-

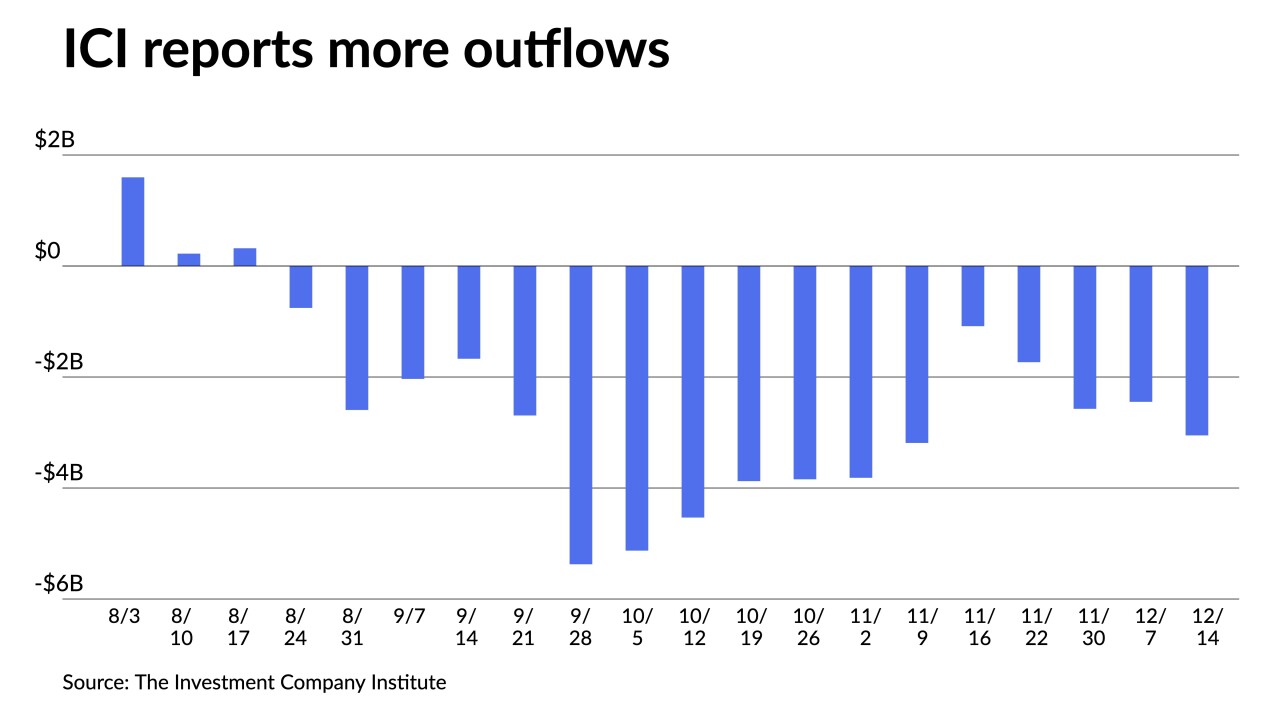

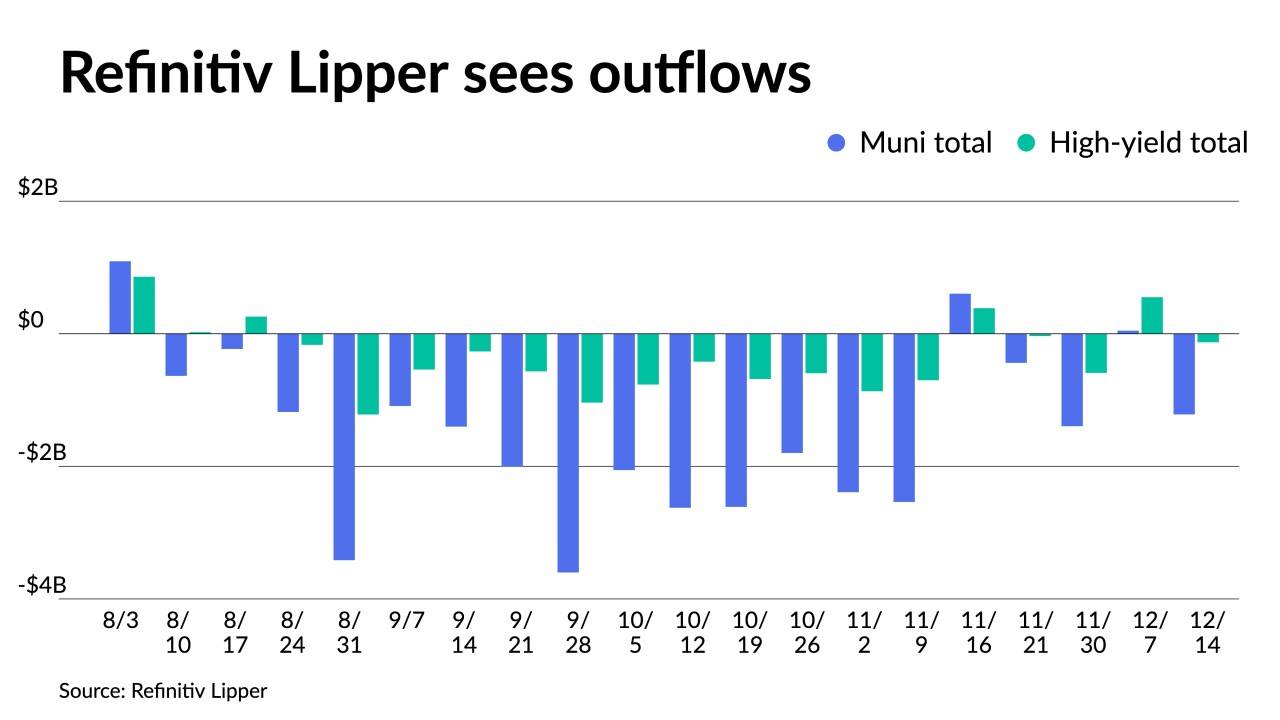

Outflows continued as Refinitiv Lipper reported $3.094 billion was pulled from municipal bond mutual funds in the week ending Wednesday after $1.217 billion of outflows the week prior.

December 22 -

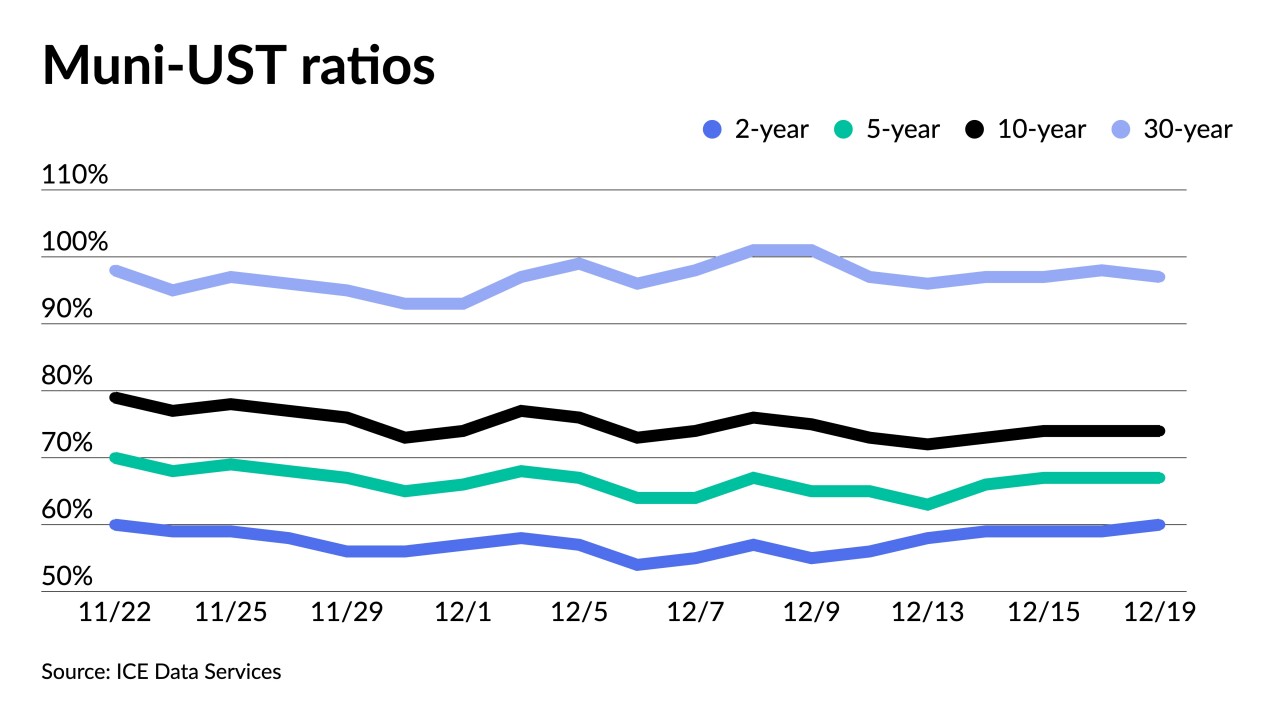

"A fade in muni prices came on the heels of sovereign debt actions, leaving ratios subject to some correction with just a few sessions remaining in 2022," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

December 21 -

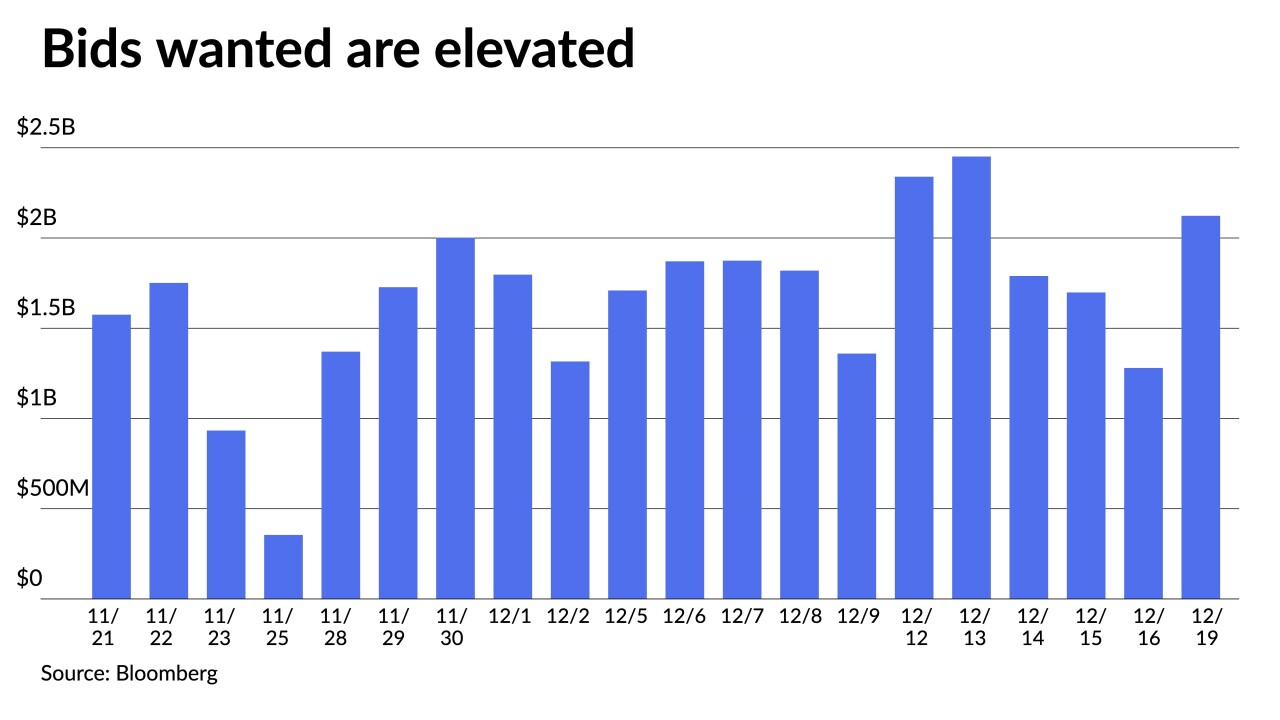

Secondary selling pressure was concentrated most heavily on the one-year Tuesday, but sellers pushed yields higher across the curve by five to seven. Bids wanteds were on the rise again with Monday's total hitting $2.122 billion.

December 20 -

"Yield levels are now notably higher throughout many sectors of the yield curve by a number of percentage points," said Morgan Stanley strategists Matthew Gastall and Daryl Helsing.

December 19 -

"This week will likely have been the last active week of the year, but it turned out to be quite eventful," according to Barclays PLC.

December 16 -

Outflows returned as Refinitiv Lipper reported $1.217 billion was pulled out of municipal bond mutual funds for the week ending Wednesday after $46.912 million of inflows the week prior.

December 15 -

The Fed chairman said he believes the Fed is getting close to a sufficiently restrictive level, but they're not quite there. While two good inflation reports are good, "there's still a long way to go to price stability."

December 14 -

The CPI report showed inflation had slowed to 7.1%, giving investors confidence the Federal Open Market Committee will hike rates 50 basis points as expected following Wednesday's much-anticipated meeting.

December 13 -

The December Federal Open Market Committee meeting, combined with the release of inflation data, "will test the good cheer currently prevailing in the bond market," said MSCI Research strategists Andy Sparks, Tamas Hanis and Edina Szirma.

December 12 -

Investors will be greeted Monday with a new-issue calendar estimated at $3.214 billion, the majority of which is a nearly $1.9 billion private activity P3 bond deal from Pennsylvania.

December 9