-

Perform, a portfolio management platform for institutional investors who want to accesses the municipal bond market, will be integrated into ICE Bonds.

July 15 -

A key demand component in the market again flexed its muscles with ICI reporting another round of $2 billion-plus fund inflows.

July 14 -

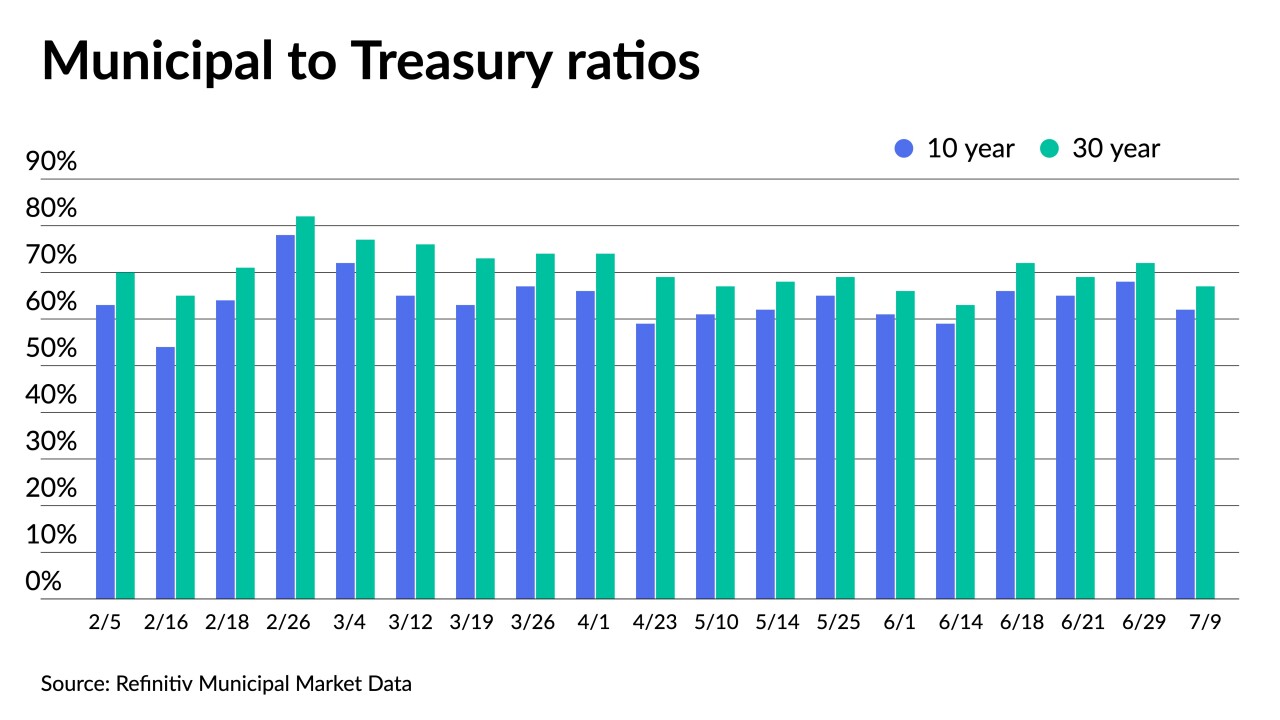

Municipals outperformed U.S. Treasuries for a third sessions moving the 10-year municipal to UST ratio below 60%.

July 13 -

The Metropolitan Pier and Exposition Authority and the Illinois Sports Facilities Authority are heading into the bond market, buoyed by state rating upgrades.

July 13 -

Most participants expect better performance for munis in the near-term. Longer-term, a lot depends on rates, COVID and other outside factors, such as infrastructure.

July 12 -

While municipals hit the pause button Friday, the movement in yields in the first week of July marked the largest one-week decline in 2021.

July 9 -

Fund inflows are a demand component unlikely to slow during the heavy reinvestment season, keeping the yield environment squarely in issuers' favor.

July 8 -

The Fitch Ratings upgrade applies only to GO debt — the city's issuer default rating remains AA-plus. The GOs benefit from California’s 2016 statutory lien law.

July 8 -

The Dormitory Authority of the State of New York overtook California for the most issuance, while New York issuers made up half of the top 10.

July 8 -

More of the same from the FOMC did little to move UST or munis. ICI reported the 17th consecutive week of inflows at $1.98 billion. July is looking good for municipal issuers.

July 7 -

As issuance increased, the top municipal bond underwriters saw their total par underwritten rise by 14.4% from the first half of 2020.

July 7 -

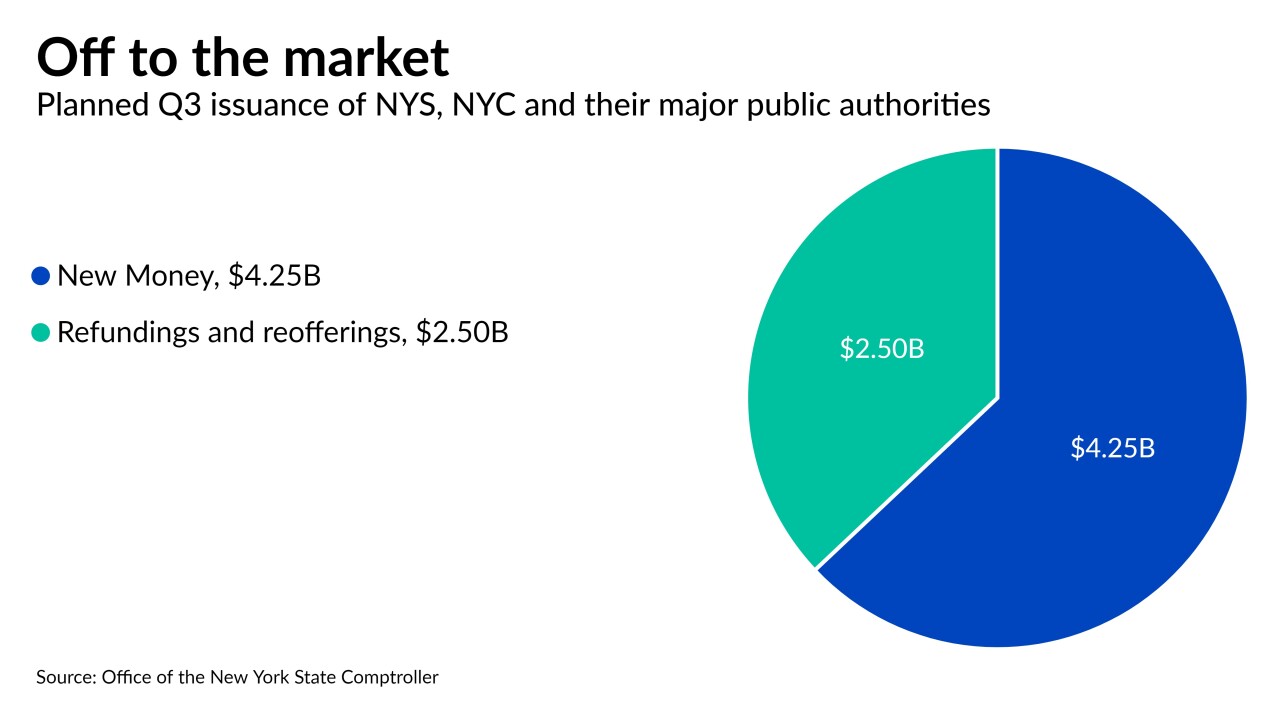

The calendar includes $4.25 billion of new money and $2.5 billion of refundings and reofferings, New York State's comptroller said.

July 7 -

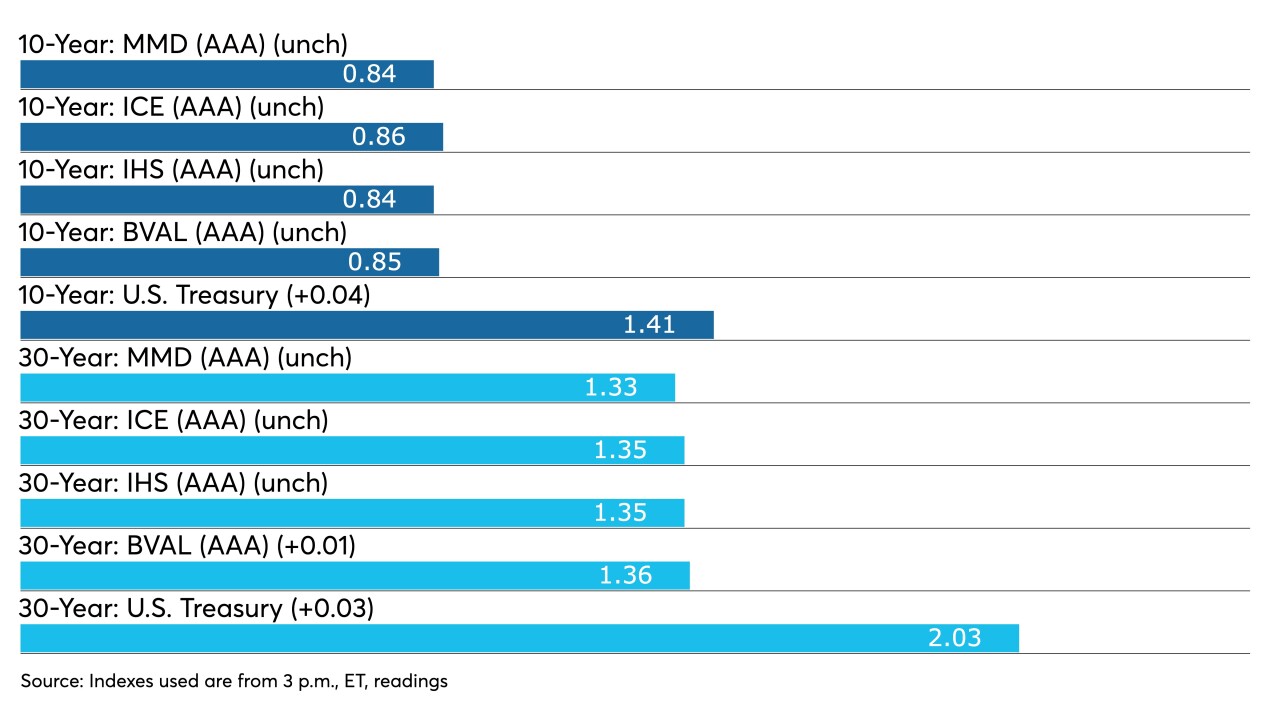

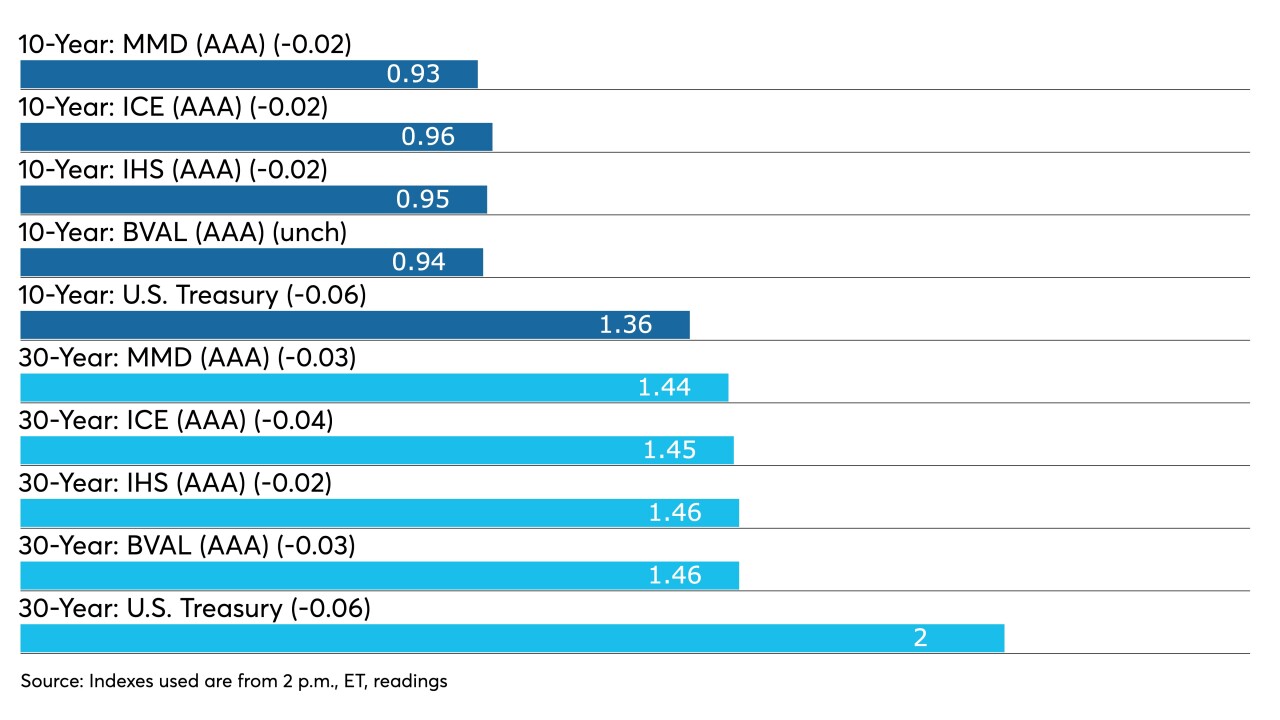

U.S. Treasury 10- and 30-year yields hit February lows. Large blocks of high-grades in secondary trading led triple-A benchmarks to lower yields by two to four basis points across the curve.

July 6 -

With better-than-expected payrolls, economists still caution full recovery is a ways away. Muni participants are closely following how the Fed's action — or inaction — will affect the municipal market going forward.

July 2 -

Gilt-edged munis fell as much as two basis points Wednesday as the month ended and the first half stats were put into the record books.

June 30 -

The Metropolitan Pier and Exposition Authority will scoop-and-toss fiscal 2022 debt service and current refund debt for savings as it looks to salve the lingering wounds inflicted by the pandemic.

June 30 -

A majority of the week's largest new issues priced at yields mostly at or around benchmarks as secondary trading did little to move scales. In economic data released Tuesday, the June consumer confidence index climbed, suggesting spending will rebound.

June 29 -

State Treasurer Shawn Wooden discusses the state's across-the-board bond rating upgrades, its immediate challenges and initiatives such as "CT Baby Bonds." Paul Burton hosts. (19 minutes)

June 29 -

With various Federal Reserve officials airing their views since the Federal Open Market Committee’s latest meeting, it may take a while for members to reach agreement on tapering, a boon for municipals.

June 28 -

Making it a summer Friday, munis were quiet. Participants contemplate why the market underperformed taxables to the degree they did when fundamentals are objectively strong and little has changed since before the FOMC.

June 25