-

Munis "continued their slide" last week as yields rose an average of 23 basis points across the curve as the Fed Chairman Jerome Powell signaled the Fed will take a "more cautious approach" on interest rate cuts next year, said Jason Wong, vice president of municipals at AmeriVet Securities.

December 23 -

Municipals are seeing losses of 1.82% in December, which has dragged down overall gains to just 0.68% for 2024, per the Bloomberg Municipal Index.

December 20 -

"Munis are grappling with a storm of uncertainty," said James Pruskowski, chief investment officer at 16Rock Asset Management.

December 19 -

It's hard enough convincing local governments to spend money on cyber insurance that covers ransomware attacks, said Omid Rahmani, public finance cybersecurity lead at Fitch Ratings. The new and very specific threat of a hacked financing process, is "absolutely" underappreciated by the public finance industry.

December 19 -

As the market prepares for 2025, there's a lot of uncertainty around what the new administration will mean for the macroeconomic environment and interest rates, the latter of which may be impacted by policy around the deficit, said Steve Shutz, portfolio manager and director of tax-exempt fixed income at Brown Advisory.

December 18 -

The NFMA has floated best disclosure practices for public power agencies that ask for more data on climate and resiliency goals.

December 18 -

With investors now anticipating Wednesday's expected rate cut may be the last one for a while, "an overall bullish paradigm has been seriously weakened," noted Matt Fabian, a partner at Municipal Market Analytics, Inc.

December 17 -

As investors start shutting down for the year, there may be some mixed sessions ahead "especially for any accounts that find themselves as forced sellers," Birch Creek Capital said.

December 16 -

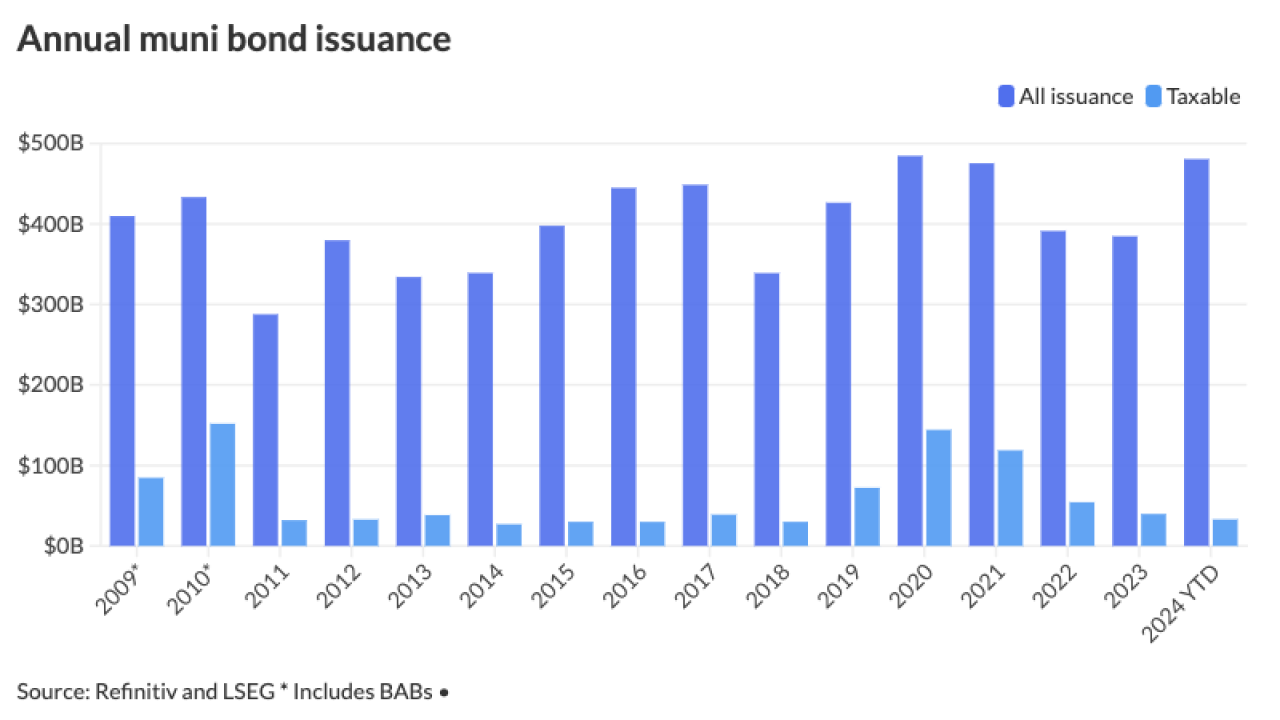

Supply falls ahead of the final Federal Open Market Committee meeting of 2024 and the holidays but issuance still breaks records. The lighter calendar should provide support for the secondary market in the final weeks of the year.

December 13 -

The face amount of munis outstanding rose to $4.171 trillion, a 0.8% increase from Q2 2024 and 2.9% from Q3 2023, according to the latest Fed data.

December 13 -

Muni mutual funds saw outflows after 23 weeks of inflows as LSEG Lipper reported investors pulled $316.2 million for the week ending Dec. 11. High-yield municipal bond funds, though, saw inflows of $192.3 million.

December 12 -

Most on the Street expect issuance to come in around $500 billion, but a few think volume will be much higher, primarily because of potential changes to the tax exemption. Most firms expect refunding volumes to also grow in 2025.

December 12 -

Municipal investors are more focused on the final new-issues coming down the pike and repositioning books as 2024 heads to a close. ICI reported another week of inflows into municipal bond mutual funds.

December 11 -

"With strong demand, rate cuts and favorable technicals, the muni market — outside of an unexpected shock — is set up to perform well over the next couple of months," said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

December 10 -

Bond Buyer senior reporter Keeley Webster hosted a wide-ranging discussion on the state's fall bond slate, housing, and second-term priorities with California Treasurer Fiona Ma and Deputy Treasurer of Public Finance John Sheldon.

December 10 -

Munis are in the black so far this month, with the Bloomberg Municipal Index at +0.33% in December and +2.88% year-to-date, the high-yield index is at +0.27% in December and returning 8.41% in 2024, while taxable munis are returning 0.43% so far this month and 4.58% in 2024.

December 9 -

Connecticut is poised to ramp up transportation borrowing, after years of consistently issuing less debt than it had the capacity and authority to sell.

December 9 -

Investors will be greeted with a diverse new-issue slate the week of Dec. 9, led by bellwether names. If all the deals price, 2024's total should break 2020's record by the end of the week. Despite rich valuations, demand has remained strong as the year winds down.

December 6 -

High-yield municipal bond funds saw inflows of $534.1 million compared to $300.6 million compared the previous week, per LSEG Lipper data.

December 5 -

"This matter is now under active investigation by federal authorities and impacted financial institutions, who are coordinating with the White Lake Township Police Department," said Daniel Keller, chief of police, in a statement.

December 5