-

Investors will be greeted Monday with a new-issue calendar estimated at $7.588 billion.

May 5 -

The secondary was quiet and the sole deal of size came from a $400 million-plus competitive water and sewer loan from Portland, Oregon. The recent rise in yields makes for more compelling levels.

May 3 -

"The market is expecting a 25 basis point rise in the Fed funds rate, but more importantly, investors are waiting for the comments for a better idea of what to expect going forward," said SWBC Investment Company's Roberto Roffo.

May 2 -

In a supply-challenged market, foreign investors can play a role in buying taxable munis. 16Rock Asset Management's James Pruskowski discusses a 2023 reset in the muni market. Lynne Funk hosts (29 minutes)

May 2 -

Municipals were in the red to close out April, down 0.2%, per the Bloomberg Municipal Index, but are in the black 2.5% year-to-date.

May 1 -

JPMorgan's move to acquire First Republic and its muni portfolio eases the risk of nearly $20 billion of munis flooding the market.

May 1 -

"Investors' jitters in the lead up to next week's Fed meeting resulted in some large macro market moves and a rise in volatility," noted BofA Securities strategists in a weekly report.

April 28 -

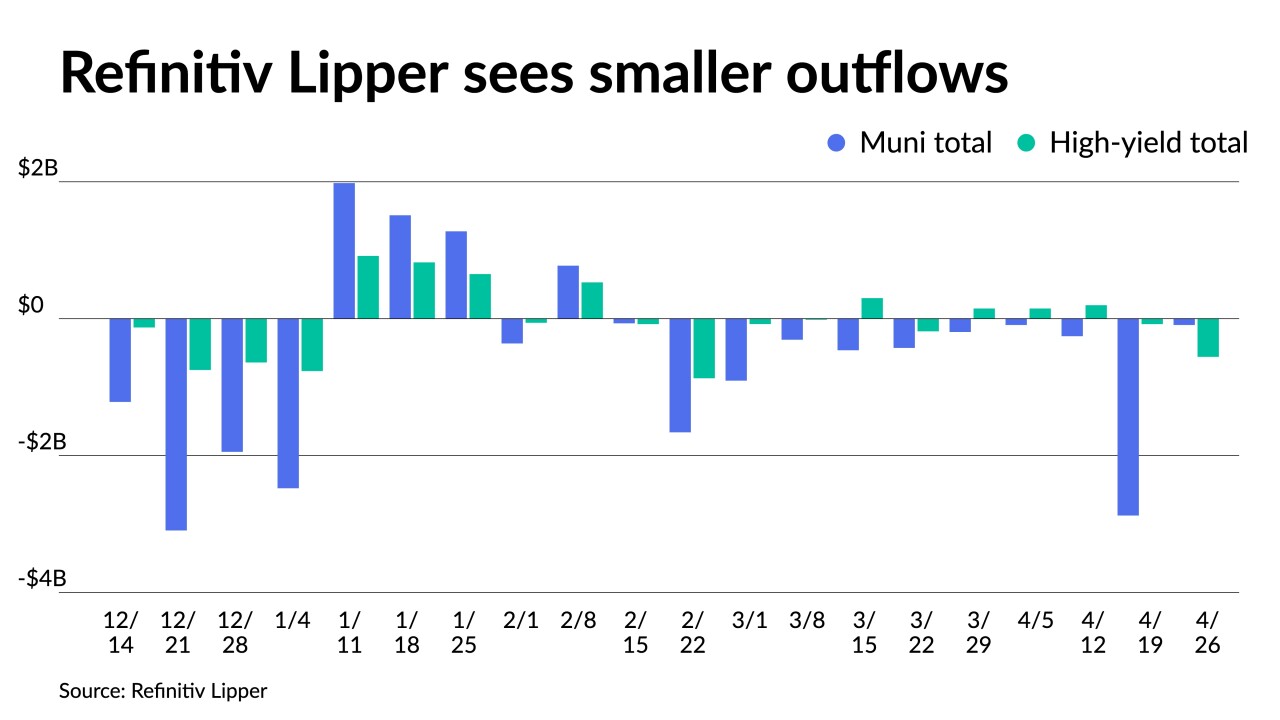

Outflows from municipal bond mutual funds receded as Refinitiv Lipper reported $92.055 million was pulled from them as of Wednesday after $2.876 billion of outflows the week prior.

April 27 -

The Investment Company Institute reported investors pulled $377 million from to mutual funds in the week ending April 12, after $229 million of inflows the previous week.

April 26 -

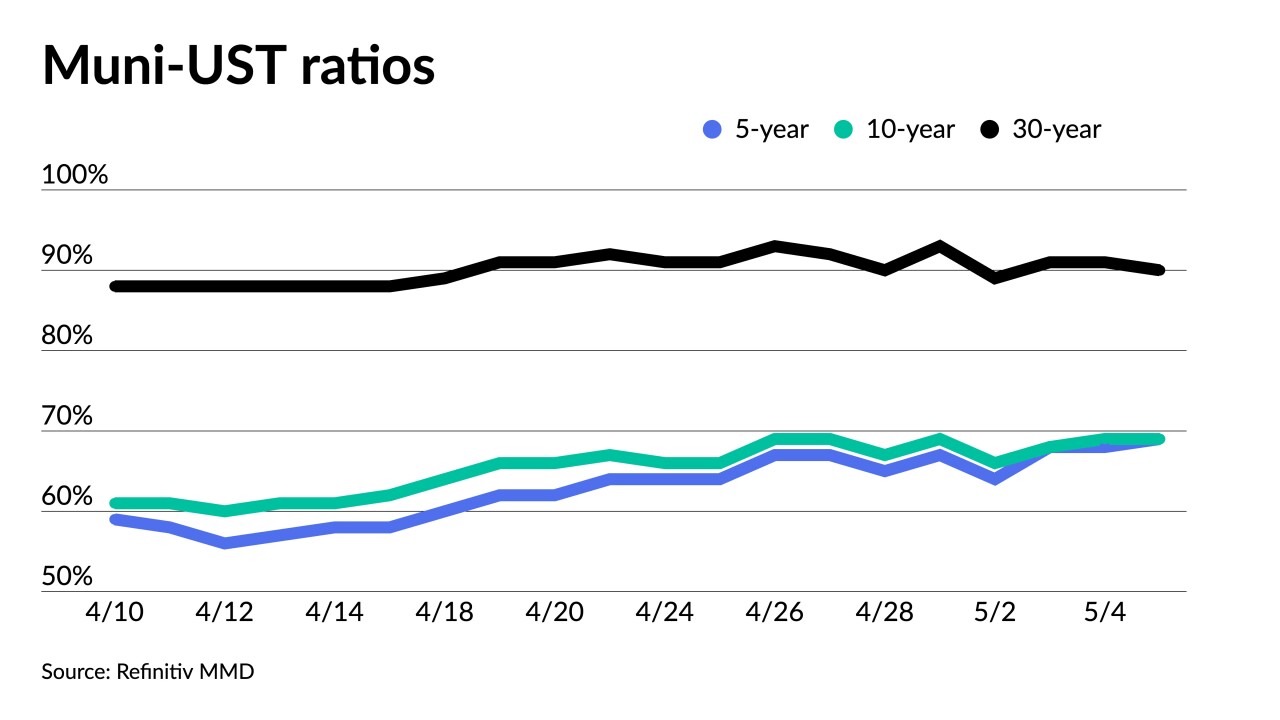

One underwriter called it a "violent inversion," given that the short end of the municipal and Treasury yield curves were so dislocated.

April 25