-

Investors are about to get a chance to buy bitcoin-backed municipal bonds. It won't be the last, according to the team behind the New Hampshire-based deal.

December 8 -

The tax-exempt muni market has performed "exceptionally well" so far this week, outperforming USTs, said J.P. Morgan strategists led by Peter DeGroot.

December 5 -

The Regents of the University of California will sell $2 billion of bonds next week after yanking a $1.5 billion summer deal amid Trump administration threats.

December 5 -

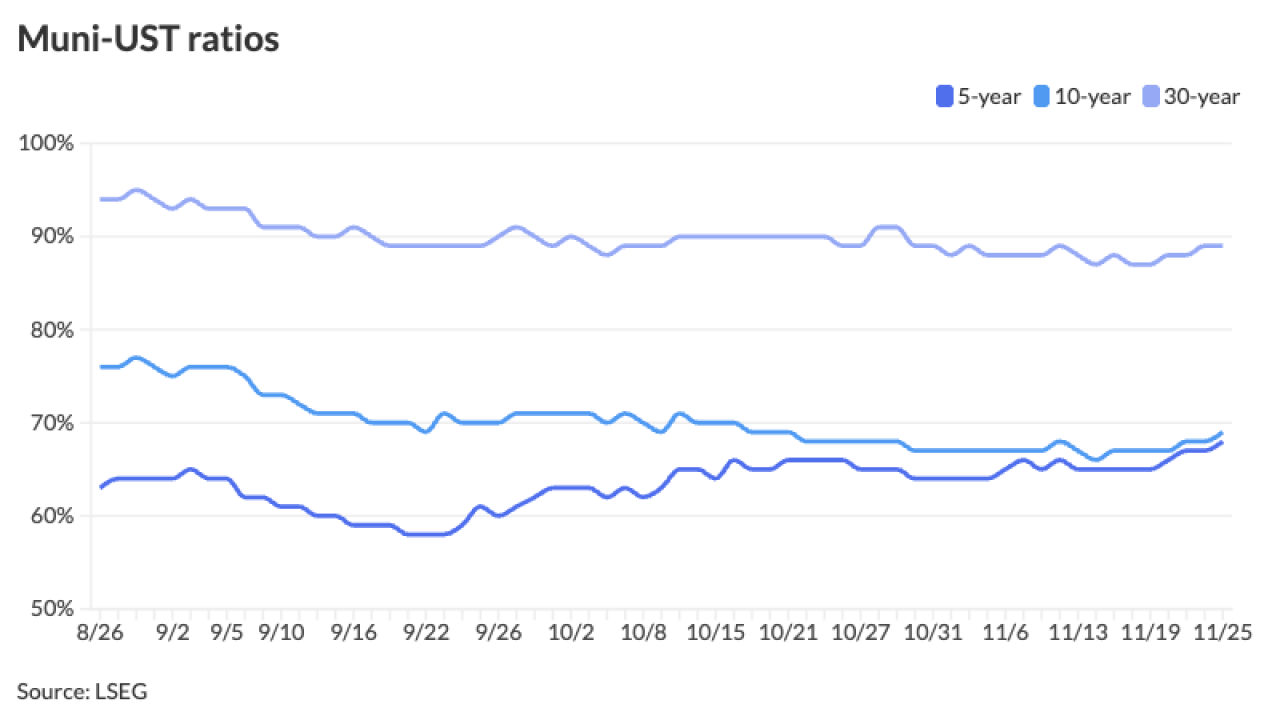

Robust issuance this year has contributed to muni underperformance relative to other asset classes, but it also has "improved after-tax relative value for investors in higher tax brackets," said Sam Weitzman of Western Asset.

December 4 -

The Local Government Commission approved bonds for Raleigh, Duke University Health System and Deerfield Episcopal Retirement Community.

December 4 -

The revenue bonds will fund highway improvements expected to spur economic development in West Alabama.

December 4 -

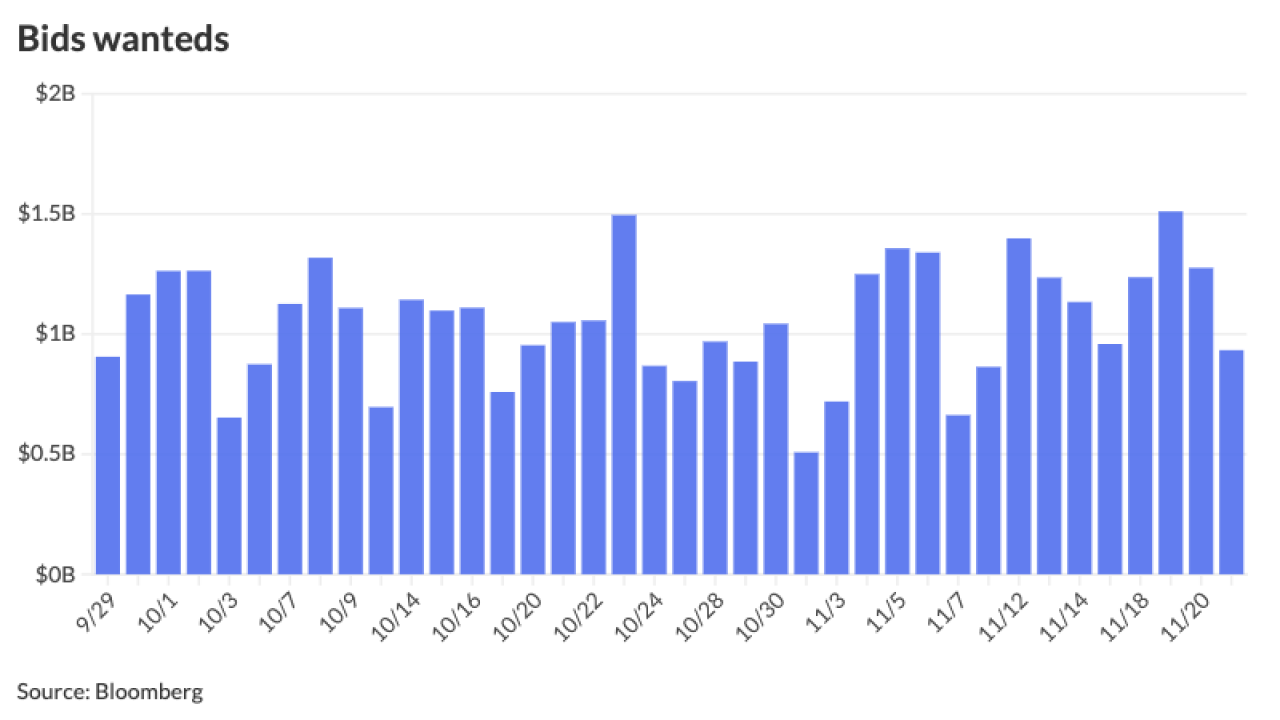

The muni market is dealing with elevated supply this week and secondary flows have "reacted in tandem," said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

-

Fortress Investment Group bought the property in 2021 after it was largely destroyed by Hurricanes Irma and Maria and financed a major renovation that featured reinforcement standards designed to protect against a category 5 hurricane.

December 3 -

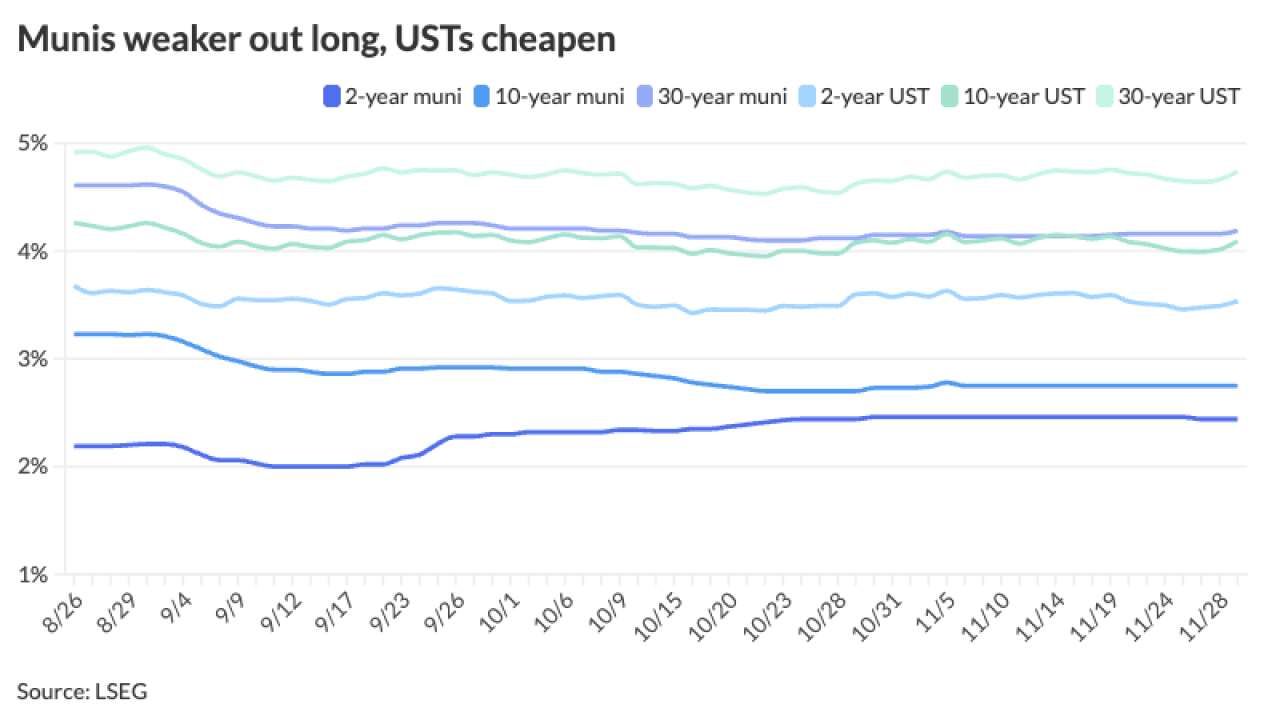

This movement comes on the heels of muni yields remaining relatively unchanged throughout November.

December 2 -

The muni market recorded its fourth straight month of positive returns in November and December is likely to keep the streak going with another strong month to round out the year.

December 1 -

November volume was $38.487 billion, up 51.1% from $25.47 billion in 2024. This is above November's 10-year average of $33.743 billion.

December 1 -

King County, Washington plans a $422.2 million competitive sale of limited tax general obligation bonds for Wednesday.

December 1 -

Preliminary November issuance figures are at $37.054 billion, up 45.5% year-over-year, according to LSEG.

November 26 -

"Dealer inventories have grown heavier throughout [November], which could put pressure on the market if supply reverts to its weekly average of over $10 billion," said Chris Brigati, CIO and managing director of SWBC, and Ryan Riffe, SVP of capital markets at the firm.

November 25 -

Oakland touts financial turnaround with a $335 million bond sale ahead, despite negative credit outlooks.

November 25 -

"We do not expect any major weakness to take hold as the new issue calendar is beginning to dwindle with only two non-holiday or non-Federal Reserve weeks left in the year," said Birch Creek strategists.

November 24 -

The New York Power Authority created a new in-state conduit issuer to maximize savings and benefits for New Yorkers on a prepaid electricity deal.

November 24 -

The new-issue calendar falls to an estimated $1.154 billion, with $939.1 million negotiated deals on tap and $214.8 million of competitives.

November 21 -

The long-awaited jobs report paints a mixed picture for market participants: nonfarm payrolls increased by a greater-than-expected119,000 in September, but the unemployment rate rose to 4.4%.

November 20 -

Flows into high-yield muni mutual funds had slowed over the past several weeks, and the past two weeks have seen outflows.

November 20