed income and data services at ICE.

February 28 -

The availability of higher yields has brought some investors into the market — even though volume in the primary and secondary markets are on the thin side and the municipal market is a bit of a mixed bag right now.

February 27 -

Investors will be greeted Monday with a new-issue calendar estimated at $4.098 billion.

February 24 -

An improving tone was apparent in the municipal market midweek — after a topsy-turvy ride last week when the market saw a close to 50-basis point adjustment to the front end of the triple-A municipal yield curve.

February 23 -

Earlier in the pandemic, bond values showed a greater divergence among local government issuers tracked, but that has reverted to pre-pandemic levels, although work-from-home and other uncertainties still take a toll.

February 23 -

Inflows continued with the Investment Company Institute reporting investors added $931 million to mutual funds in the week ending Feb. 15, after $2.194 billion of inflows the previous week.

February 22 -

"The close to 50 bp adjustment to the front end of the AAA municipal curve, taken at face value, appears to be a huge step toward pricing normalization for tax-exempts," said Eric Kazatsky, head of municipal strategy at Bloomberg Intelligence.

February 21 -

Investors will be greeted Monday with a new-issue calendar estimated at $3.603 billion.

February 17 -

Refinitiv Lipper reported $68.054 million was pulled from municipal bond mutual funds in the week that ended Wednesday after $775.006 million of inflows the week prior.

February 16