-

Illinois will borrow $2 billion through the Federal Reserve's Municipal Liquidity Facility to help manage its 2021 budget gap. The state previously borrowed $1.2 billion from the MLF for its fiscal 2020 pandemic hole.

November 25 -

The Investment Company Institute reported municipal bond funds saw $2.675 billion of inflows in the latest reporting week.

November 25 -

Fitch Ratings cited concerns about LADWP's debt leverage in setting a negative outlook.

November 25 -

Sources said the JFK deal was massively oversubscribed, allowing underwriters to lower yields from 15 to 45 basis points.

November 24 -

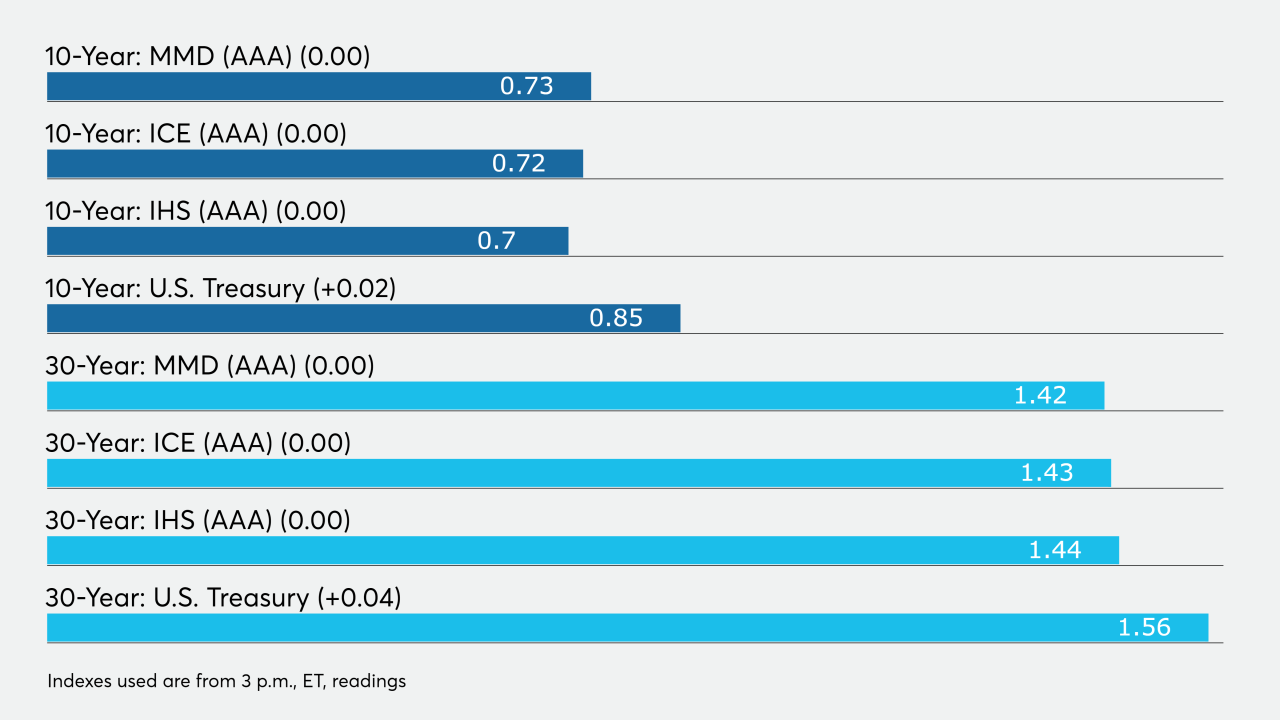

Municipals held firm ahead of this week's new issue slate, which features deals from issuers in New York and Texas. Treasuries weakened as stocks rose on positive coronavirus news.

November 23 -

Selling in a week with an expected light calendar should help the deal as will market fundamentals.

November 23 -

Municipals continue to rally as market participants get ready to head into a quiet holiday week.

November 20 -

Large blocks of New Jersey paper changed hands with yields that pushed spreads below 100 basis points on some maturities for the recently downgraded state.

November 19 -

Sarah Mitchell, CFA and a portfolio manager at Mondrian Investment Partners, talks with Chip Barnett about one of the hottest sectors in the municipal bond market today – green bonds – and the possibility of the U.S. government issuing a sovereign green bond. (20 minutes)

November 19 -

A supply/demand imbalance allowed New Jersey and Massachusetts to reprice to lower yields while the beleaguered New York MTA will head back to the Fed for liquidity.

November 18