-

The "weakness in the secondary market will carry over into this week, which may lead to higher yields and wider spreads in the primary market," said CreditSights strategists Pat Luby and Sam Berzok.

April 24 -

Investors will be greeted Monday with a new-issue calendar estimated at $7.208 billion, led by $1.3 billion of GOs from bellwether Washington.

April 21 -

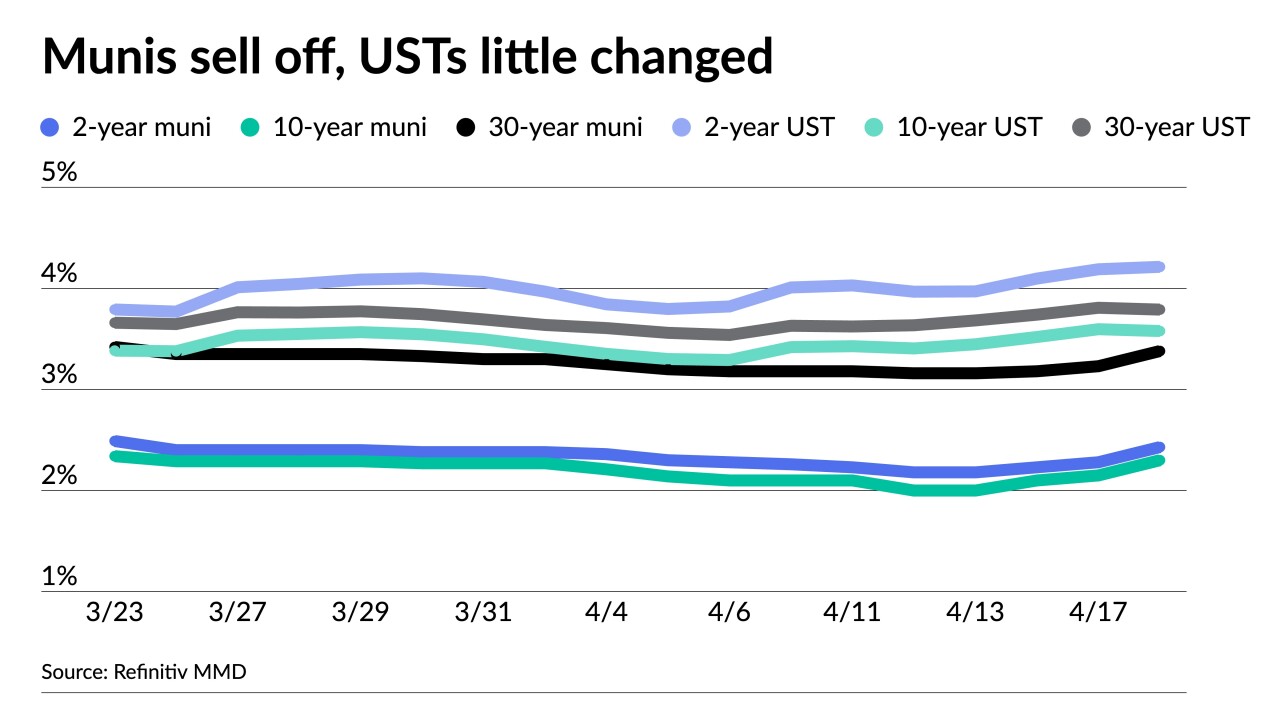

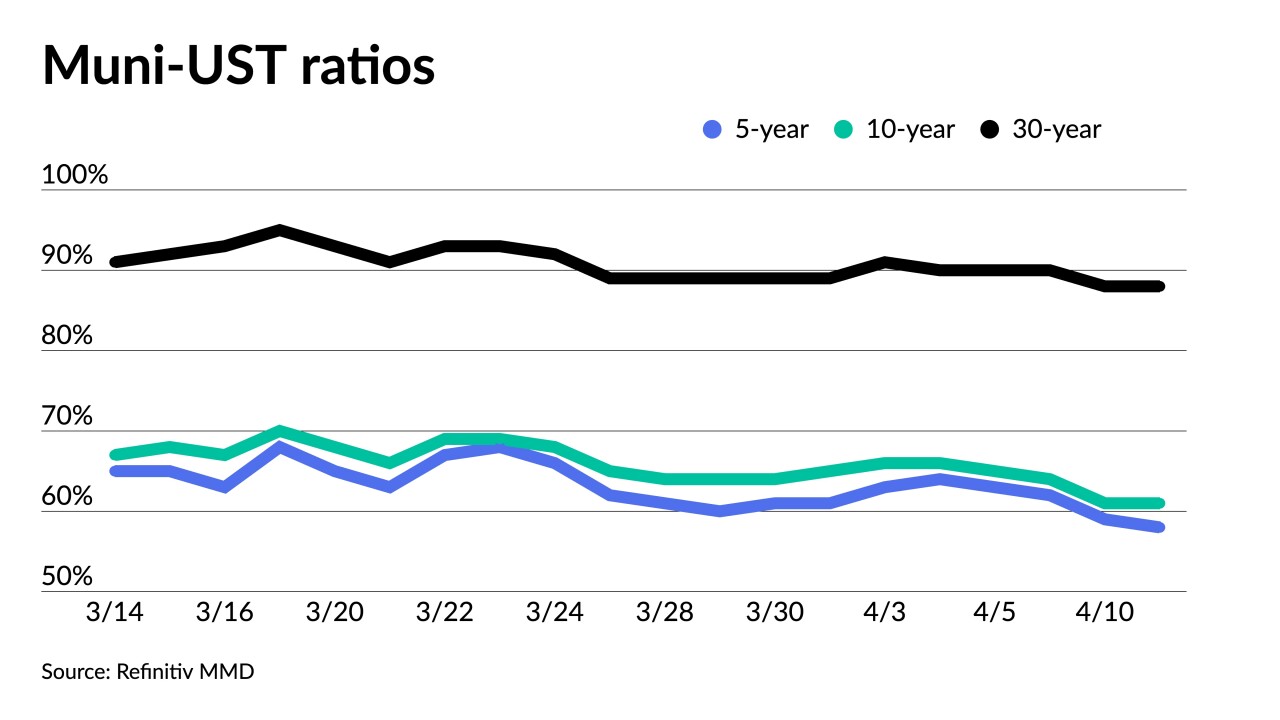

Even though yields have moved to higher ground, some participants say that even cheaper levels are needed to bring about more retail conviction. Muni-to-UST ratios are still rich.

April 20 -

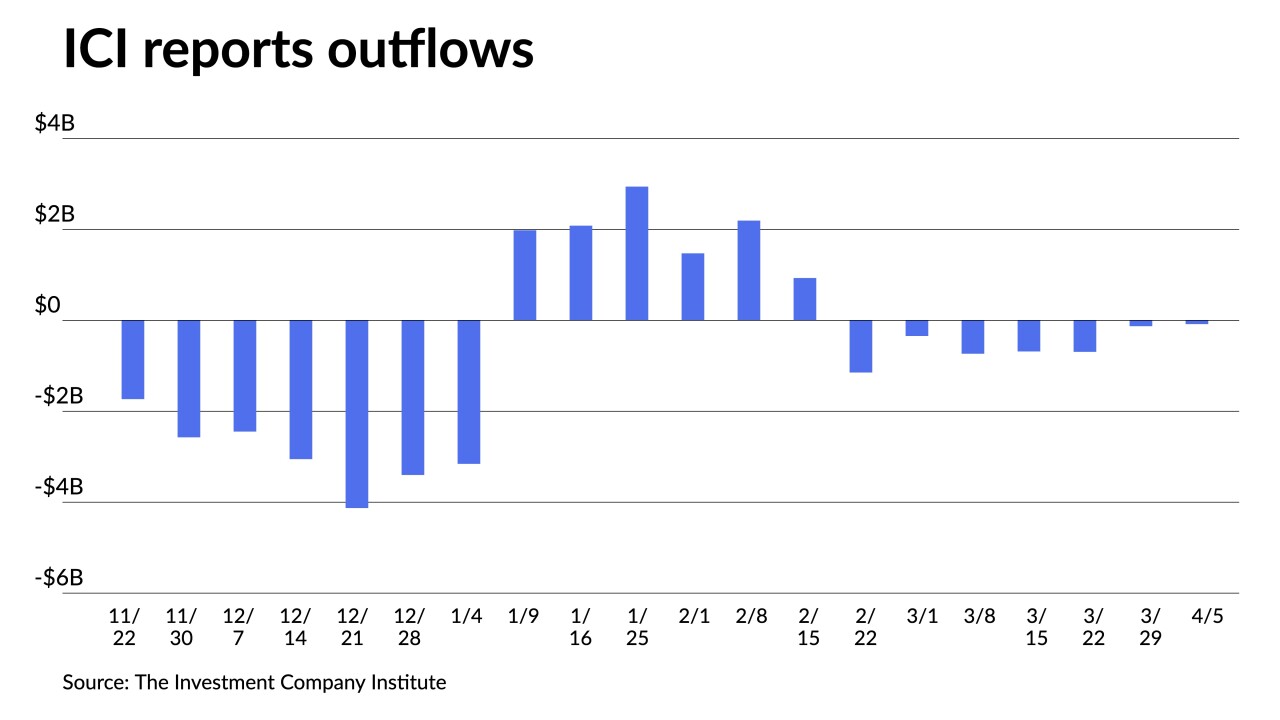

The Investment Company Institute reported investors added $229 million to mutual funds in the week ending April 12, after $83 million of outflows the previous week.

April 19 -

Municipal outperformance to UST ended Tuesday as triple-A yields rose 12 to 20 basis points as several new issues began pricing.

April 18 -

Muni yields were cut four to eight basis points, depending on the scale, while UST yields rose seven to nine basis points. Muni outperformance and rich ratios continue.

April 17 -

For long-term muni bonds, BofA strategists noted that macro market and supply/demand conditions "are dominating the picture, pushing the high-grade muni market to a relatively rich valuation versus Treasuries."

April 14 -

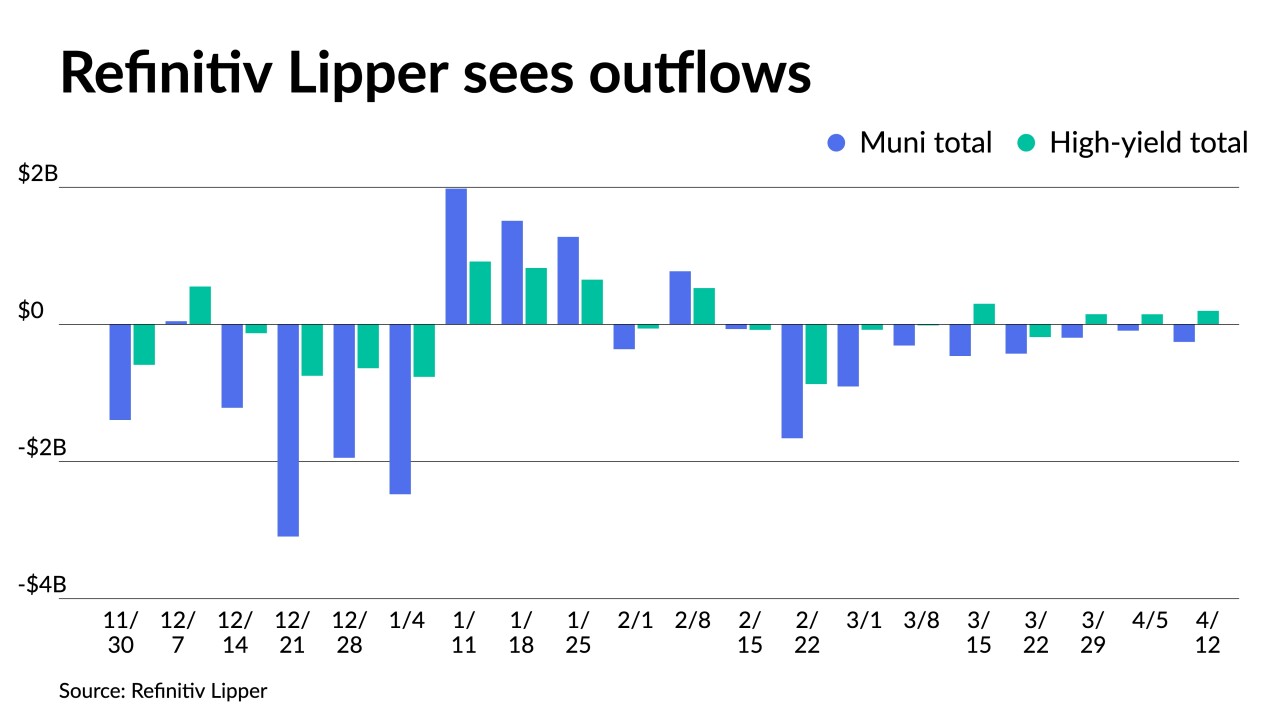

For the week ending Wednesday, outflows intensified as Refinitiv Lipper reported $255.794 million was pulled from municipal bond mutual funds after $91.713 million of outflows the week prior. High-yield saw inflows.

April 13 -

Strong demand in the primary market is leading to the oversubscription of many new issues. Municipals and USTs were better again as macroeconomic concerns pressure equities.

April 12 -

The second half of 2023 may see a slowdown, perhaps even a mild recession, said Daniel Close, the newly named head of municipals at Nuveen.

April 11