-

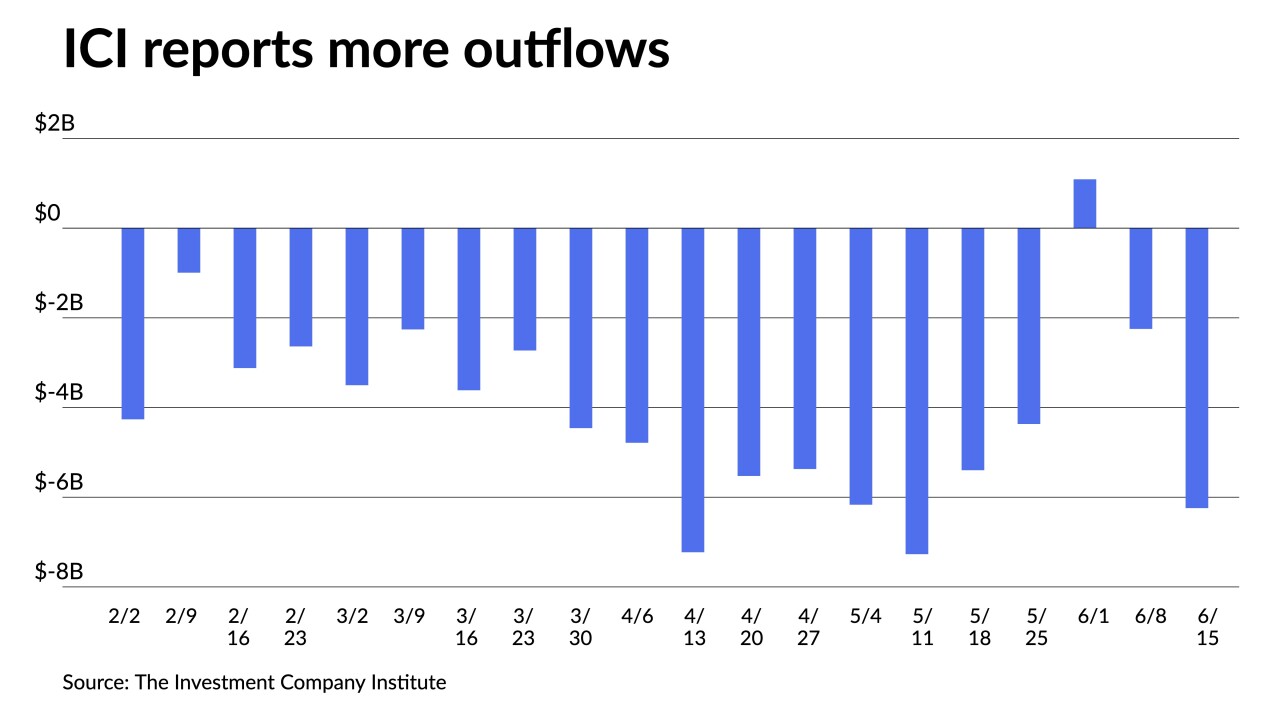

The Investment Company Institute reported investors pulled $6.243 billion from muni bond mutual funds in the week ending June 15.

June 22 -

The lighter calendar may help ease the imbalance between demand and supply, as selling pressure in the secondary has weighed significantly on the market tone.

June 21 -

Investors will be greeted Monday about $6.4 billion of new issuance led by triple-A Georgia general obligation bonds and Los Angeles notes.

June 17 -

It's the third time this month that the SEC has announced charges against city officials for disclosure-related violations.

June 17 -

Monday's massive selloff contributed to investors pulling more out from the mutual fund complex. Exchange-traded funds saw $1 billion of outflows and high-yield investors yanked out $1.7 billion.

June 16 -

The 75 basis point hike, prompted partly by hotter-than-expected inflation data, is the largest since 1994.

June 15 -

Triple-A yield curves rose five to eight basis points. Volatility somewhat eased Tuesday as investors took pause ahead of the Federal Open Market Committee meeting.

June 14 -

The 25-basis-point move to higher yields is the largest one-day change in triple-As since March 2020 when COVID began roiling markets. Munis could not ignore a continued selloff in UST led by inflation and recession concerns.

June 13 -

Ahead of the FOMC meeting, municipal issuers pull back. Investors will be greeted Monday $2.880 billion of new-issue supply.

June 10 -

Refinitiv Lipper reported $2.094 billion of outflows, reversing the $1.216 billion of inflows from the mutual fund complex.

June 9