-

The $11-billion-plus calendar is the largest in eight weeks and includes two large high-grade issuers which may entice buyers into the market.

July 11 -

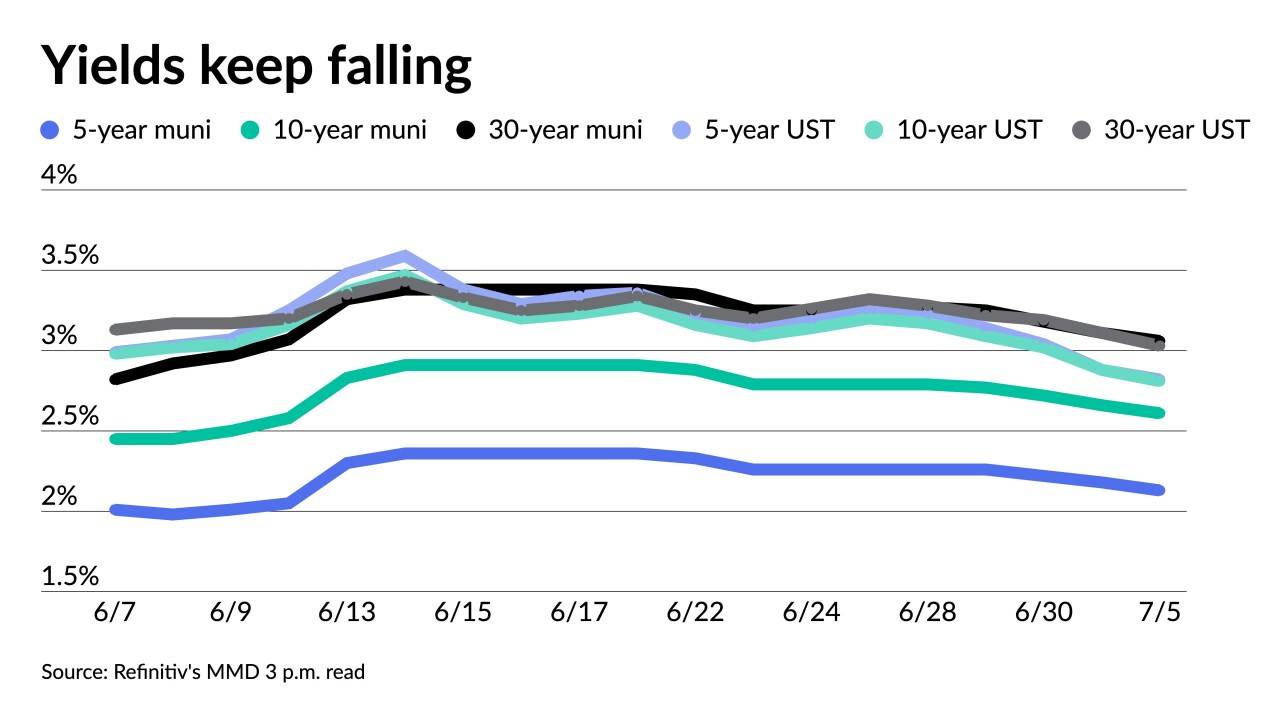

Despite rising U.S. Treasuries, municipals are making gains and are in the black to start July.

July 7 -

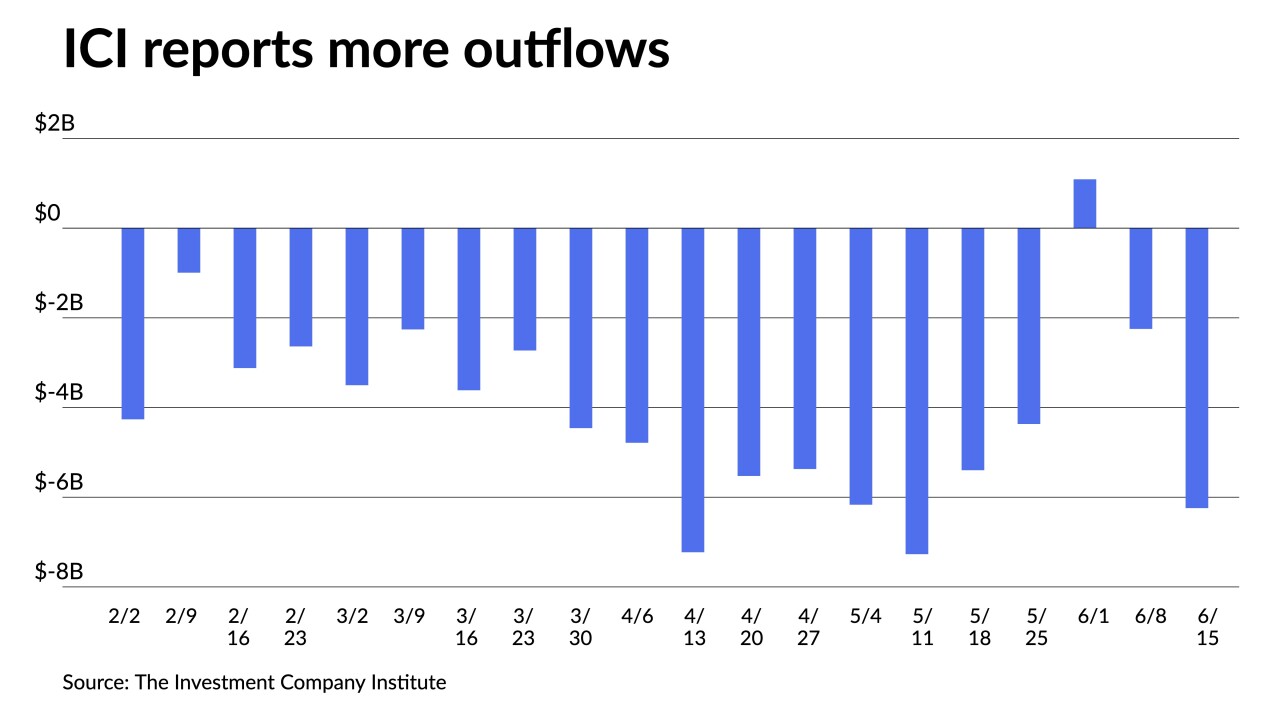

The Investment Company Institute reported investors pulled $1.372 billion from muni bond mutual funds in the week ending June 29.

July 6 -

As investors shift the focus from inflation to recession concerns, fixed income markets, including munis, may regain some of the year's losses.

July 5 -

With the Fourth of July holiday shortening the week, investors will see a paltry $2.861 billion of new issues to kick off the second half of 2022.

July 1 -

Investors pulled more from municipal bond mutual funds, with Refinitiv Lipper reporting $1.3 billion of outflows, down from the $1.6 billion the week prior and bringing the total to $47 billion year-to-date.

June 30 -

The Investment Company Institute reported investors pulled $4.590 billion from muni bond mutual funds in the week ending June 22, down from $6.243 billion of outflows in the previous week.

June 29 -

A new-issue supply-focused buy-side had their sights on the $8 billion-plus flowing into the primary market this week, while municipal traders remained cautious, keeping an eye on bid-wanted lists in the secondary market.

June 28 -

A bearish market sentiment and elevated muni to UST ratios often represent a buy signal. Taxable equivalent yields are compelling for buy-and-hold investors, analysts say.

June 27 -

Municipals head into the final week of the first half of 2022 on more stable footing, but a cautious tone hangs over the market.

June 24 -

Refinitiv Lipper reported smaller outflows at $1.6 billion, down from the $5.6 billion the week prior. It brings the total outflows to $45.7 billion year-to-date.

June 23 -

The Investment Company Institute reported investors pulled $6.243 billion from muni bond mutual funds in the week ending June 15.

June 22 -

The lighter calendar may help ease the imbalance between demand and supply, as selling pressure in the secondary has weighed significantly on the market tone.

June 21 -

Investors will be greeted Monday about $6.4 billion of new issuance led by triple-A Georgia general obligation bonds and Los Angeles notes.

June 17 -

It's the third time this month that the SEC has announced charges against city officials for disclosure-related violations.

June 17 -

Monday's massive selloff contributed to investors pulling more out from the mutual fund complex. Exchange-traded funds saw $1 billion of outflows and high-yield investors yanked out $1.7 billion.

June 16 -

The 75 basis point hike, prompted partly by hotter-than-expected inflation data, is the largest since 1994.

June 15 -

Triple-A yield curves rose five to eight basis points. Volatility somewhat eased Tuesday as investors took pause ahead of the Federal Open Market Committee meeting.

June 14 -

The 25-basis-point move to higher yields is the largest one-day change in triple-As since March 2020 when COVID began roiling markets. Munis could not ignore a continued selloff in UST led by inflation and recession concerns.

June 13 -

Ahead of the FOMC meeting, municipal issuers pull back. Investors will be greeted Monday $2.880 billion of new-issue supply.

June 10