Municipals were mixed Thursday and outflows from municipal bond mutual funds returned, while U.S. Treasuries were weaker on the short end and equities sold off.

Triple-A yields saw a mix of bumps and cuts on the short end and cuts up to six basis points on long end. USTs were cut up to four basis points inside 10 years.

Muni-to-UST ratios were at 66% in five years, 82% in 10 years and 94% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 66%, the 10 at 83% and the 30 at 95% at a 4 p.m. read.

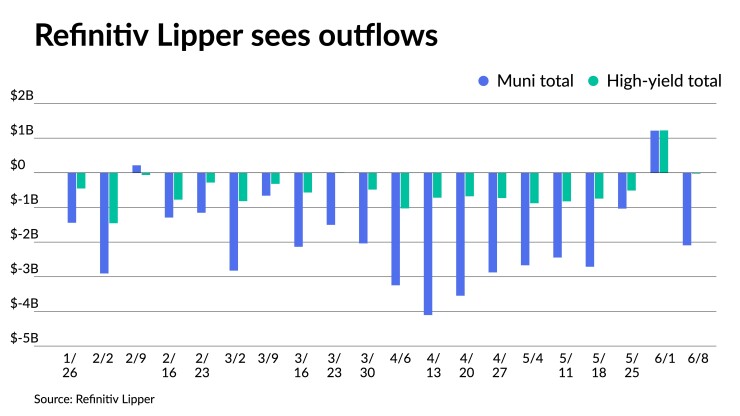

Refinitiv Lipper reported $2.094 billion of outflows, reversing the $1.216 billion of inflows from the mutual fund complex. High-yield saw $25.861 million of outflows after $1.222 billion of inflows the week prior. Exchange-traded funds saw outflows to the tune of $364.452 million.

In the primary market, Piper Sandler & Co. sold for the Prosper Independent School District, Texas, (Aaa//AAA/) $189.690 million of fixed-rate unlimited tax school building bonds, Series 2022, with 5s of 2/2023 at 1.41%, 5s of 2027 at 2.11%, 5s of 2032 at 2.66%, 5s of 2037 at 2.92%, 4s of 2039 at 3.34%, 4s of 2-47 at 3.74% and 4s of 2052 at 3.80%, callable at 2/15/32,

RBC Capital Markets priced for the Iowa Student Loan Liquidity Corp. (/AA//) $153 million of senior student loan revenue bonds. The first tranche, $126.600 million of taxables, Series 2022A, saw all bonds price at par: 3.586s of 12/2023, 4.349s of 2027, 4.859s of 2032 and 5.08s of 2039, callable in 12/1/2032. The second tranche, $26.400 million of AMT bonds, Series 2022B, saw 5s of 12/2029 at 3.29% and 5s of 2032 at 3.59%, noncall.

John Farawell, managing director of municipal underwriting at Roosevelt & Cross, said the triple-A curve steepening means there is demand on the front end but not so much on the long end in part reflective of inflation concerns.

“It's more of a flight to safety. Investors are more comfortable being on the front end of the curve. It's no secret, that's what they have a tendency to do,” he said.

Despite the dichotomy, he expects munis to remain fairly strong.

He said any time muni-UST ratios drop to a “lower percentage range” — like when ratios spot drop from 85% to the low 60s — it can be a red flag. He noted it can make people hesitant.

“In that front end, there seems to be a lot of money. June and July are big coupon months,” with bonds maturing and being called, Farawell said. “So that money has to go to work.”

“As the market adjusts to changing metrics, the curve slope is offering a perspective into areas of opportunity,” said Kim Olsan, senior vice president of municipal bonds trading at FHN Financial.

The curve slope has been “fairly volatile this year, on the heels of a large yield pullback that began in February,” she said.

She noted, “at year-end, the muni slope was 135 basis points on a 10-year yield of just over 1%,” and by the end of the first quarter, “the slope had flattened to 98 basis points while the 10-year ratcheted up to 2.18%.”

The 10-year spot, she said, ended in April at 2.72%, “a near-200 basis point correction from the end of 2021.”

“There has been a gradual curve steepener in place since then, as the slope ended May at 130 basis points,” Olsan said. “Intermediate yields have moderated but the shifts in flows on the longer end have created a steeper slope of 153 basis points.”

Over a broader timeframe, she said that “the curve slope has been much steeper," noting that in the last 10 years, the average sits at 210 basis points.

“The concession currently offered in sub-5% structures can be viewed as an offset to the yield rally and opening for quality allocations at wider spreads," according to Olsan.

However, the "growing chasm between short and long yields is only partially connected to taxable moves,” she said.

She said, “short-term trading reflects a growing bias toward spread-for-safety as the rate picture remains uncertain,” while “flat conditions past 15 years have created less demand for longer-dated munis.”

“Following a modest adjustment leading up to Wednesday, bidders reacted more decisively by moving yields up,” eight to 10 basis points in this range, Olsan noted.

She said that “while the shorter maturities in the sale held modest relative value,” following where secondary prints are occurring, “the tradeoff is a more defensive position.”

The issue’s five-year maturity “came -9/AAA BVAL (66%/UST) and the 10-year was won at a yield of 2.55% for a spread of +10/AAA BVAL (84%/UST),” Olsan said. “However, the 5% 15-year maturity priced +24/AAA BVAL to yield 2.83%.”

She noted that “spreads on longer state names are widening on cautionary flows.”

“A sale of New York Environmental 4s due 2047 (issued in April at 3.11% and spread +46/AAA) traded at 4.02% and +115/AAA,” she said. “Investors in the 21% bracket in this issue when it came to market received a 3.93% [taxable equivalent yield], but current levels have moved the TEY to 5.08%.”

“That level of dislocation offers an opportunity for wider entry points without any credit implications,” Olsan said.

“For many, the natural response to heightened risk, uncertainty and market volatility is to move to the sidelines until things calm down,” said Gayl Mileszko, senior vice president and director of credit analysis at HJ Sims. “But there is not much calm on the horizon and plenty of new flavors of uncertainty as the Federal Reserve begins to reverse nearly 14 years of unprecedented market intervention.”

She noted an “awful lot of cash has now been stockpiled as we approach mid-year,” with some of it finding its way into bonds as well as exchange-traded funds.

“The technical conditions for municipal bonds look very strong with the recent reversal in fund flows, daily bids wanted dropping from the $2 billion historic highs, very active trading, supply down 14% from last year’s level and a summer redemption schedule that will produce cash from principal, interest and coupons that will exceed the amount of new issuance by $61.7 billion,” she said.

Beginning on June 1, about $37 billion was paid out and, “by the end of the month, redemptions, maturities and coupons will total $65 billion,” Mileszko said.

“ 'There is a reasonable alternative' is the new rallying cry in this period of rising yields and high inflation, and investors should consider munis” as reasonable alternative trades, she said.

Secondary trading

North Carolina 5s of 2023 at 1.38%-1.36%. Washington 5s of 2025 at 1.89% versus 1.94% Monday. Wisconsin 5s of 2026 at 1.98%.

Maryland 5s of 2027 at 2.03%. California 5s of 2027 at 2.08% versus 2.12% Wednesday. Ohio 5s of 2027 at 2.06% versus 2.10% Wednesday.

Prince George's County 5s of 2028 at 2.22%. Charleston County, South Carolina 5s of 2030 at 2.43%-2.41%. University of Texas 5s of 2032 at 2.68% versus 2.66% Wednesday.

Los Angeles DWP 5s of 2039 at 3.00% versus 3.88%-3.86% Friday. Illinois Finance Authority Northshore Health at 3.80%. New York City TFA 4s of 2051 at 4.17% versus 4.00%-4.20% Wednesday.

AAA scales

Refinitiv MMD’s scale was cut two to five basis points 3 p.m. read: the one-year at 1.41% (+2) and 1.71% (+2) in two years. The five-year at 2.01% (+3), the 10-year at 2.50% (+5) and the 30-year at 2.97% (+5).

The ICE municipal yield curve saw bumps on the short end and cuts on the long end: 1.38% (-1) in 2023 and 1.73% (-1) in 2024. The five-year at 2.05% (flat), the 10-year was at 2.50% (+5) and the 30-year yield was at 3.02% (+6) at a 4 p.m. read.

The IHS Markit municipal curve was cut three to five basis points: 1.43% (+3) in 2023 and 1.73% (+3) in 2024. The five-year at 2.00% (+3), the 10-year was at 2.52% (+5) and the 30-year yield was at 2.96% (+5) at 4 p.m.

Bloomberg BVAL saw bumps on the short end and cuts out long: 1.43% (-1) in 2023 and 1.71% (-1) in 2024. The five-year at 2.02% (-1), the 10-year at 2.51% (+3) and the 30-year at 2.96% (+4) at a 4 p.m. read.

Treasuries were mixed.

The two-year UST was yielding 2.817% (+4), the three-year was at 3.005% (+4), the five-year at 3.071% (+4), the seven-year 3.090% (+3), the 10-year yielding 3.049% (+3), the 20-year at 3.403% (flat) and the 30-year Treasury was yielding 3.172 (flat) at the close.

Mutual fund details

In the week ended June 8, Refinitiv Lipper reported $2.094 billion of outflows Thursday, following an inflow of $1.216 billion the previous week.

Exchange-traded muni funds reported outflows of $364.452 million after inflows of $890.769 million in the previous week. Ex-ETFs, muni funds saw outflows of $1.729 billion after $324.877 million of inflows in the prior week.

The four-week moving average narrowed to negative $1.156 billion from negative $1.244 from in the previous week.

Long-term muni bond funds had outflows of $1.466 billion in the last week after inflows of $1.414 billion in the previous week. Intermediate-term funds had outflows of $289.927 million after $177.117 million of outflows in the prior week.

National funds had outflows of $2.034 billion after $1.234 billion of inflows the previous week while high-yield muni funds reported $25.861 million of outflows after $1.222 billion of inflows the week prior.

Informa: Money market muni assets rise again

Tax-exempt municipal money market funds continued a seven-week inflow streak as $2.53 billion was added the week ending June 7, bringing the total assets to $101.76 billion, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for all tax-free and municipal money-market funds fell to 0.35%.

Taxable money-fund assets gained $1.85 billion to end the reporting week at $4.365 trillion in total net assets. The average seven-day simple yield for all taxable reporting funds rose 0.02% to 0.47%.