-

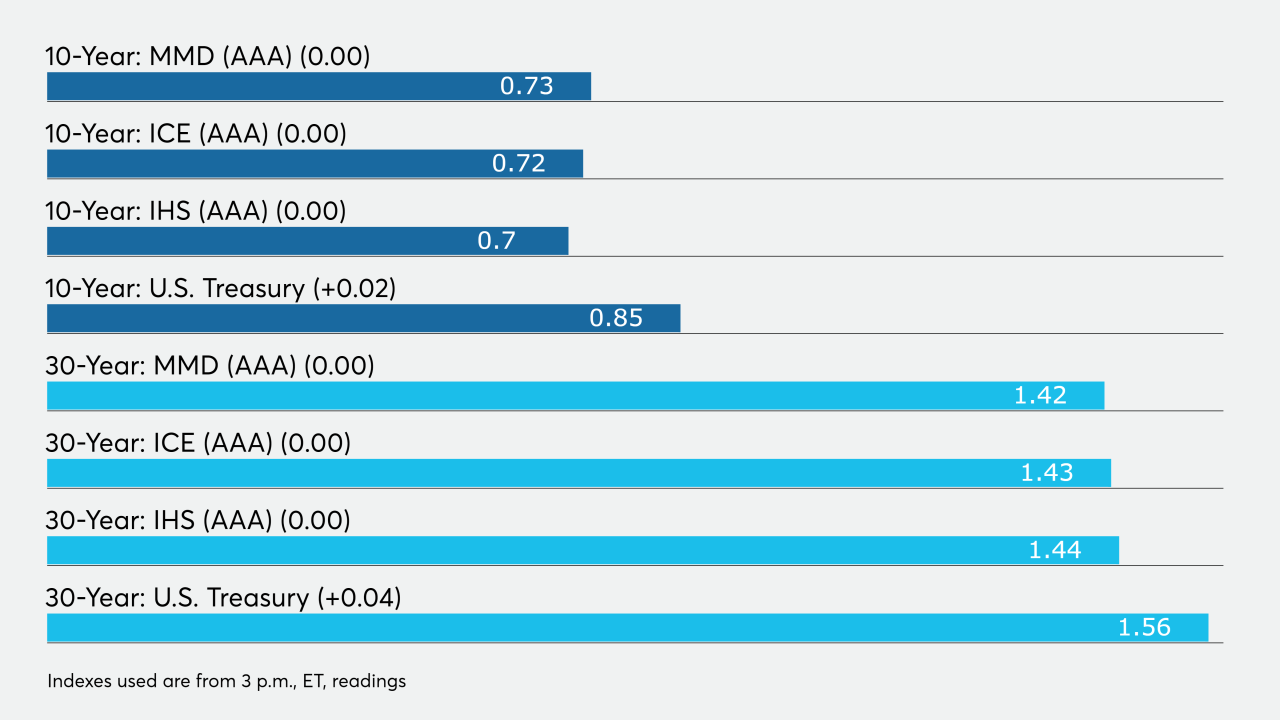

The entire municipal exempt yield curve is seeing consolidation with a 125 basis point spread between one and 30 years, and sub-1% yields are holding firm inside of 15 years.

December 17 -

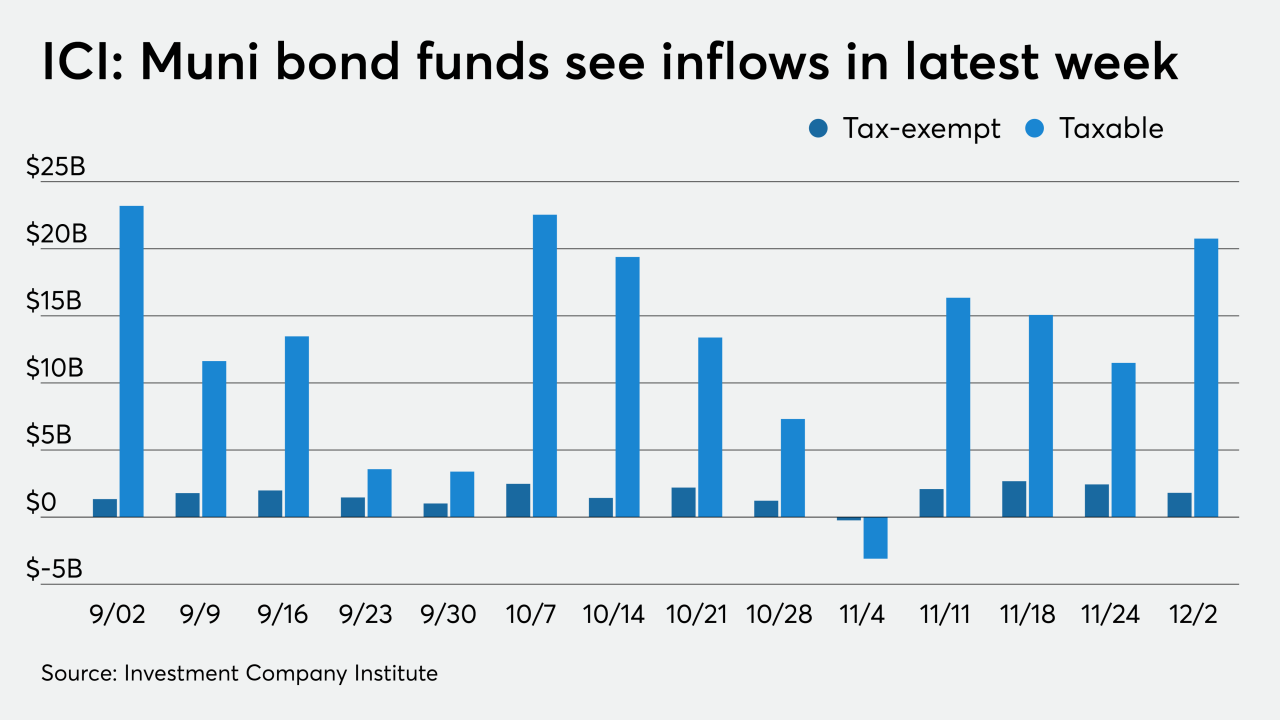

ICI reported another $2.3 billion of inflows, new deals continue the march to lower yields and benchmarks rose a basis point seven years and out for the first time since the beginning of December.

December 16 -

The state of Illinois sold $2 billion of three-year notes to the Federal Reserve's Municipal Liquidity Facility at 3.42%.

December 15 -

Even with COVID-19-related shutdowns — a New York City lockdown may be imminent — issuers are pricing bonds into an extremely low-rate environment.

December 14 -

Munis firmed Friday, only the second time in December they weren't flat, and more than a few participants are waiting on yields to rise before getting involved, particularly given the rich muni/treasury ratios and low absolute yields.

December 11 -

Bid list volume is trending higher into the end of the year, but its share as measured against overall high demand does not pose much of a threat, analysts say. Refinitiv Lipper reports $992 million of inflows.

December 10 -

Muni benchmarks were steady while new deals re-priced to lower yields in a tale of two markets. ICI reported more inflows.

December 9 -

Strong technicals, low supply, yield-seekers keep munis outperforming.

December 8 -

The primary's diversity of credits and size relative to November has grown, but it is just not enough to push yields higher as redemptions flood the market. Some analysts still say a mild correction at least is due.

December 7 -

A heavier calendar still will not fulfill the $20 billion-plus of December redemptions. Muni/UST 10-year ratios fell to 74% as the UST 10-year came closer to 1.00%.

December 4 -

Difficulty tracking securities means a harder time for investors to understand their credit risk during the pandemic.

December 4 -

Refinitiv Lipper reported inflows of net $201 million for the week ending Dec. 2, down from $386 million the week prior.

December 3 -

Until supply increases, year-end demand has munis outperforming. ICI reports another multi-billion week of inflows.

December 2 -

Munis are likely to lag Treasuries in some fashion once year-end empathy settles in mid-month and ratios become a factor.

December 1 -

After volume in November came in around $19 billion, the lowest since 1999, investors look to December.

November 30 -

Michael Chalker, portfolio manager and senior analyst at LM Capital Group, talks with Chip Barnett about the fixed-income markets and the fallout from the COVID-19 pandemic. (16 minutes)

November 26 -

The Investment Company Institute reported municipal bond funds saw $2.675 billion of inflows in the latest reporting week.

November 25 -

Sources said the JFK deal was massively oversubscribed, allowing underwriters to lower yields from 15 to 45 basis points.

November 24 -

Municipals held firm ahead of this week's new issue slate, which features deals from issuers in New York and Texas. Treasuries weakened as stocks rose on positive coronavirus news.

November 23 -

Municipals continue to rally as market participants get ready to head into a quiet holiday week.

November 20