Municipal bonds strengthened on the long end Friday after the latest employment report showed continued job growth and buoyed equities and Treasuries.

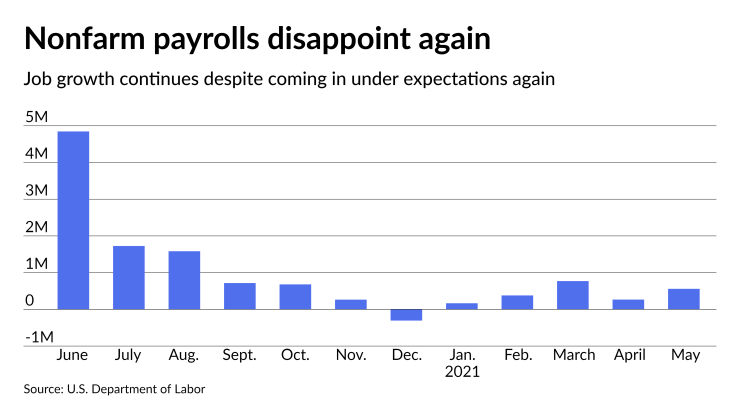

The Labor Department said nonfarm payrolls rose 559,000 in May as the jobless rate fell to 5.8% from 6.1%. The numbers showed slow but steady strength in the labor market, but came in under some economists'

President Joe Biden touted the strength in the data.

"Today’s jobs report shows historic progress for American families and the American economy," he said

Yields on top-quality bonds fell on the long end of the AAA scales by as much as two basis points. On the week, muni yields were little changed.

Looking ahead to the new week, bond buyers will see a robust new-issue calendar, led by a big taxable healthcare deal from Kaiser Permanente in California.

IHS Ipreo estimates volume at $10.15 billion in a calendar composed of $6.95 billion of negotiated deals and $3.20 billion of competitive sales. Refinitiv MMD estimates the total consists of $9.53 billion of tax-exempts and $620 million of taxables. The year-to-date weekly sale average is $6 billion.

Primary market

Topping the list of new deals is Kaiser Permanente’s Series 2021 (NR/AA-/AA-/NR) taxable and taxable green bonds.

The deal is set to be priced by Goldman Sachs and its size is dependent upon market conditions.

Sources told The Bond Buyer that if the taxable market is favorable then up to $2.65 billion will be sold as corporate CUSIP bonds with 20- and 30-year bullet maturities. If the underwriter decides the issuer could get a better deal in the tax-exempt market, Goldman will reduce the taxable amount by a like amount to price up to $700 million of Series 2022A&B tax-exempt fixed-rate put bonds, with maturities from five- to 10-years with a final 2042 due date, for the California Statewide Communities Development Authority with Kaiser Foundations Hospital as the obligor.

In the competitive arena,

The state will offer $412.47 million of Series 2021A Bidding Group 1 tax-exempt GOs, $366.47 million of Series 2021A Bidding Group 2 tax-exempts, $174.57 million of Series 2021B Bidding Group 1 taxable GOs and $153.53 million of Bidding Group 2 taxables.

Public Resources Advisory Group and Terminus Municipal Advisors are the financial advisors. Gray Pannell & Woodward is the bond counsel and Kutak Rock is the disclosure counsel.

In the short-term sector, Los Angeles County is coming to market with a $1 billion note deal. UBS Financial Services is set to price the Series 2021-2022 tax and revenue anticipation notes on Thursday.

What to expect this month

Looking ahead to the first full week in June, BofA Securities expects a flatter curve with narrower spreads.

“Demand overwhelms supply even more. We expect the muni curve to go flatter and spreads to grind lower,” according to a Friday report from BofA Global Research. “Total principal and coupon redemptions may run as high as $180 billion and mutual fund inflows as high as $30 billion for the June-August period.”

The analysts also noted the possibility of a Build America Bond-type issuance surge if an infrastructure plan is passed in Washington.

“Total new BABs-like bond issuance volume may reach $1 trillion-$3 trillion if physical infrastructure federal funding is in the $500 billion-$800 billion range and average coupons in the 3%-5% range,” BofA wrote.

Deep dive into jobs data

Jobs are being created but, for various reasons people are still not coming back to the workforce, and that was highlighted in what some analysts called a disappointing jobs report for May.

"Payrolls have been growing at 540,000 per month over the last three months. This is a lot of job creation compared to our steady state mid-cycle estimate of 70,000 per month, but it still leaves us 6.5 million jobs short of full employment,” according to Brian Coulton, chief economist at Fitch Ratings. “It's taking participation rates a bit longer to bounce back — and the BLS survey suggests pandemic related restrictions and concerns are still preventing 2.5 million from looking for work — but it’s quite hard to see this as a situation of labor shortage in the economy as a whole.”

Kevin Flanagan, head of fixed income strategy at WisdomTree, said that the lackluster report will now “buy some time” for the Federal Reserve and Chair Jerome Powell.

“There was mounting pressure on the Fed, we know where inflation is at but employment is still a long way off from maximum,” he said. “The Fed can now pump the brakes on the taper talk, Friday’s report was not a game changer but Powell can breathe a sigh of relief, for now.”

He noted that jobs are “flattening out” and it will be interesting to see how the Fed interprets the report. He expects people to start working again going into the summer.

“In some states, people are being incentivized to stay at home as they can make more money doing that than they would going to work,” he said. “Some states will start to break away from that, so the summer will be interesting. I see more people getting out of the house and moving back into the workforce.”

While payrolls came in under expectations the data still showed continued improvement in the job market, although at lower levels than earlier in the recovery, said Sameer Samana, senior global market strategist at Wells Fargo Investment Institute.

“The internals were also a bit weak, with manufacturing and private payrolls coming in shy of expectations, the participation rate ticking lower, and only slight improvements in the unemployment/underemployment rates,” he said.

Samana said the results reinforce the Fed’s patience approach to removing monetary stimulus. “Although they may begin talking about talking about tapering in the upcoming meetings,” he said.

"While volatility continues month to month — emphasizing the nature of living through a pandemic — this morning’s bounce in hiring is a welcome reminder not to focus too much on one single report," said Stifel's chief economist Lindsey Piegza. "There was already a strong underlying trend of hiring established before the May report. This morning’s increase only reinforces the sentiment of continued improvement as the recovery ages."

She said the employment picture will continue to become clearer.

"The labor market is likely to continue to improve, diminishing both barriers and disincentives to return to the labor force and by extension, correcting labor supply shortages reported across the country," she said.

Diane Swonk, chief economist at Grant Thornton, said that the bottom line is that the labor market is healing, but not as rapidly as the overall economy.

“Consumers are spending and businesses are reopening faster than many employees are able or willing to return to work,” she said. “A return of day care centers, summer camps and schools in August will all help alleviate those hurdles.”

According to Scott Ruesterholz, portfolio manager at Insight Investment, along with the difficulty in bringing employees back to work, wage growth continues to surprise to the upside, particularly in lower paying jobs.

“For instance, nonsupervisors in the leisure sector saw wages rise over 1% this month, bringing this year’s increase to over 8% — whether these wage gains persist after enhanced unemployment benefits lapse is highly uncertain, but the combination of only moderate job growth, lackluster labor force participation and faster wage growth point to a labor market that faces more supply constraints than one would expect looking solely at the unemployment rate.”

Also released on Friday, factory orders dropped 0.6% in April after a revised 1.4% climb in March, first reported as a 1.1% gain. IFR estimated orders to dip 0.5%. New factory orders minus transportation nudged up 0.5%, IFR expected an increase of 0.8%. Non-durable goods ticked up 0.1%; IFR anticipated that number to come in flat.

“While factory orders declined, the miss was due to the volatile transportation categories with core capital goods orders and shipments up solidly,” said Ruesterholz. “Manufacturers’ backlog of unfilled orders also continues to grow.”

He also noted that aside from the aerospace sector, many manufacturers’ output is “constrained by supply chains’ capacity rather than by a lack of demand, leading to growing backlogs.”

“Working through this should elongate the recovery in manufacturing output, likely providing a tailwind for growth into 2022,” he said. “While higher input and transportation costs may pressure margins a bit, the outlook for manufacturers is strong.”

Secondary market

Some notable trades on Friday as reported by ICE Data Services:

The Los Angeles Department of Water and Power's 5s of July 1, 2040, [CUSIP: 544525A24] traded in a block of over $5 million at 131.838, a trade yield of 1.270%. The DWPs were priced on May 5 at 133.35% to yield 1.26%.

A block of over $5 million West Virginia 5s of June 6, 2040, [956553P21] traded at 133.094, a yield of 1.43%. The 5s were priced on June 3 at 132.263% to yield 1.51%.

The Florida Board of Education 5s of June 1, 2030, [34153QUZ7] traded in a block of over $5 million at 134.783, a yield of 0.95%. The 5s were priced on June 30, 2020 at 138.426% to yield 0.70%.

The New York State Urban Development Corp. 5s of March 15, 2027, [650036CR5] traded in a block of over $5 million at 124.913, a yield of 0.60%. The 5s were priced on Dec. 23, 2020 at 127.558% to yield 0.50%.

A block of over $1 million New York City Municipal Water Finance Authority 5s of June 15, 2032, [64972GYN8] traded at 137.472, a yield of 1.05%. The 5s were priced on March 18 at 134.914% to yield 1.34%.

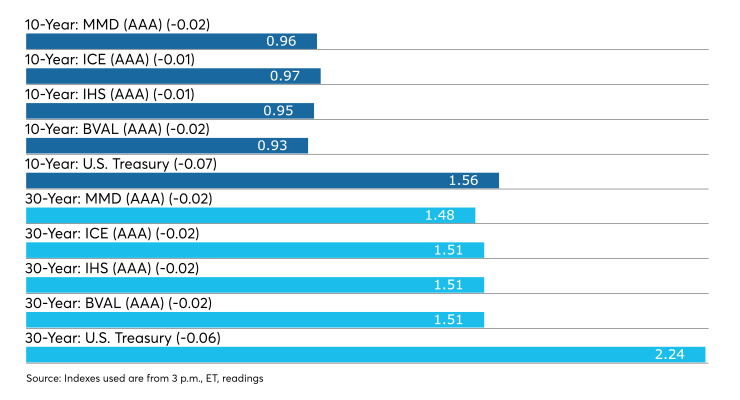

High-grade municipals were stronger, according to final readings on Refinitiv Municipal Market Data’s AAA benchmark scale. Short yields in 2021 and 2022 were unchanged at 0.07% and 0.10%, respectively. The yield on the 10-year muni fell two basis points to 0.96% while the yield on the 30-year declined two basis points to 1.48%

The 10-year muni-to-Treasury ratio was calculated at 61.5% while the 30-year muni-to-Treasury ratio stood at 66.0%, according to MMD.

The ICE AAA municipal yield curve showed short maturities were down one basis point in 2021 and 2022 at 0.06% and 0.11%, respectively. The 10-year maturity dipped one basis point to 0.97% and the 30-year yield fell two basis points to 1.51%.

The 10-year muni-to-Treasury ratio was calculated at 61% while the 30-year muni-to-Treasury ratio stood at 62%, according to ICE.

The IHS Markit municipal analytics AAA curve showed short yields at 0.07% and 0.10% in 2021 and 2022, respectively, with the 10-year at 0.95% and the 30-year yield at 1.51%.

The BVAL AAA curve showed the yield on the 2021 maturity at 0.07% and the 2022 maturity at 0.09% while the 10-year fell two basis points to 0.93% and the 30-year dropped two basis points to 1.50%

U.S. Treasury prices rose as stocks traded higher.

In late trading, the three-month Treasury note was yielding 0.23%, the 10-year Treasury was yielding 1.56% and the 30-year Treasury was yielding 2.24%. The Dow increased 0.50%, the S&P 500 rose 0.90% and the Nasdaq gained 1.50%.

Next week's other deals

Massachusetts (Aa1/AA+//AAA) is set to price $720 million of transportation fund revenue rail enhancement bonds. The first series, $168 million of sustainability bonds, are serials 2050-2051. The second, $232 million, are serials 2023-2046. The third, $320 million, are refunding serials 2022, 2029-2030, 2033-2043. BofA Securities is head underwriter.

The Indiana Finance Authority is set to price on Wednesday $623.7 million of first and second lien wastewater refunding revenue bonds, $443.6 million first lien (Aa3/AA//) and $180.1 million (A1/AA-//). BofA Securities is lead underwriter.

The Department of Water and Power of the City of Los Angeles (Aa2//AA-/AA) is set to price $439.4 million of power system revenue refunding bonds on Thursday. Serials 2022, 2026-2037, 2039-2041; terms 2046, 2051. RBC Capital Markets will run the books.

The West Virginia Parkways Authority (/AA-/AA-/) is set to price on Wednesday $333.6 million of senior lien turnpike toll revenue bonds, serials 2022-2051. Wells Fargo Securities is head underwriter.

Houston, Texas, (A1///AA-) is set to price $293.1 million of AMT subordinate lien revenue refunding bonds on Tuesday. Goldman Sachs is lead underwriter.

The Maryland Economic Development Corp. (////) is set to price $263.7 million of taxable SSA Baltimore Project federal lease revenue bonds, term 2034. Oppenheimer & Co. will run the books.

The Cass County Joint Water Resource District, North Dakota, (Aa3///) is set to price on Wednesday $180 million refunding bonds. Colliers Securities is head underwriter.

The Wayne County Airport Authority, Michigan, (A1//A/AA-) is set to price on Wednesday $163.1 million of Detroit Metropolitan Wayne County Airport revenue bonds consisting of $131.2 million of Series 2021A (non-AMT) serials 2023-2041, term 2046, and $31.9 million Series 2021B (AMT), serials 2023-2041, term 2046. Siebert Williams Shank & Co. is lead underwriter.

The New Memphis Arena Public Building Authority of Memphis and Shelby County, Tennessee, (Aa2/AA//) is set to price on Thursday $161.1 million of local government public improvement capital appreciation bonds and convertible capital appreciation social bonds. BofA Securities is head underwriter.

The University of North Carolina Chapel Hill (Aaa/AAA/AAA/) is set to price on Tuesday $150.9 million of general revenue refunding bonds. BofA Securities will run the books. The University of North Carolina Chapel Hill (Aaa/AAA/AAA/) is also set to price on Tuesday $140.9 million of tax-exempt and taxable general revenue refunding bonds. BofA Securities will run the books.

The San Mateo County Joint Powers Financing Authority, California, (Aa1/AA+//) is set to price on Thursday $144.45 million of Cordilleras Mental Health Center Replacement Project lease revenue bonds, serials 2027-2055. Citigroup Global Markets is head underwriter.

The Anaheim Public Financing Authority, California (A2/AA//AA+) is set to price on Thursday $140.5 million of taxable working capital financing lease revenue bonds, insured by Assured Guaranty Municipal Corp. Goldman Sachs is head underwriter.

Clark County, Nevada, (A1//A+/A+) is set to price on Tuesday $138.3 million of airport system junior subordinate lien revenue notes (AMT), serials 2022-2027. Citigroup Global Markets is bookrunner.

The Illinois Housing Development Authority (Aaa///) is set to price $125 million of social revenue refunding bonds. Jefferies is lead underwriter.

The Greater Texas Cultural Education Facilities Finance Corp. (Aa3//AA-) is set to price on Wednesday $101.2 million of Epicenter Multipurpose Facilities Project taxable lease revenue bonds. Piper Sandler is head underwriter.

The Mission Economic Corp. in Texas is set to price $100 million of senior lien revenue bonds (Panda High Plains Hemp Gin LLC project) on Tuesday, serials 2024-2041. Citigroup Global Markets will run the books.