-

The muni market has "cheapened and steepened," which is a great opportunity for people still on the sidelines to get into the market again, said Jennifer Johnston, director of municipal bonds research at Franklin Templeton.

July 29 -

An investor presentation highlights industry conferences and consulting services that "have made the CIA the 'think tank' of the food service industry."

July 28 -

The asset class got a "much-needed boost" from inflows into muni mutual funds last week, said Birch Creek strategists.

July 28 -

Issuance for the week of July 28 is estimated at $11.035 billion, with $9.018 billion of negotiated deals and $2.017 billion of competitive deals on tap, according to LSEG.

July 25 -

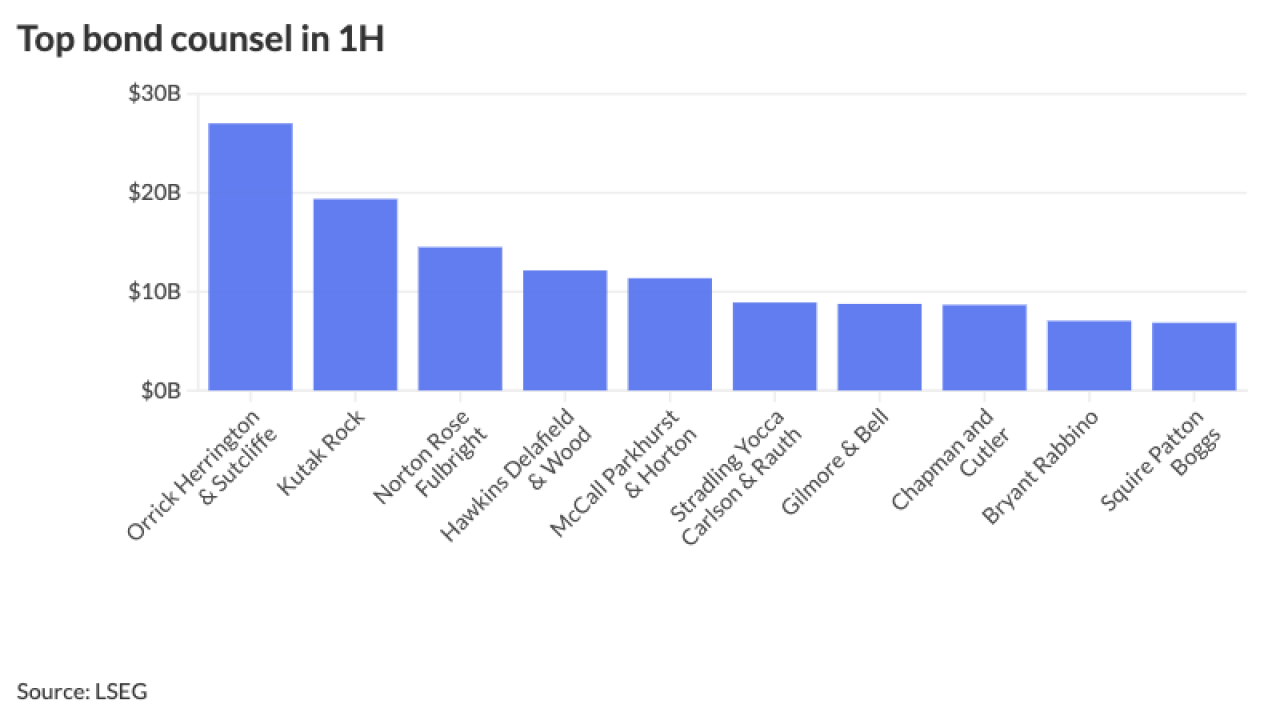

The top five featured in the ranking handled deals totalling more than $84 billion in par value.

July 25 -

The airport, also selling $412.8 million of new money, will join a bevy of issuers who have deployed a tender offer in the hope of realizing refunding savings.

July 25 -

Investors added $571.5 million from municipal bond mutual funds in the week ended Wednesday, following $224.6 million of outflows the prior week, according to LSEG Lipper data.

July 24 -

Longer-term munis have become more attractive, said Cooper Howard, a fixed income strategist at Charles Schwab.

July 23 -

An academic paper presented at the Brookings Institute's annual conference found that future wildfire risks are already having economically significant impacts on financial markets, municipal borrowing costs and vulnerable communities.

July 23 -

Why more issuers are opting for the tender offer. San Francisco PUC's Nikolai Sklaroff lays it out for Bond Buyer Senior Infrastructure Reporter Caitlin Devitt.

July 22