-

The nature of municipal bonds is to help people, says Peter Hayes, "I really like that it's public purpose."

October 6 -

All eyes will be on Friday's report, though "it seems most leading indicators suggest job growth will remain healthy, which should keep the bond market selloff going strong," said OANDA's Edward Moya.

October 5 -

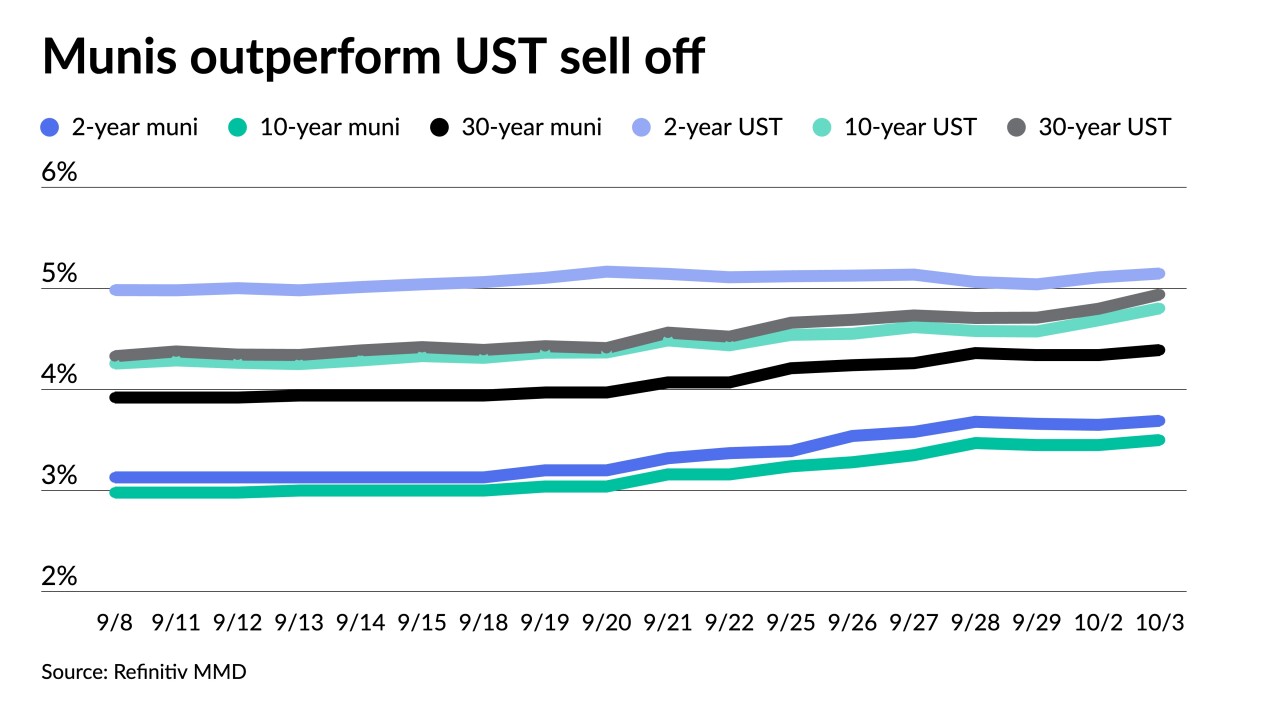

Municipal yields fell up to three basis points, depending on the scale, but underperform a better UST market.

October 4 -

UST rates are driving all things in the muni market, said Jon Mondillo, head of North American Fixed Income at abrdn.

October 3 -

There will be "choppiness in the municipal bond market through the end of the year," said Anders S. Persson, Nuveen's chief investment officer for Global Fixed Income, and Daniel J. Close, Nuveen's head of municipals.

October 2 -

"We were pleased to achieve such strong results, especially in light of the recent volatile market conditions," said Philadelphia Treasurer Jacqueline Dunn.

October 2 -

The Bloomberg Municipal Index and High-Yield Index lost 3.3% and 3.9%, respectively, in September.

September 29 -

September's total volume ticked up 1.2% to $27.585 billion in 531 issues from $27.251 billion in 592 issues a year earlier. However, the month's total is lower than the $30.652 billion 10-year average, according to Refinitiv data.

September 29 -

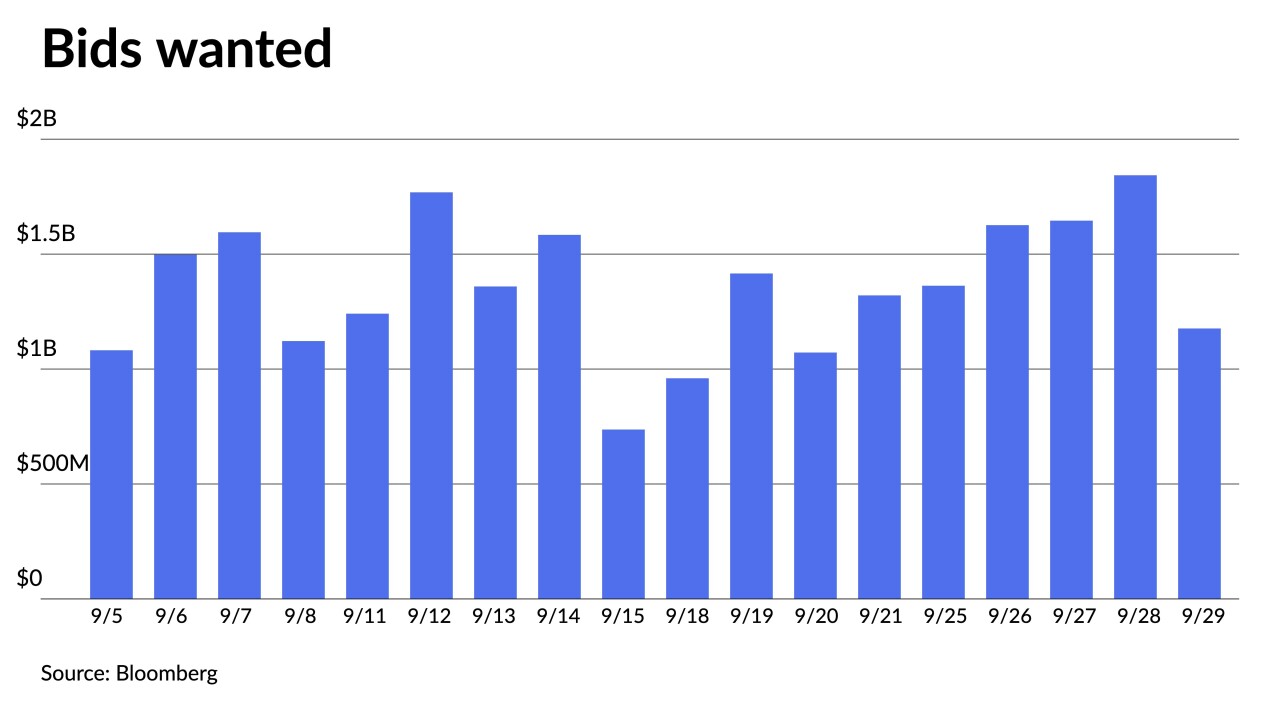

The last time muni mutual funds saw outflows top $1 billion was the week ending May 31 when they were $1.345 billion.

September 28 -

California priced $625 million in State Public Works Board lease revenue bonds this week.

September 28