-

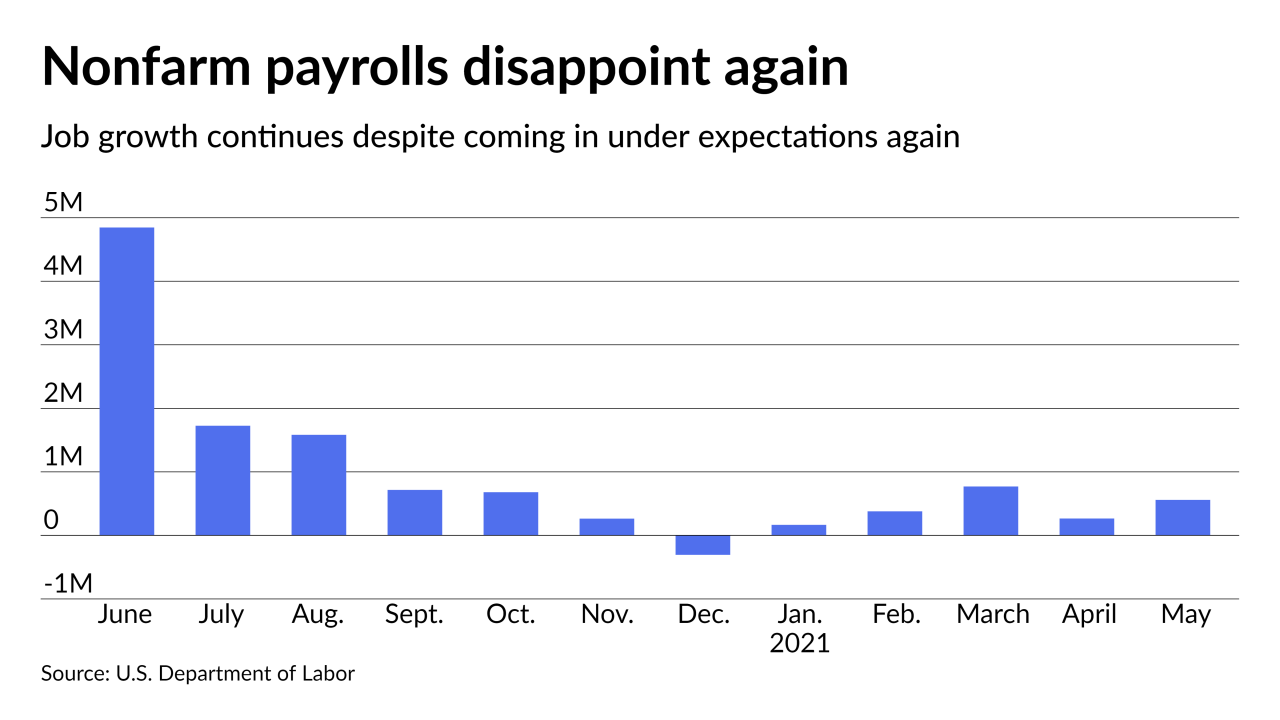

Muni prices were firm Friday after the employment report showed nonfarm payrolls rose 559,000 in May as the jobless rate fell to 5.8%.

June 4 -

Raymond James is senior manager for the sale, which will feature $82 million of Series B tax-exempt and $17 million of Series A federally taxable bonds.

June 4 -

As most participants await Friday's jobs report, the municipal market Thursday sustained a firm tone as rates remained on a gradual path of decline.

June 3 -

ICI's report marks the 12th consecutive week of inflows bringing the total for 2021 to more than $40 billion. Lower- and non-rated deals saw 20 to 30 basis point bumps in repricings as any paper with yield is massively oversubscribed.

June 2 -

The state's general obligation bonds are rated triple-A by Moody's, S&P and Fitch.

June 2 -

The revenue sector winners in May included healthcare with +0.53% gains, transportation with +0.42%, each benefiting from "the reach for yield and improving metrics," analysts said.

June 1 -

Sheila King of Eagle Asset Management talks with Chip Barnett on the growing importance of environmental, social and governance issues for municipal governments. She gives examples of what works and what doesn't and why it matters. (14 minutes)

June 1 -

Municipal yields will likely stay in a narrow range with trading activity subdued unless larger interest rate volatility unexpectedly sets in, analysts say.

May 28 -

The agency is refunding $104.5 million of Federal Transit Administration section 5307 bonds and $23 million of FTA section 5337 bonds.

May 28 -

Even with a 23.3% year-over-year drop in May, with five months now officially in the books, long-term muni volume stands at $169.45 billion, ahead of the $157.96 billion issued in 2020.

May 27