-

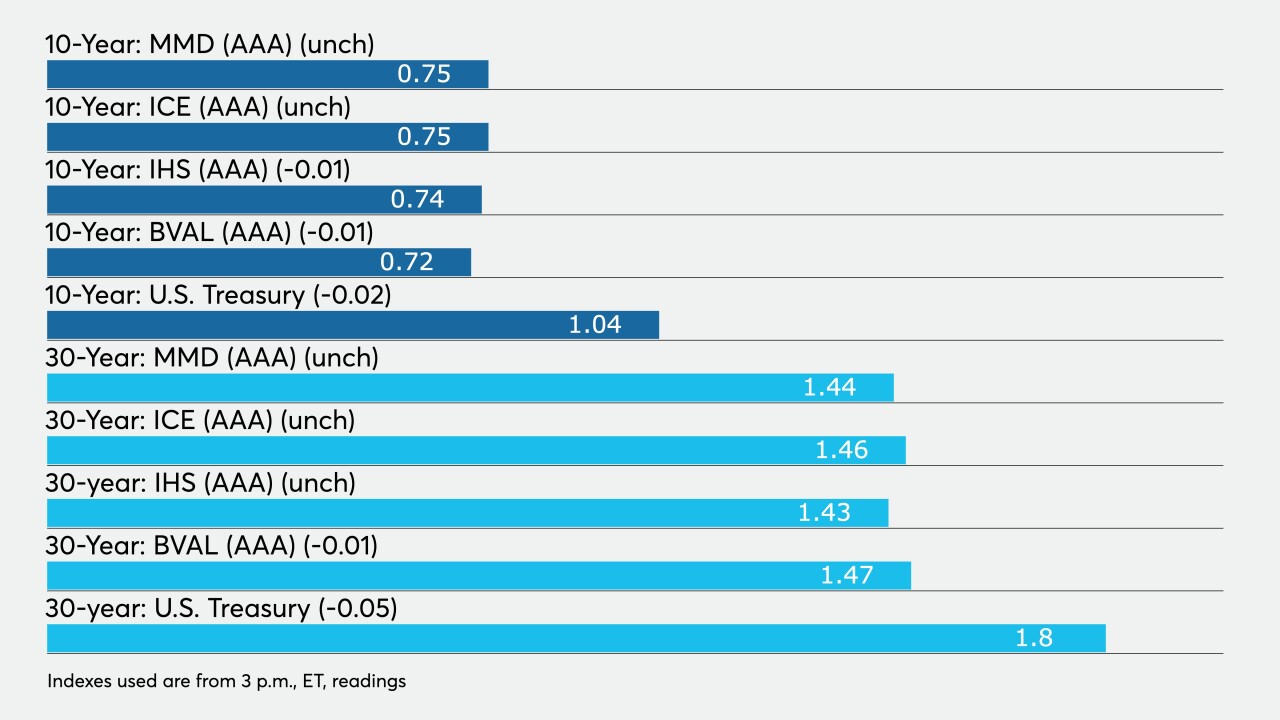

High-yield continues to be sought after as high-grade paper is yielding about 0.70% in 10 years and 1.40% or lower in 30 years and credit spreads continue to tighten in nearly every sector. Ratios are near 20-year record lows.

February 1 -

It is most certainly an issuers' market as rates are low, credit spreads continue to tighten, money pours into municipal bond mutual funds at record levels and a net negative supply of more than $11 billion.

January 29 -

Chicago Board of Education bonds were repriced to lower yields by as much as 37 basis points, showing just how far investors will go for any incremental yield.

January 28 -

Fed chair says it's unlikely there will be "troubling inflation" any time soon, and rates will stay low and asset purchases will continue at current levels. ICI reports another $3.24 billion of inflows as munis follow UST to lower yields.

January 27 -

New issues priced with ease with high-grade issuers tight to triple-A benchmarks. It was the first time the municipal yield curve saw such noticeable movement, following little changed secondary activity for nearly the past two weeks.

January 26 -

Returns of all the investment grade options "pale in comparison to those for municipal high-yield," which should bolster Texas gas and Chicago public schools deals.

January 25 -

The $187 million deal is the largest yet to be hosted on the Clarity platform, which is approaching the half billion mark of resets every week.

January 25 -

A 'perpetual calm' continues to fall over the municipal market as inflows into municipal funds, combined with the shortage of traditional tax-exempt supply, is directing most aspects of daily market activity.

January 22 -

Refinitiv Lipper reports another multi-billion week of inflows, the domino effect from such strong flows is that secondary selling doesn’t need to be so active, creating fewer opportunities for new inquiry, analysts say.

January 21 -

Robin Marshall, director of fixed income research at FTSE Russell, talks about what investors should be paying attention to during the coming year. He looks at inflation prospects, possible Central Bank actions and the continuing effects of the COVID-19 pandemic. Chip Barnett hosts. (15 minutes)

January 21