-

Despite an S&P rating upgrade ahead of this week's GO bond deal, Louisiana paid a wider spread to a 10-year benchmark than it did a year ago. Longer maturities saw tighter spreads on from a year ago.

April 11 -

"The news is sparking an equity market selloff while sending bond yields to the stars as investors dial down their Fed easing expectations again, this time to only two rate cuts this year," said José Torres, senior economist at Interactive Brokers.

April 10 -

"DASNY's financing, construction and grants management on behalf of science, health and educational not-for-profits [are] the foundation for stronger, inclusive and more sustainable communities across the state of New York," said Robert J. Rodriguez.

April 10 -

Wednesday's CPI report will "shed more light on the path of inflation and the potential timing for rate cuts this year," said Cooper Howard, a fixed income strategist at Charles Schwab.

April 9 -

The deal comes amid market inflows and a dearth of high-yield supply, but demand will depend, as always, on the price, investors said.

April 9 -

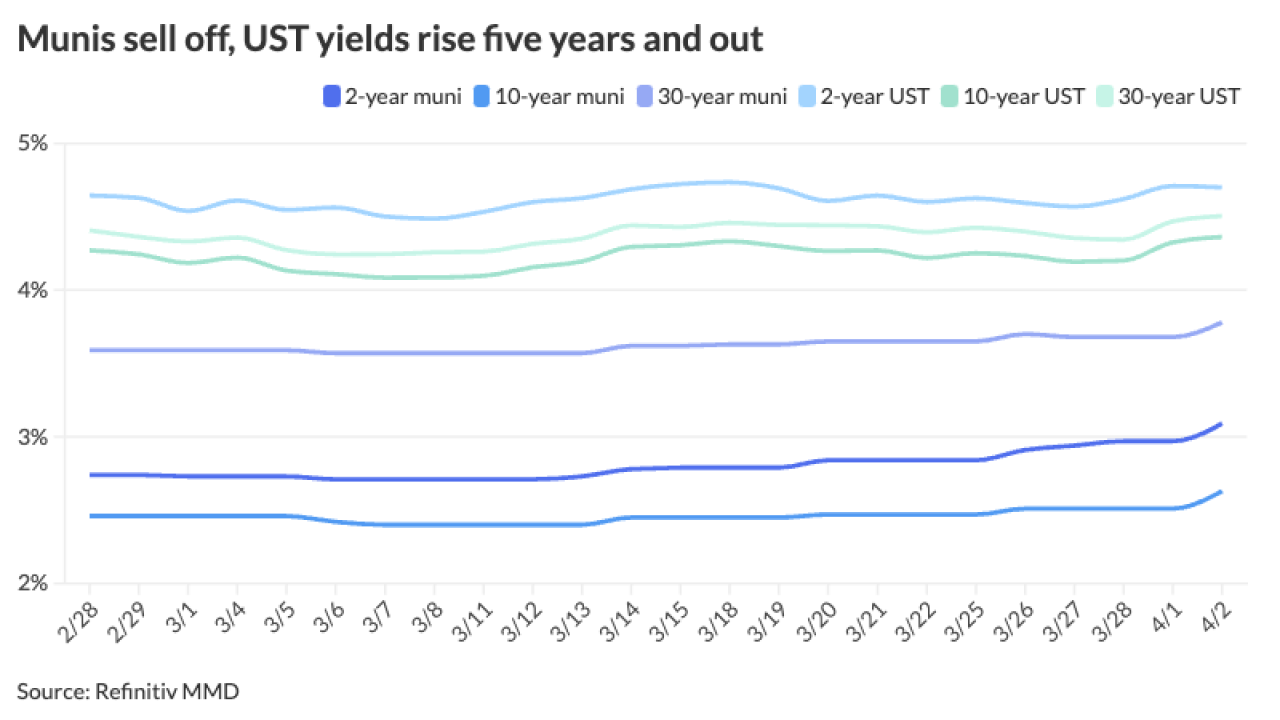

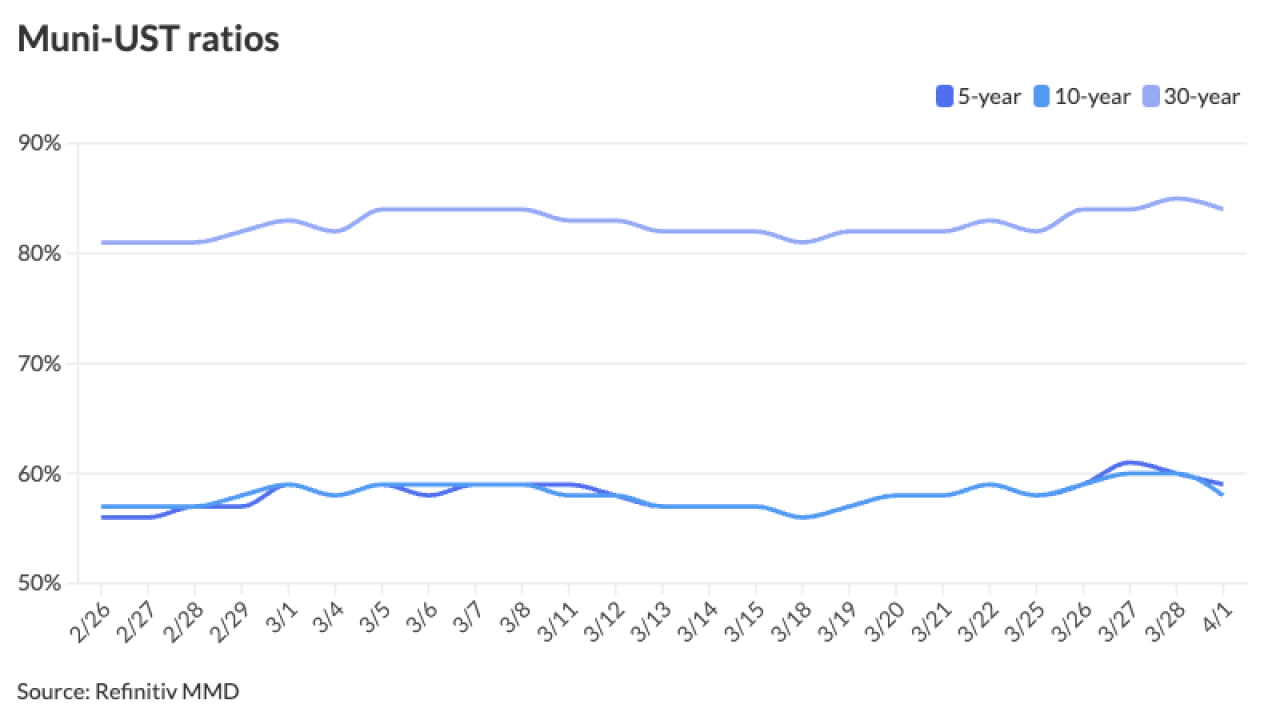

Muni to UST ratios also continue to rise across the curve, inching closer to more normal averages.

April 8 -

As another economic indicator pushed investors closer toward the assumption that rate cuts are farther away, the relationship between munis, USTs and the vast amount of capital sitting on the sidelines becomes more challenging to navigate, particularly ahead of the tax-filing deadline and growing new-issue calendar.

April 5 -

Instead of her original proposal, Miami-Dade County Mayor Levine Cava said she will work toward crafting an even larger bonding plan that will also include money for transit projects.

April 5 -

Some buying returned to the market Thursday from the buy-side and asset managers as dealers attempted to sell bonds, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

April 4 -

Two mega deals recently priced with make-whole calls for bonds due in 2034 and shorter where the market does not appear "to be penalizing issuers for including an optional make whole call feature in the short maturity tax-exempt bonds," said Pat Luby, head of Municipal Strategy at CreditSights, in a report.

April 4 -

"HB 727, if signed into law, should lower borrowing costs for Kentucky school districts and will serve as a critical tool in dealing with cost overruns and other inflationary pressures," said Compass Municipal Advisors.

April 4 -

"Most spots on the muni AAA HG curve are at or near year-to-date highs, and the muni HG curve showed significant underperformance across the curve in March, relative to the broader fixed income market, after sizable muni outperformance in February," said J.P. Morgan strategists.

April 3 -

-

Among the items approved by the state Local Government Commission were $750 million of affordable housing bonds, the Turnpike Authority's Thursday sale of $184 million to refund BABs and Wake County's $321 million refunding bonds.

April 3 -

Before Tuesday's selloff, muni yields have been rising over the last several weeks due to "outsized" new-issue supply, said Anders S. Persson, Nuveen's chief investment officer for global fixed income, and Daniel J. Close, Nuveen's head of municipals.

April 2 -

John Hallacy of John Hallacy Consulting and Rich Ciccarone, president emeritus of Merritt Research Services, talk with Chip Barnett about the municipal bond business over the past 40 years. They take a look back at where the industry has been, where it is and where it will be going.

April 2 -

The uptick in supply amid tax season has led to a short-end correction and higher muni to UST short ratios, but the levels are still rather rich from a historical perspective.

April 1 -

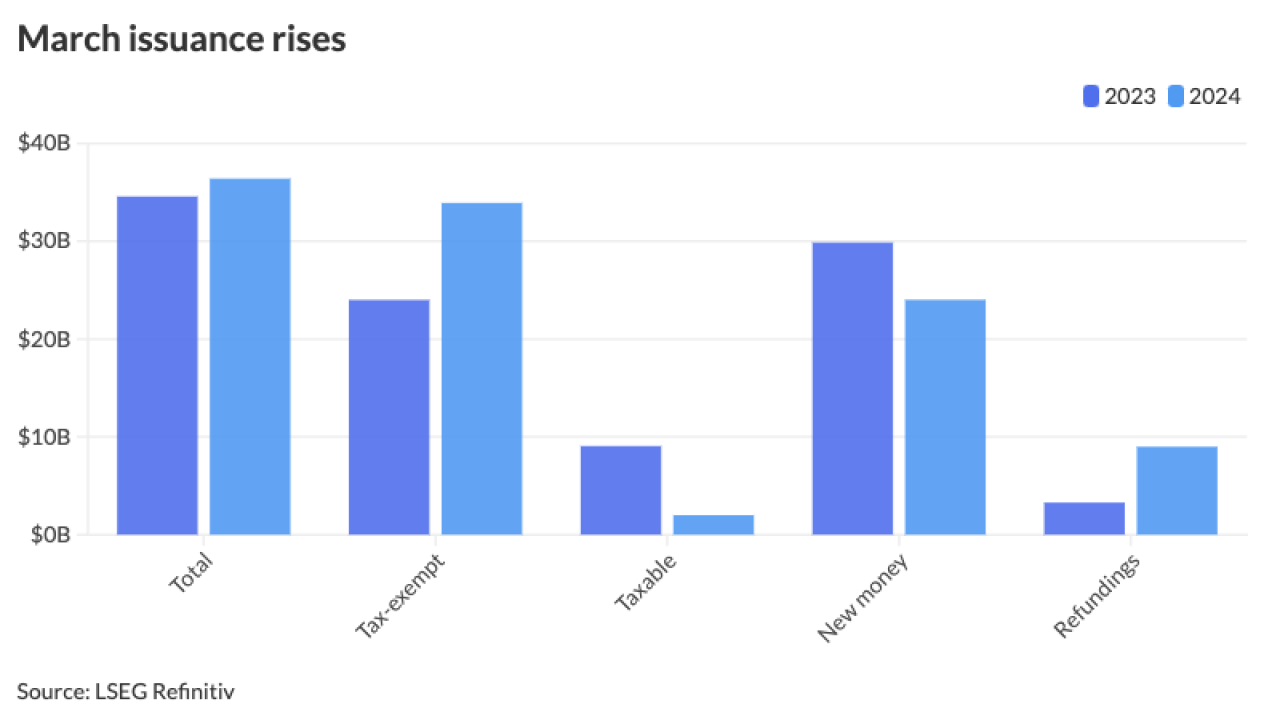

March issuance came in at $36.405 billion, above the $34.579 billion 10-year average, according to LSEG Refinitiv data.

April 1 -

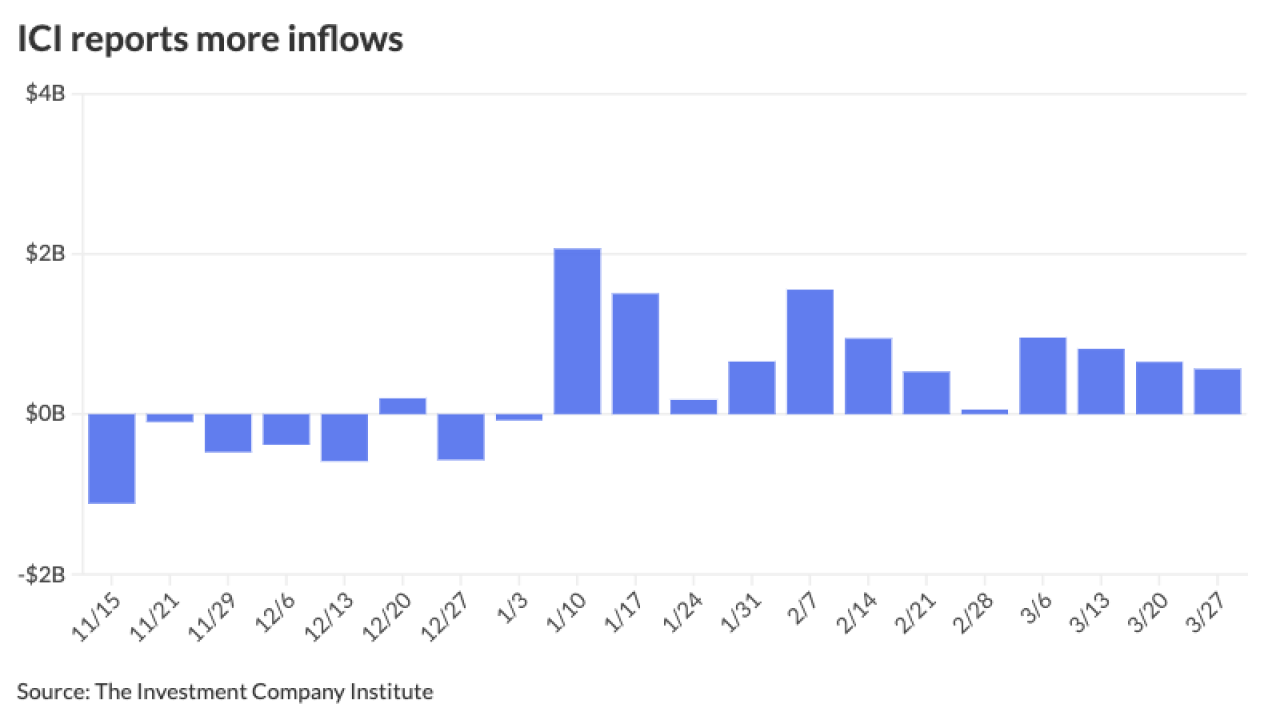

LSEG Lipper reported fund inflows of $447 million while high-yield muni bond funds saw another round of inflows at $246 million, marking the 12th consecutive week of positive flows in that space.

March 28 -

Most of the selling during tax season happens on the front end of the curve, said Wesly Pate, senior portfolio manager at Income Research + Management.

March 28